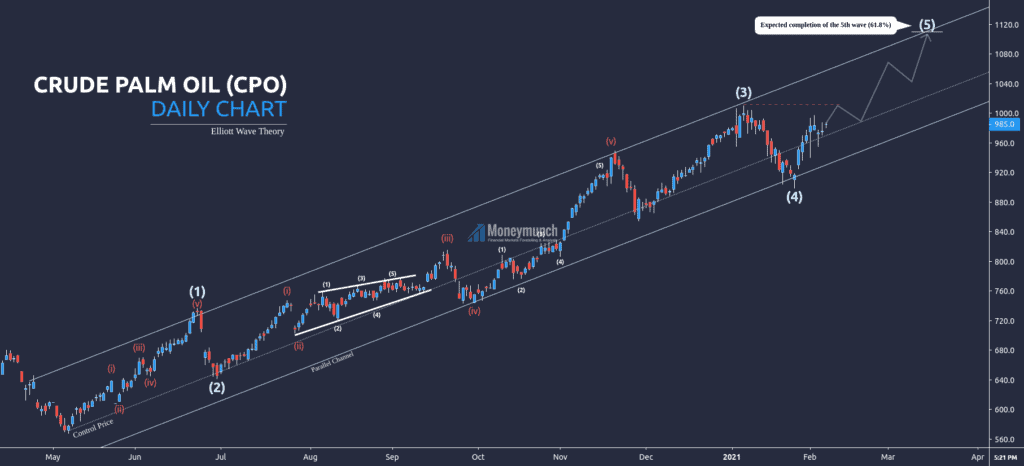

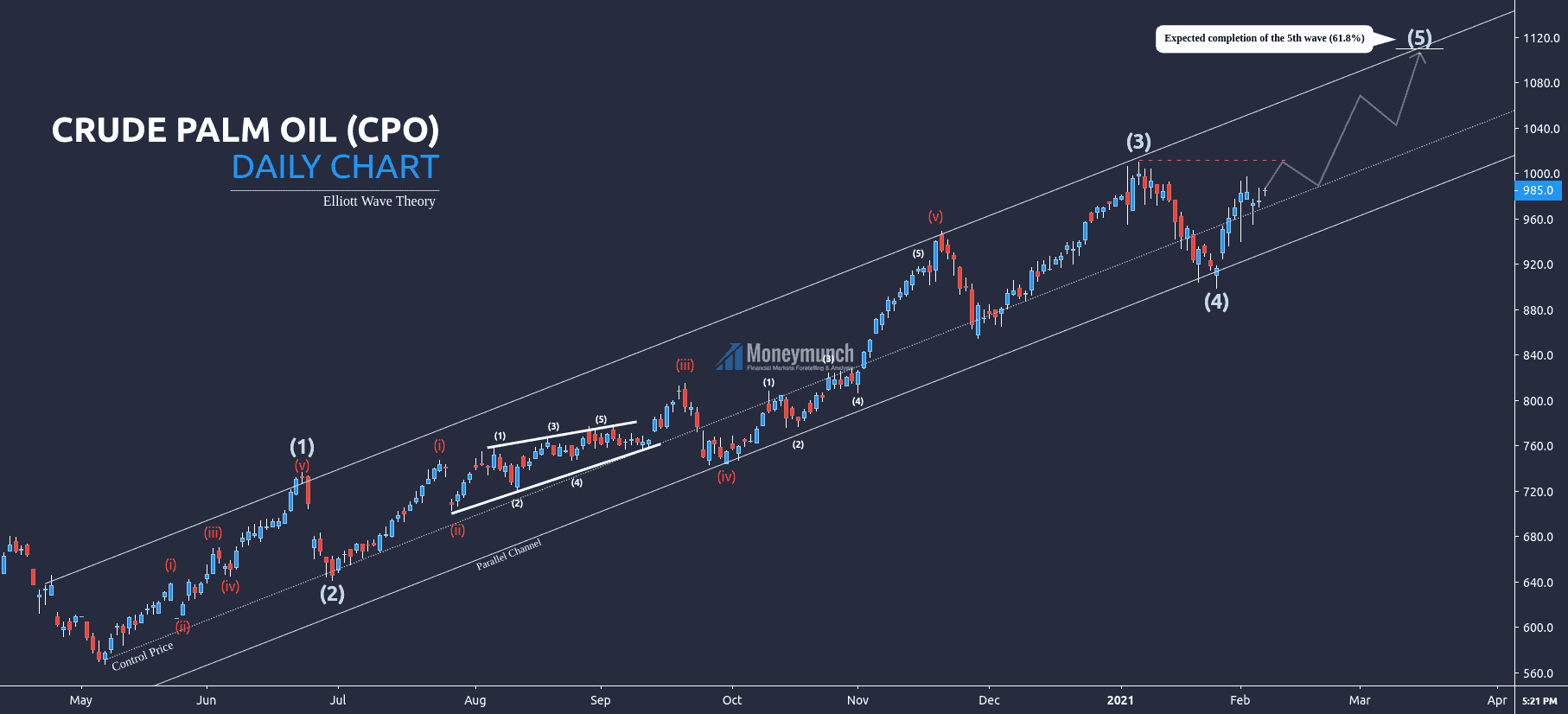

Main scenario: consider long positions from the control price or support trendline for the target level of 1000 – 1040 – 1080 – 1100 – 1110.

Analysis: Daily time frame – presumably, the crude palm oil has started an Elliott wave and made the 4th wave, and now it’s making a fifth wave. According to EWT, the fifth wave will be completed at 61.8% or 50% of Fib retracement 1+3.

Alternative scenario: breakout and consolidation below the support trendline will allow the CPO to continue declining to the levels of 880 – 760.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.