Is this how the euro crisis ends? Not with a bang, but a “firebreak”?

What’s a firebreak? And how is it different from a firewall? And what distinguishes that from a financial bazooka? These are semantic, if not existential, questions that markets have little use for. Whatever you want to call it, the meaning is clear: throwing money, and lots of it, at Europe’s problems.

It’s been enough to send Spanish borrowing costs tumbling the past few days. On Monday, the yield on Spanish 2-year bonds was 5.5 percent; on Thursday it was 4.6 percent. Is the euro saved?

Haha, no. Of course not.

We’ve seen this movie before. Every few months, Eurocrats hint at SOMETHING BIG. And every few months, it turns out to not be something big. Here’s the anatomy of a euro salvation rumor. It starts with a top official saying that the euro bailout funds — the EFSF and ESM — might buy bonds from troubled countries on the open market to push down borrowing costs. That’s fine. But it’s not “new”. It’s the definition of what those bailout funds can do.

But here’s the catch. The ESM doesn’t even exist. Not yet, at least. It still needs to be ratified. And that will take a bit longer than expected. But there’s an even bigger catch. There isn’t enough money in the actual bailout fund, nor will there be in the hypothetical one. Suppose the EFSF buys some bonds. That will push down yields for awhile. But what happens when the money starts to run out? Yields will go back up. A firebreak/firewall/bazooka needs unlimited funds to work.

In other words, it needs to be the ECB. They have infinite money. That’s the magic of the printing press.

And that’s the final part of every euro rumor. It involves the EFSF getting a banking license so the ECB can give it money. Of course, the ECB doesn’t want to do that. That’s when the rumor dies.

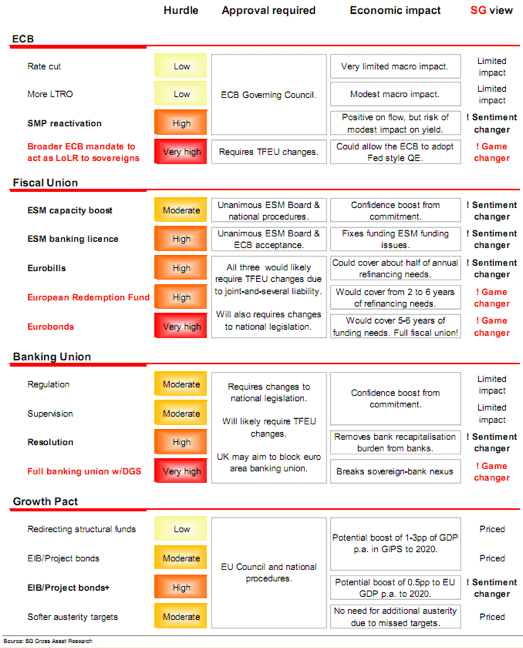

This chart from Societé Generale, via Simon Hinrichsen of FT Alphaville, lists the things Europe could do, how big a hurdle there is to them happening, and how much they’d help. To paraphrase Ezra Klein, everything that would help a lot is politically impossible and everything that’s politically possible wouldn’t help a lot. Hence, the neverending crisis.

There’s another takeaway here. Europe’s currency union needs a fiscal union and a banking union if it’s going to work, in the long run. But Europe needs the ECB to get it to that long run. Spain and Italy won’t stay solvent anywhere near the years it will take Europe to make the tough political decisions on fiscal and banking unions. The ECB needs to bridge that gap.

That’s the scariest part about the euro crisis. There are very few scenarios where the euro survives that don’t involve the ECB doing much, much more. Their track record doesn’t exactly inspire confidence.

In the mean time, did you hear that the EFSF might buy some bonds?

Get free forex & currency ideas, chart setups, and analysis for the upcoming session: Forex Signals →

Want to get premium trading alerts on GBPUSD, EURUSD, USDINR, XAUUSD, etc., and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Forex Signals

Premium features: daily updates, full access to the Moneymunch #1 Rank List, Research Reports, Premium screens, and much more. You΄ll quickly identify which commodities to buy, which to sell, and target today΄s hottest industries.

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.