Nov 20, 2012

- Earlier this year, Goldman Sachs’ Peter Oppenheimer said that compared to bonds, US stocks were the cheapest in 50 years.

- If Peter is correct, that could be good news for your gold stocks, because there is an ongoing correlation between the Dow and most gold equities.

- Unfortunately, Goldman also believes that the fiscal cliff situation could drive stock markets 8% lower by year-end.

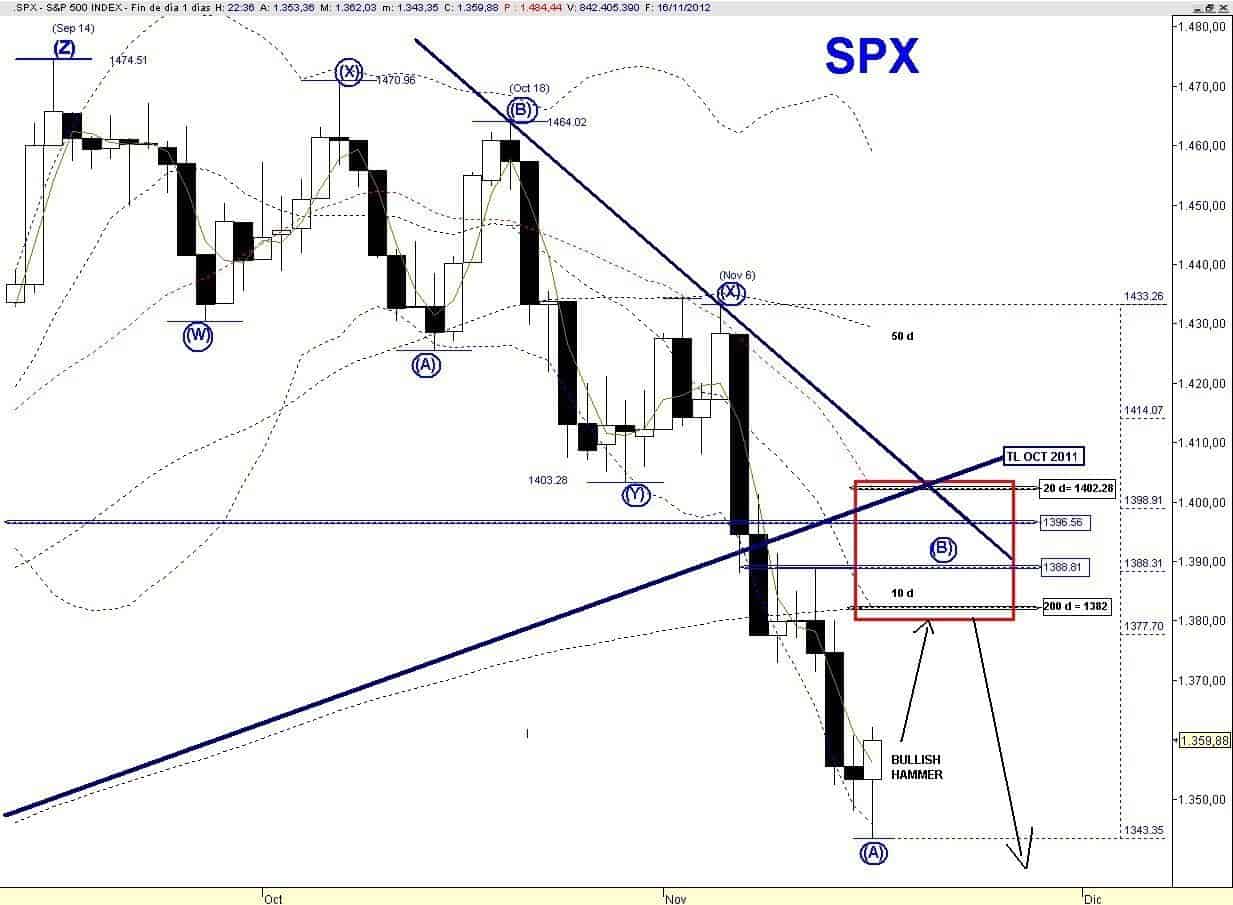

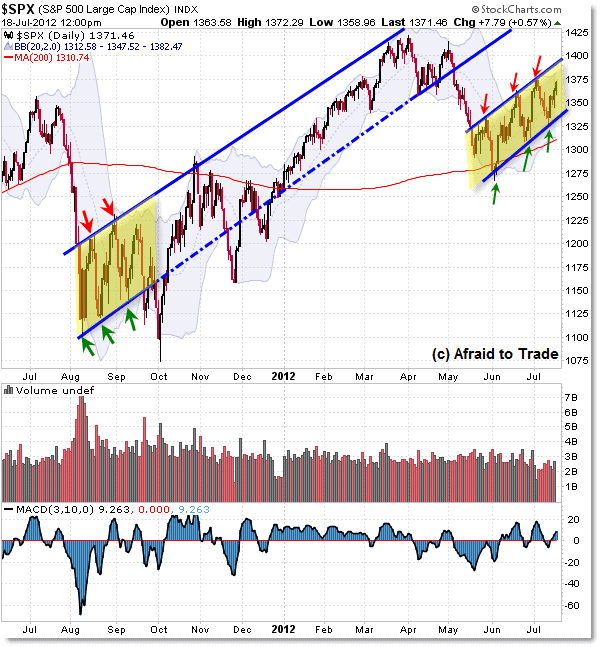

- You are looking at the daily chart for the Dow, and you can see that it made a small top in mid-September. It has declined about 8% from the high.

- Gold stocks are more volatile than the Dow. GDX declined about 18%, during the period in which the Dow fell 8%. There is a lot of symmetry between these two charts.

- If the Dow is set to fall another 8% from the lows of last week, GDX could fall another 18% from its recent lows. That would put GDX at about $37, and below the May-July lows.

- Some of the largest gold companies are already trading near their summer lows, which is somewhat alarming.

- If you own a home, it is wise to purchase home insurance. If you own gold stocks, carrying some cash and short positions is a form of insurance. That’s the daily chart of DUST, which is effectively a triple-leveraged bet against GDX. The performance is calculated on a daily basis. I’m a buyer, moderately, in the $28 and $22 areas.

- What would happen to gold stocks, if Goldman Sachs is correct about the Dow falling another 8%, and then they called for an even harder fall, instead of a rally?

- The situation could get quite ugly. A small position in DUST may help gold stocks investors to professionally manage fiscal cliff fear.

- Gold recently sold off along with the other so-called “risk on” markets, but it bottomed quickly. The daily chart shows a nice head and shoulders bottom pattern in play.

