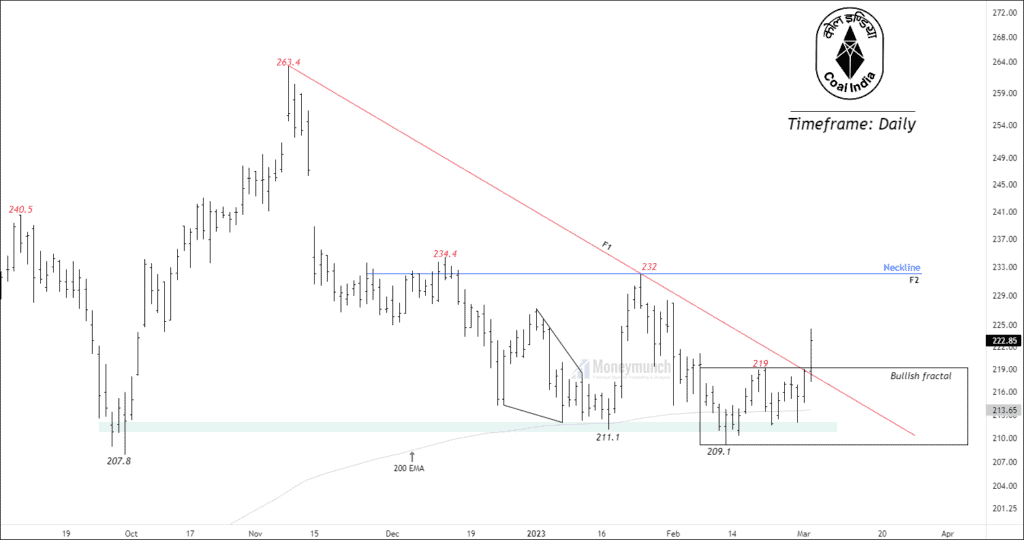

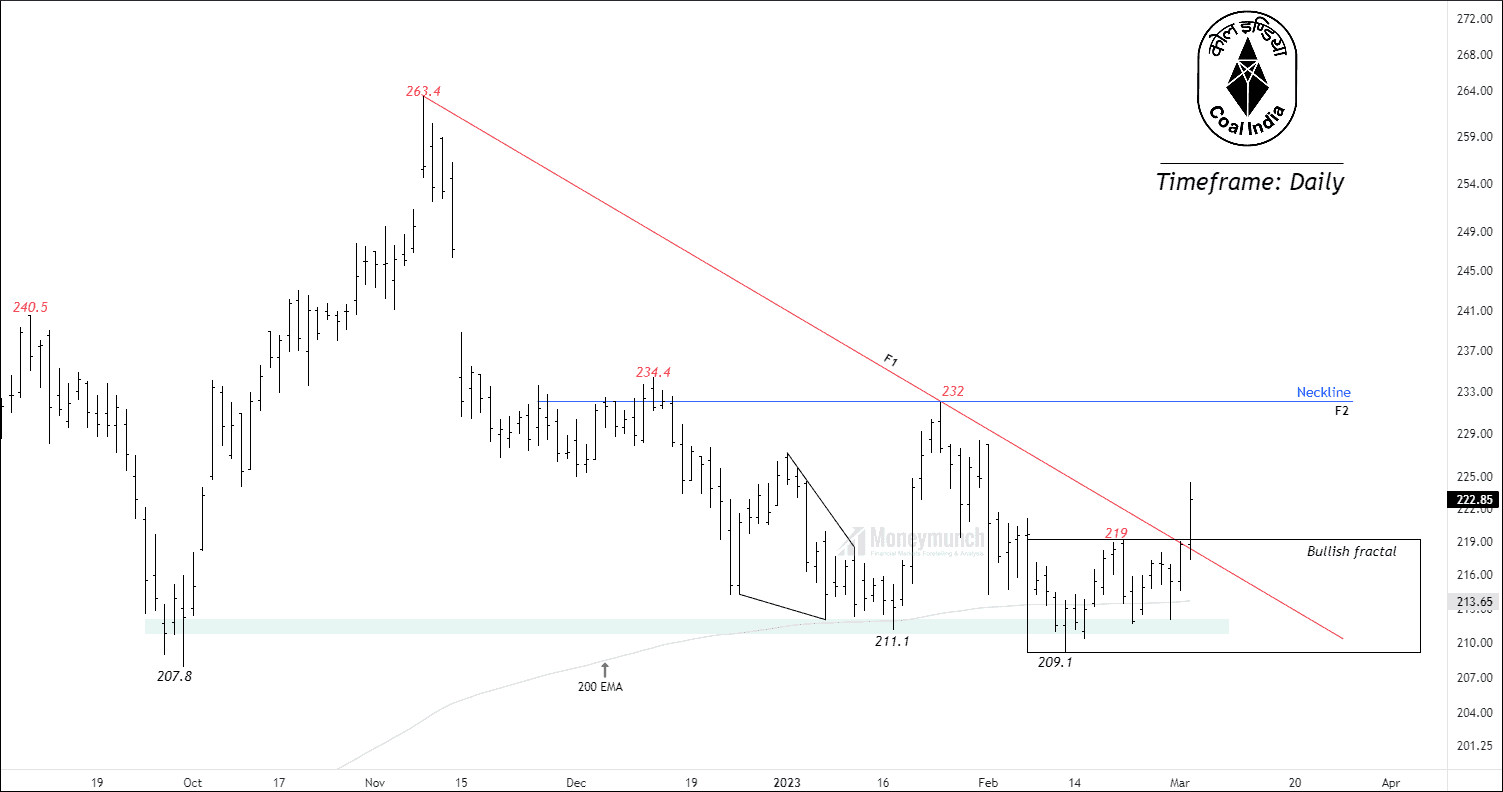

Timeframe: Daily

At a critical demand zone, NSE COAL India has gained support. It has served as support more than four times at this demand level. Price is trading above the 50/100/200 exponential moving average, indicating buyers are in charge.

The extended W pattern and the fractal pattern are two bullish patterns that have shown in security prices. The expanded W’s neckline is at 232, and the fractal’s power point is at 219.

If the price maintains above the fractal swing high at 219, Traders might trade for the following targets: 225.6 – 228.8 – 231.5. The expected return is about 6%. The price must then breach the extended w pattern’s neckline in order to continue rising. Traders can expand their aim in this scenario.

I will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Nice one! Thanks for sharing.

I agree with this analysis, good luck