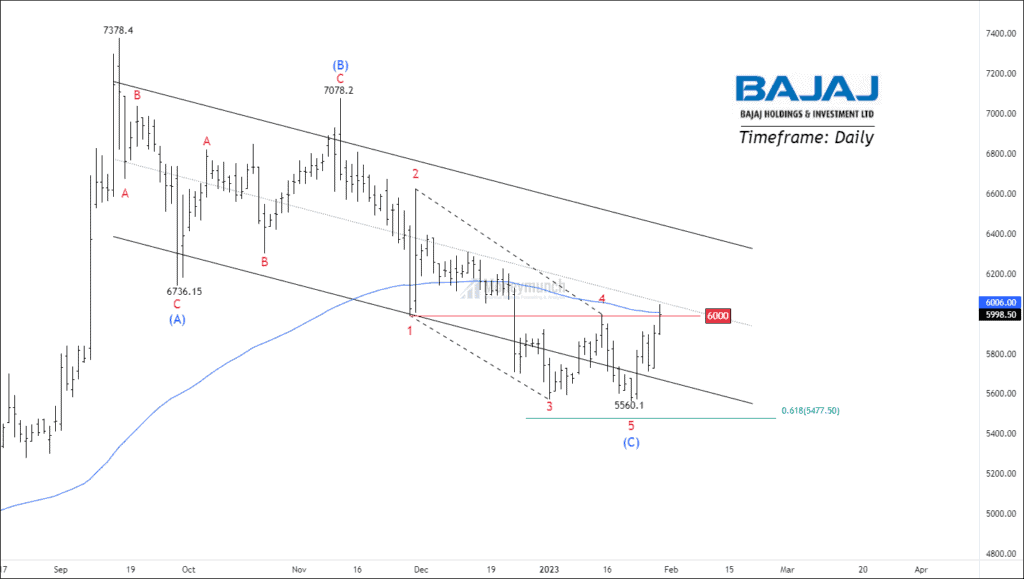

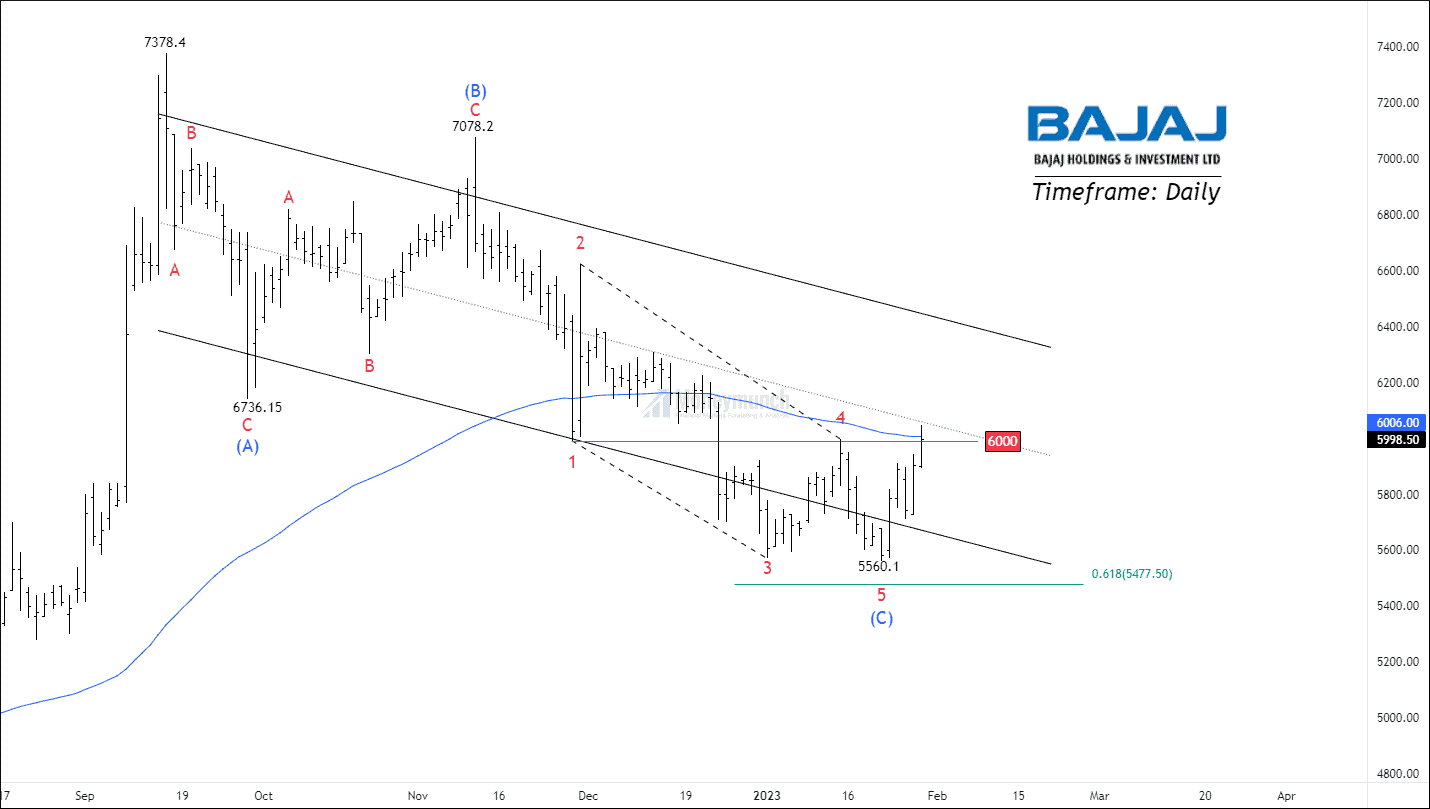

NSE BAJAJ HOLDING has been forming the correction for 19 weeks. Price has established an ending diagonal in wave C, which signals the downward move is not strong enough for a sharp fall.

According to Elliott waves, if the price sustains above the previous wave (4), traders can trade for the following targets: 6120 – 6229 – 6324+.

As you can see, the price has formed a double bottom on the daily timeframe chart, and 6000 is the neckline of the channel. The corrective structure has retraced 61.8% Fibonacci retracement of its previous move.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock