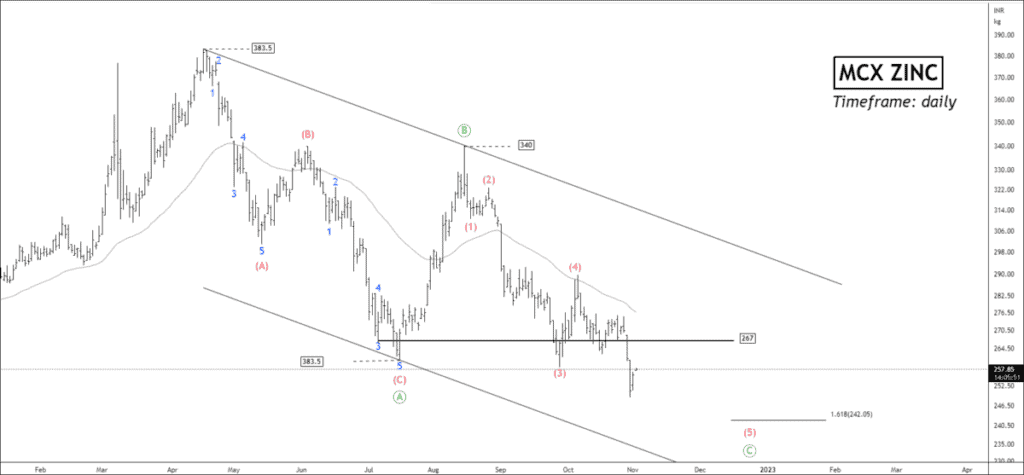

MCX zinc has been forming the corrective structure in the descending channel for more than 28 weeks. The ending point of impulse was 383.55.

At present, MCX zinc has accomplished the corrective wave ((B)) and started forming sub-waves of the impulsive wave (C). Price has completed 78.6% retracement, where wave A = C at 217. Zinc has accomplished wave (4) of wave ((C)). Wave ((C)) retraced 61.8% of wave ((A)). Zinc is trading below 50-day EMA, and RSI is above 30.

Zinc will try to test the price hurdle of 267, so traders can sell zinc nearby 267 for the following targets: 252.6 – 246 – 244.

Target measurement using the Fibonacci relationship:

- Wave (5) of wave ((C)) can end near 161.8% reverse Fibonacci retracement.

- Wave ((C)) can occur near 100% extension at 217, where wave A = C.

- Wave ((C)) can cease to exit at the lower band of the parallel channel.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

superb analysis

Well done on your analysis and charts! Thanks for sharing

Your forecast is sensible for sure.

fantastic analysis thank you very much

Brilliant explanation ✌🏻