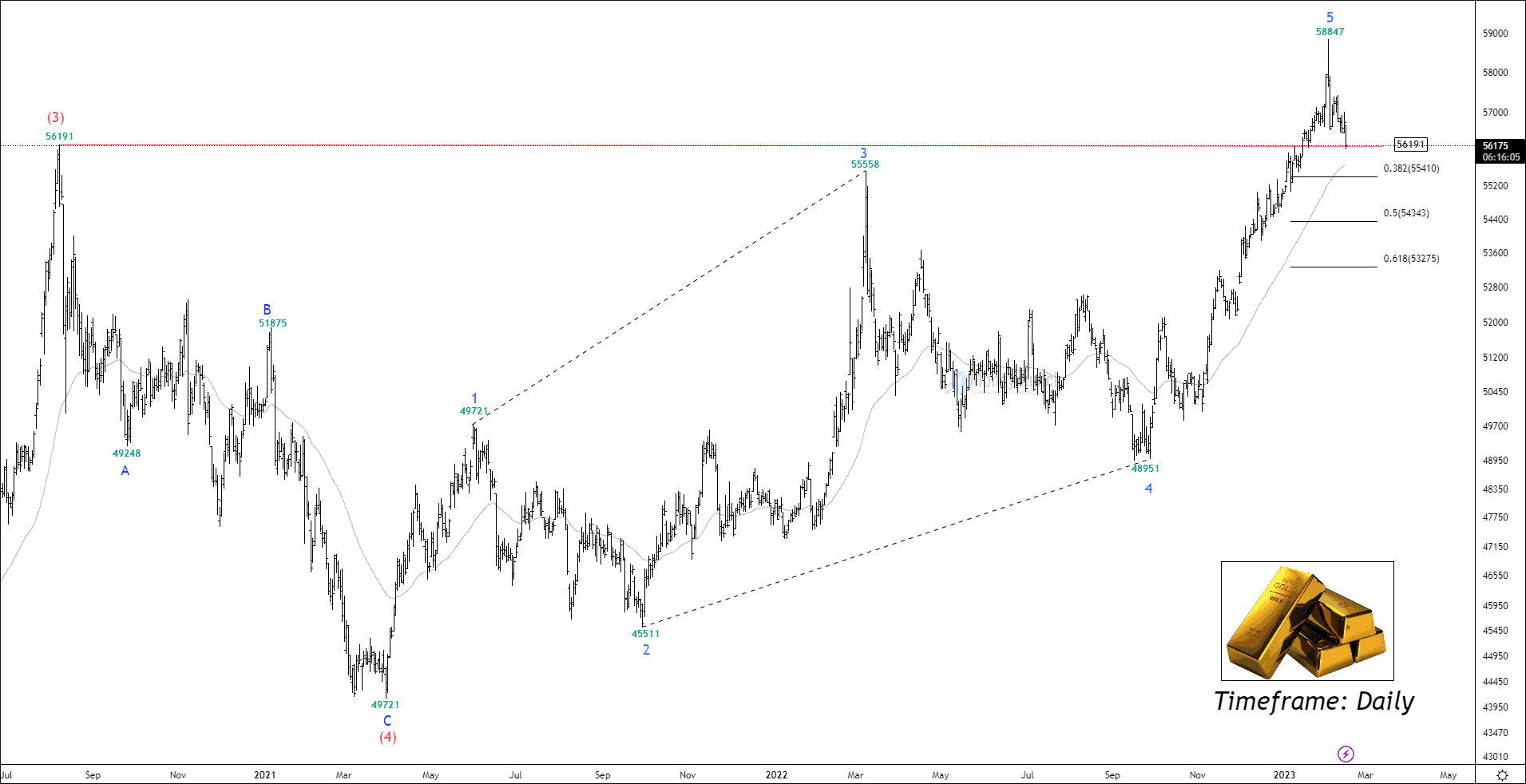

Did you read MCX Gold’s Previous Research Report?

Click here: Will gold’s uptrend survive till the 60000 level?

