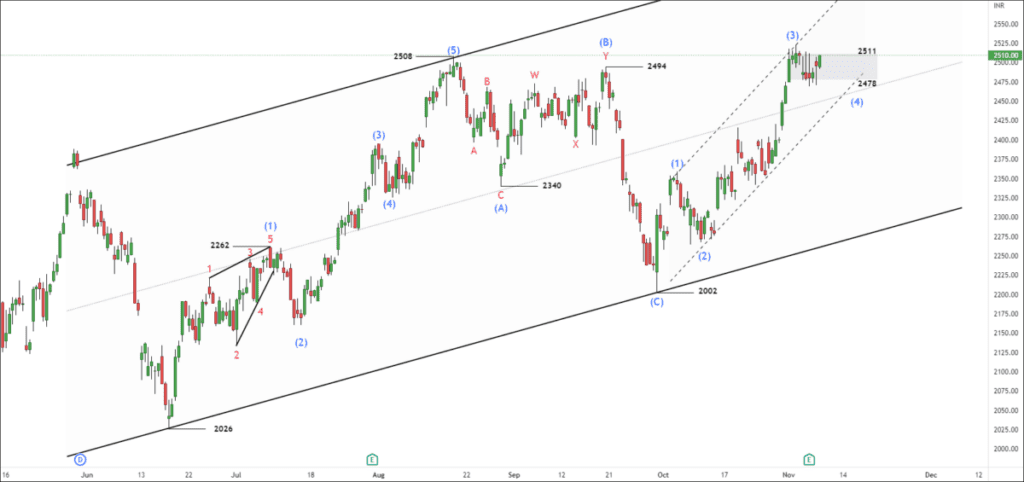

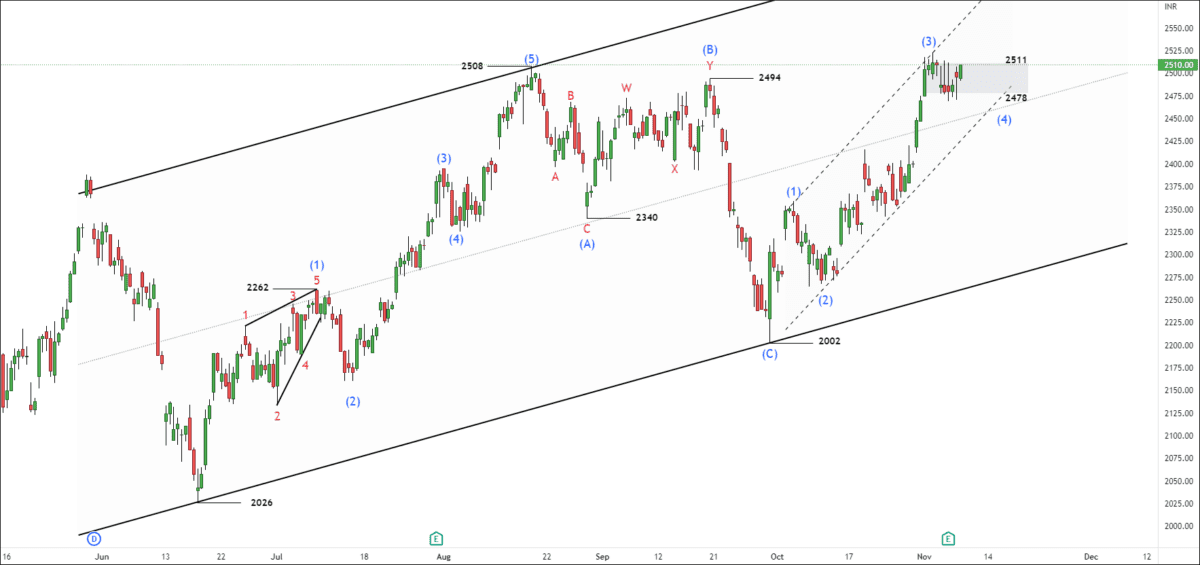

EWT – NSE HDFC Is Outnumbering Sellers

Timeframe: 4h

Housing Development Finance Corporation accomplished the corrective structure in 2002 and formed an impulsive structure. Price is consolidating in the value area, and close above range can give us a great move to the upside.

The price is above the 200 moving average, which indicates bulls are in control. The value area range for the HDFC is 2511 – 2478.

If the price sustains above 2511, traders can trade for the following targets: 2533 – 2572 – 2610+. Note that 2478 is a strong support level. In case of failure, the price will take support at the control line of the parallel channel.

We will update further information soon.

NSE INDHOTEL FUT – Trade Setup

NSE India hotel has given a crucial close near resistance of 347, and price is preparing for a breakout. Note that prices are moving above 200 EMA, which signals bullish momentum.

If NSE INDHOTEL sustains above 347, traders can trade for the following targets: 356 – 363 – 372.

Further information will be available for premium subscribers soon. (To become a subscriber, subscribe to our free newsletter services. Our service is free for all.)

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Good insight!

Thank you for sharing this analysis.

I have the exact expectations. I will bet on your idea.