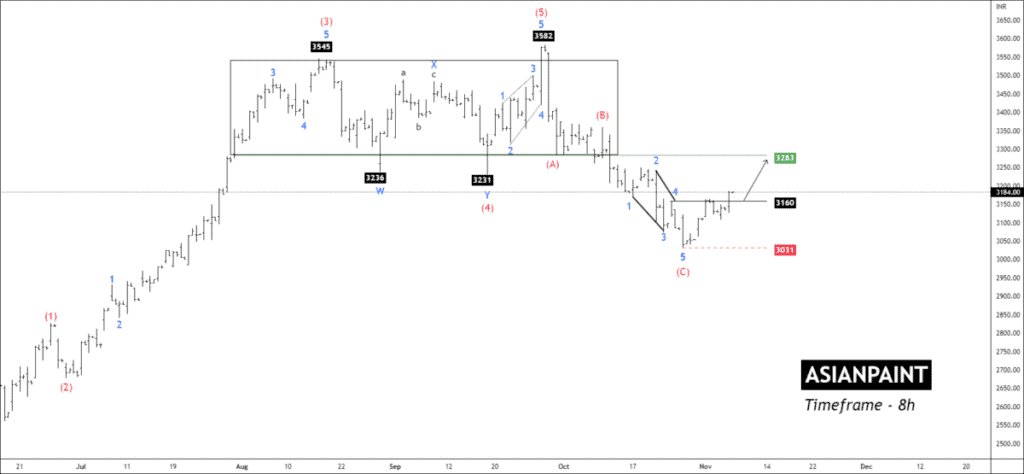

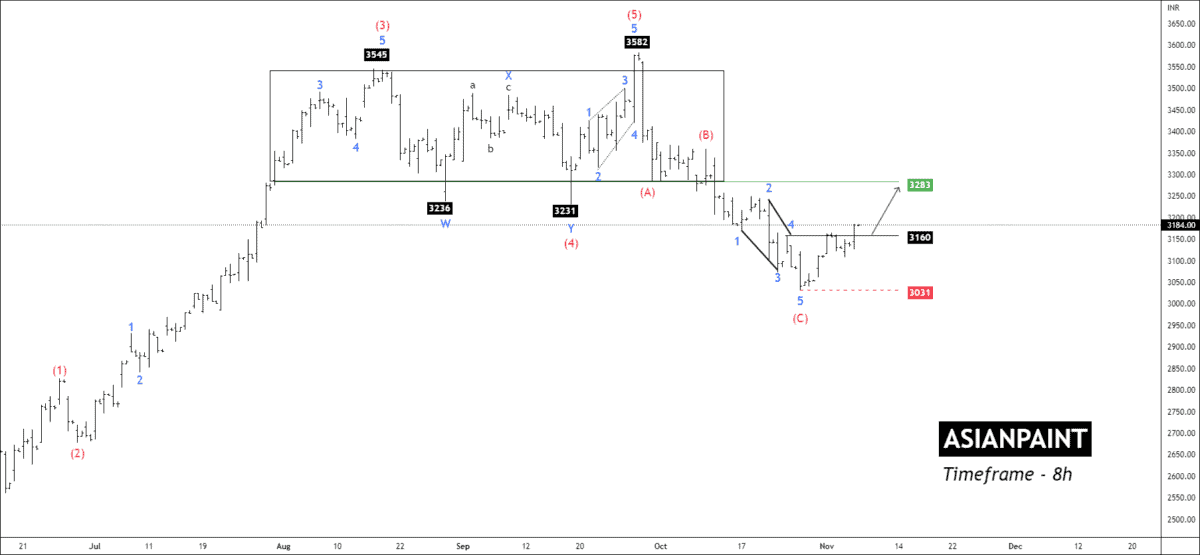

Timeframe: 8h

The price accomplished wave C at 3031 and started developing an impulsive structure, which is a crucial support level for the price. For ten weeks, Asian Paints has been struggling to maintain above its corrective range.

Stochastic is above 60, indicating prices are not overbought and have the potential to increase further. According to Elliott’s wave principle, an impulsive cycle can only start after the breakout of the sub-wave 4 of a lower degree.

At present, Asian Paints have broken sub-wave four at 3160. Demand pressure is still more significant than supply force. If price sustains above 3160, traders can trade for the following targets: 3231 – 3283 – 3360+.

A systematic downward movement will allow us to enter the market, but price can create new low after the breakdown of 3031.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for your knowledge. Your analysis works most of the time. Please keep it coming.

good insight and favorable analysis.