Will MCX Gold Hit The Final Target?

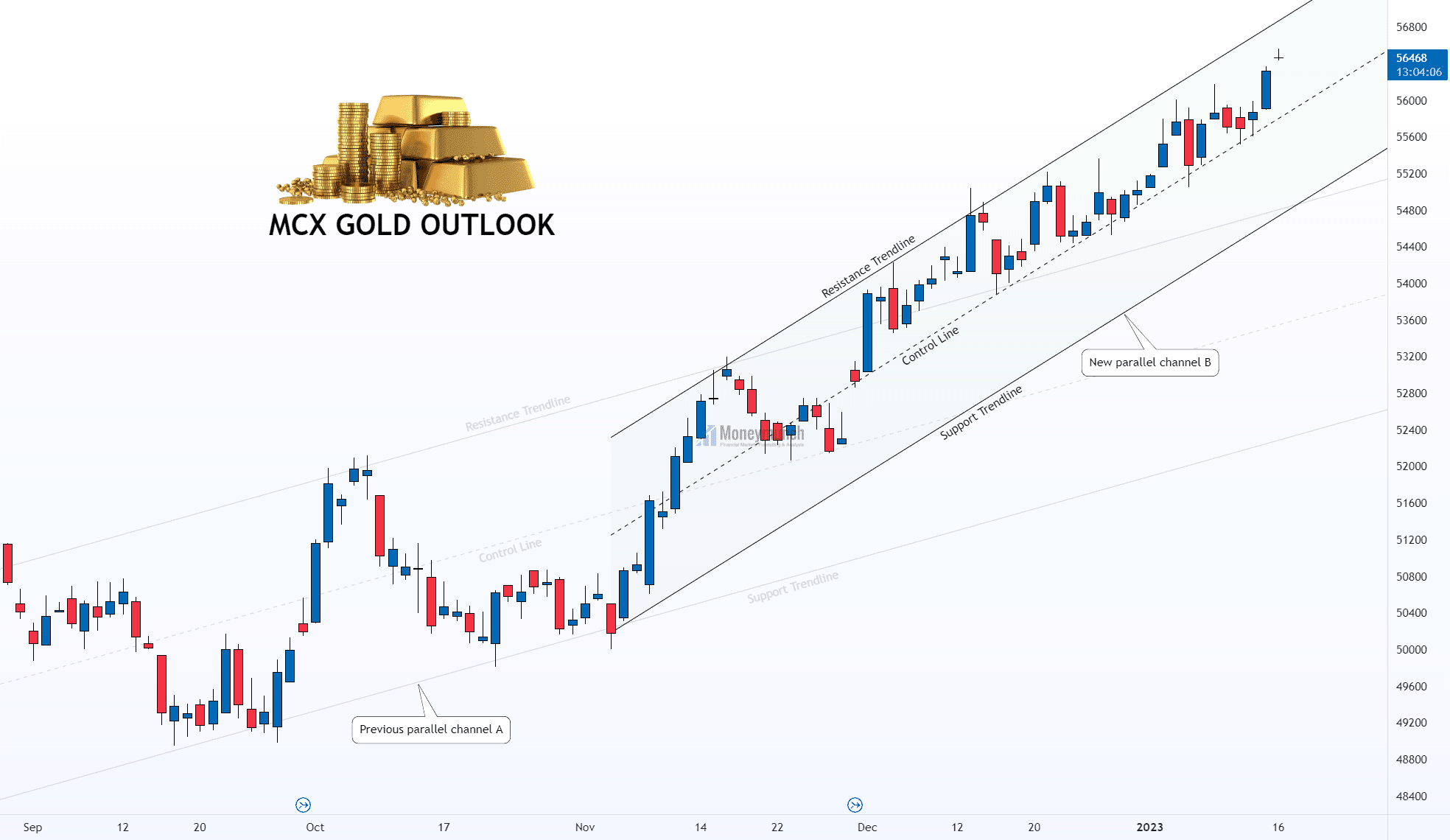

I have written clearly, I don’t see any reversal sign still yet. Hence, we can expect 56800 – 57000 – 57200+ levels.”

