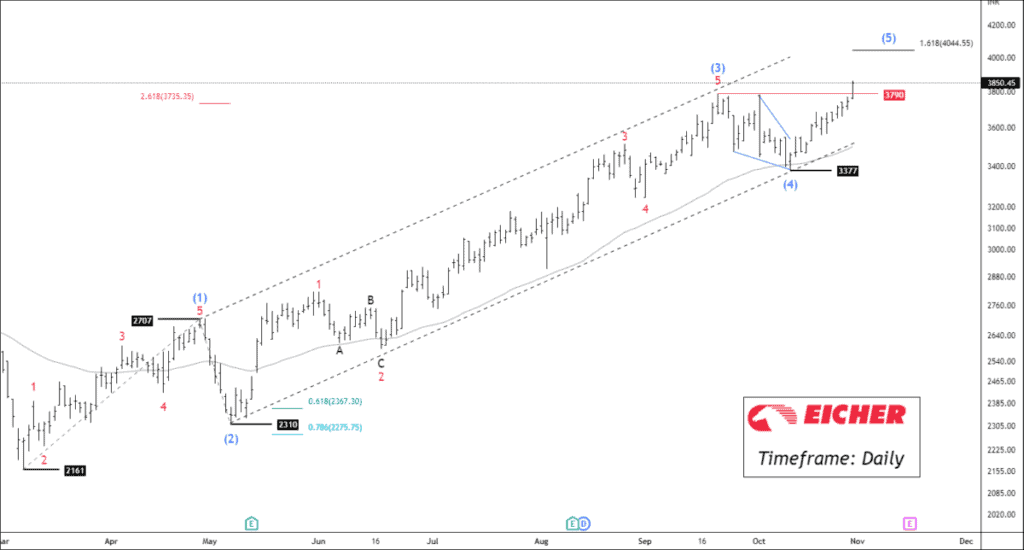

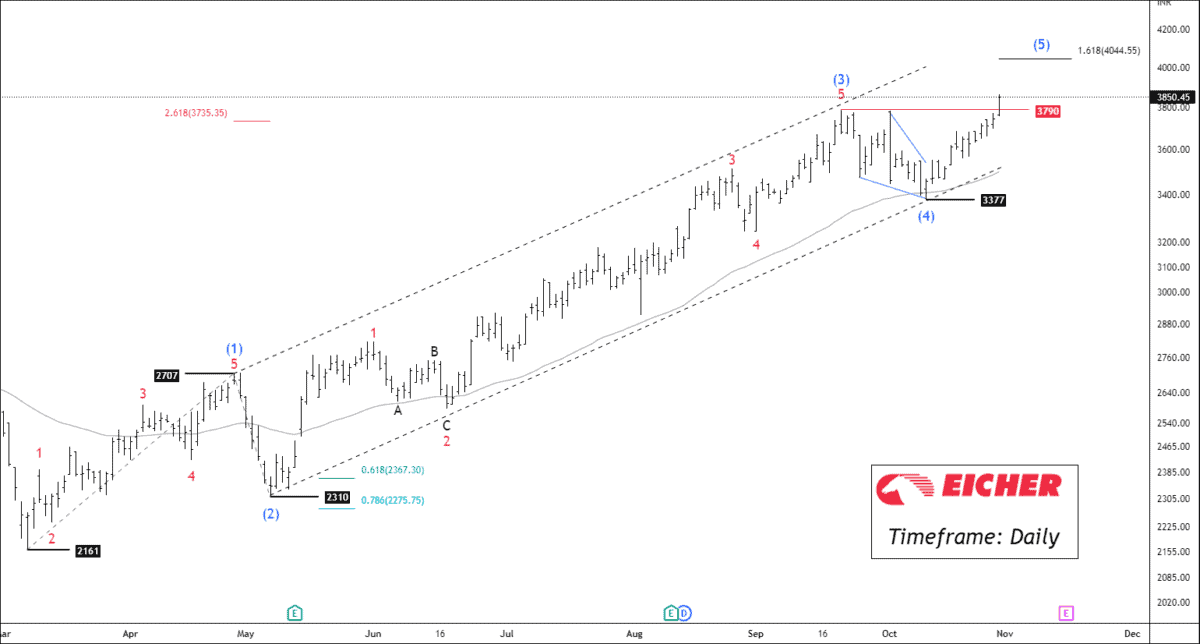

Timeframe: Daily

NSE EICHER motors have accomplished the corrective wave (4) and started forming impulsive waves (5). The price is currently forming sub-waves of the impulsive waves (5).

Wave (2) was a sharp zigzag, so wave (4) formed the choppy structure triangle. Since wave (3) was an extensive wave, we cannot expect wave (5) to extend with a high probability.

Eicher motors have given a good breakout and broken out wave 2 of the triangle and impulsive wave (3). If the price sustains above 3790, traders can trade for the following targets: 3948 -3992 – 4030+.

Fibonacci relationship:

- Wave (2) retraced 78.6% of wave (1).

- Wave (3) extended 161.8% of wave (1).

- Wave (4) retraced 38.2 % of wave (3).

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Nice work! appreciate the effort you put into this analysis.

This is amazing