- The daily gold chart looks superb. The H & S pattern sits near the demand line of a beautiful rising channel.

- HSR (horizontal support & resistance) at $1758 is the initial upside target, and then $1800. A “price pop” to the $1825 price zone could be a game changer for gold stocks.

- Silver looks even better than gold. Yesterday’s price action was important, because it took silver above the neckline of a head and shoulders bottom.

- At this point in time, gold has yet to rise above its neckline, so silver is clearly the leader.

- Silver seems eager to race to $35.50, and if gold can rise above $1800, that could catapult silver into the $40 range.

- There’s more good news. Ben Bernanke makes a speech in New York today, and he may give more hints about ramping up QE3. Currently, QE3 is being “diluted”, because the Fed is selling short term Treasuries.

- There are rumours that the Fed may cut back on that practice, or even halt it, before the end of the year. If “Big Ben” speaks boldly about ending the dilution of QE3, gold and silver could spike higher, very quickly.

- Most investors in the gold community like speculative resource stocks. If you are looking for action, my favourite play right now is the “Global X Gold Explorers” fund.

- At about $8 a share, the GLDX ETF is something that is probably priced “just right”, for action-oriented investors. In contrast, GDXJ is trading at about $22.

- It’s a lot easier to look down from $8, than it is from $22. Aggressive investors should considering accumulating GLDX on every 25 cent decline, inside the highlighted $7-$9.75 “price box”.

- I like both GDXJ and GLDX, but there’s no question that GLDX is a lot easier to handle, emotionally.

- A move above $1800 in gold could be the catalyst that takes GLDX above $10. From there, the target would be $13, which is about 50% higher than today’s price!