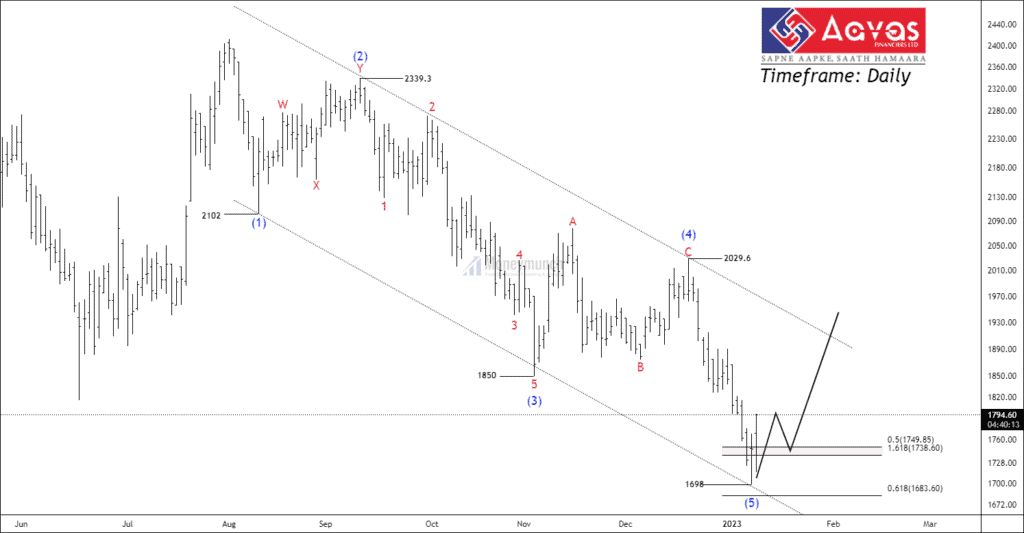

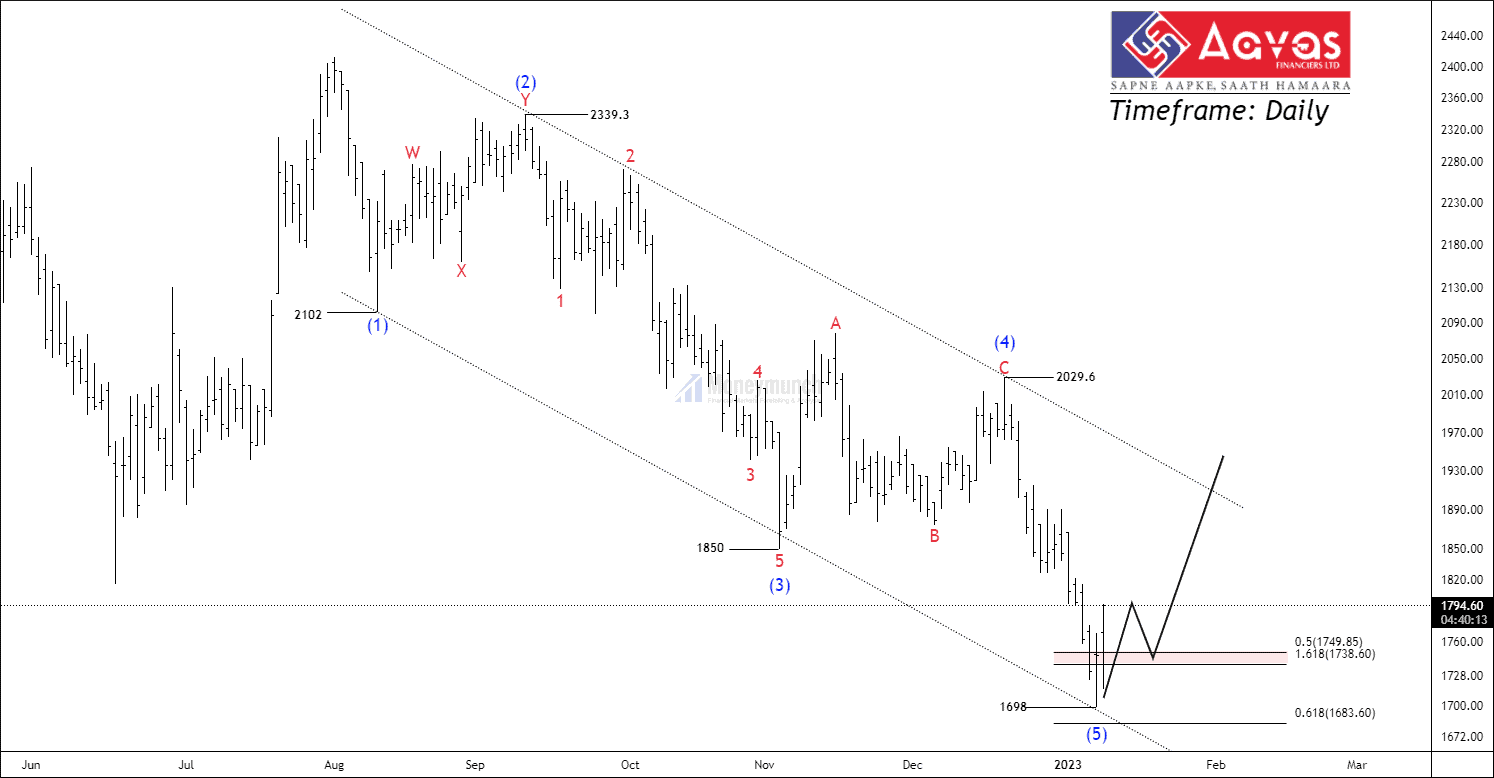

Timeframe: Daily

NSE AAVAS accomplished wave (5) of wave C at 1698 and started an impulsive cycle from the parallel channel’s lower band. Prices are forming into the downtrend channel, and wave (4) breakout can give a steady uptrend for bulls.

Fibonacci Clusters:

- Cluster range of 1749 – 1738.6. Trend-based Fibonacci extension of 0.5 at 1749, and 1.618 reverse Fibonacci of 4th wave at 1738.6.

- Fibonacci extension of 0.618 at 1683.6.

Trading Plan:

If the price sustains a cluster range of 1749 – 1738.6, traders can trade for the following targets: 1835 – 1885 – 1945. Safe entry is possible after a pullback. The setup will be invalid below wave (5).

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Hi team,

I checked your plans and I can see only yearly plans, Do we have any monthly plan for beginners?

If we have please mail me details on [email protected]

Thanks,

We are not offering monthly services in the stock and commodity markets except Forex. Visit our frequently asked questions to quickly answer your questions about how Moneymunch works: click here →

Near and clear analysis

Wave theory is complex but it works well.