[20 January 2023]

- 01:34 PM – Price touched the first target of 56800.

[24 January 2023]

- 09:00 AM – Price hit the final target of 57000.

- 09:22 AM – MCX Gold made a new high of 57099.

I will update further information soon.Continue reading

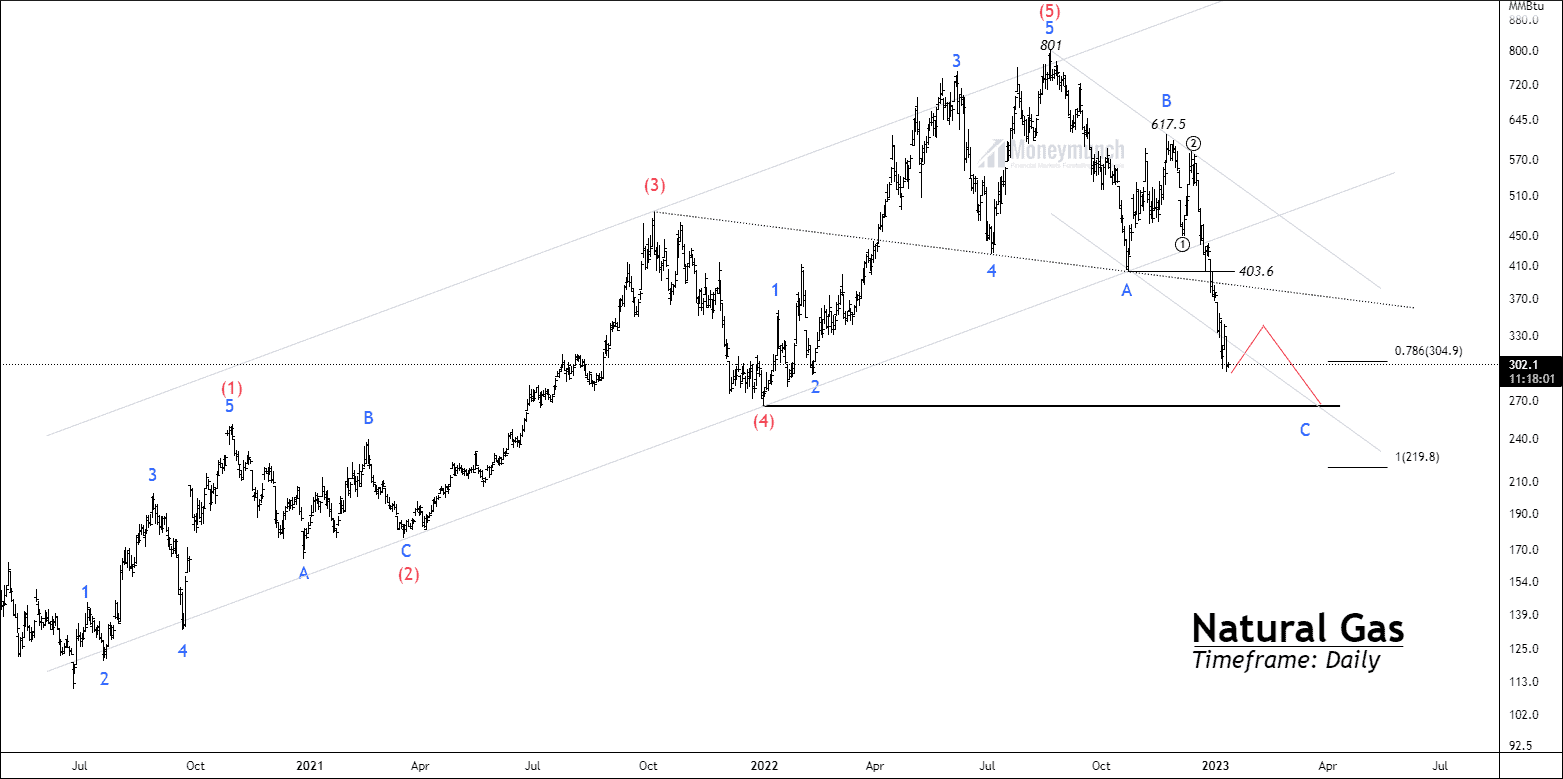

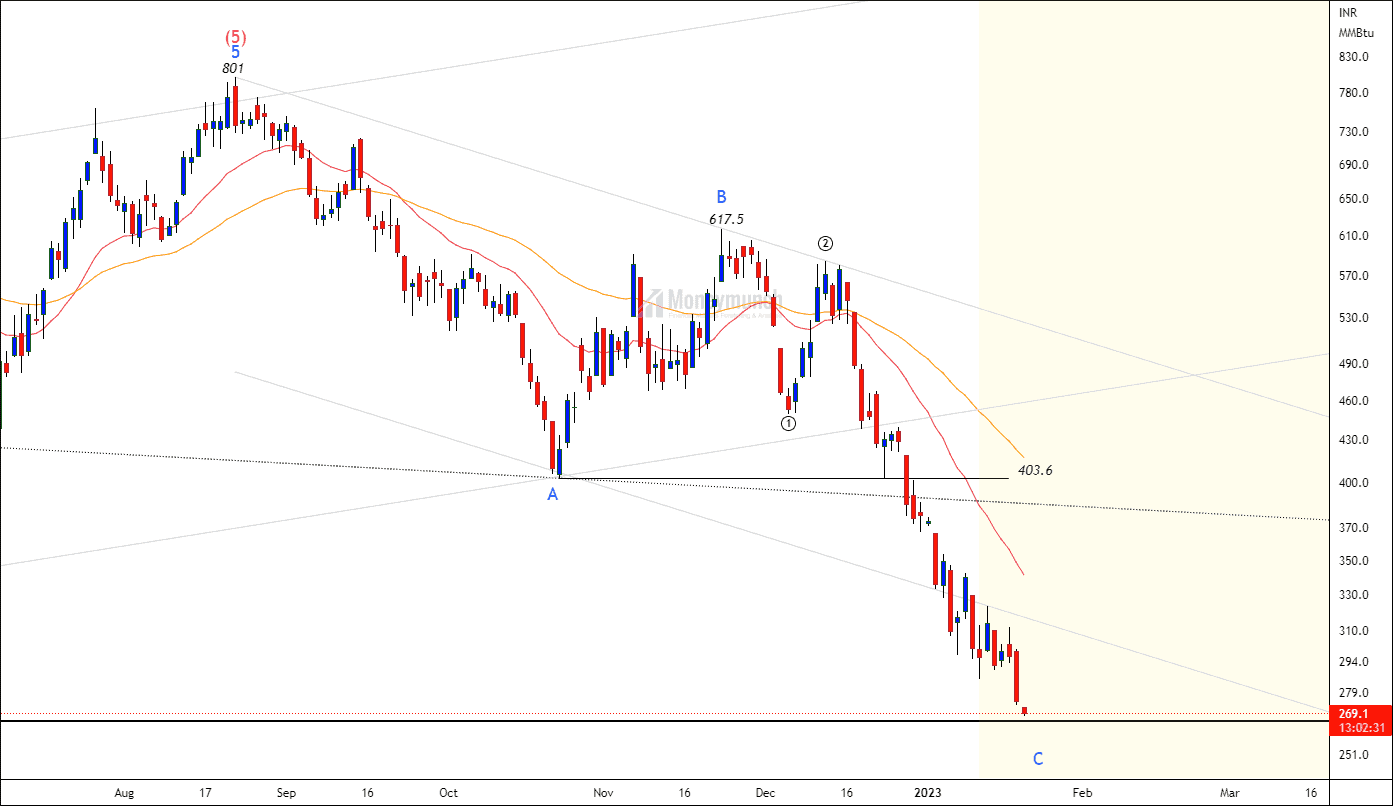

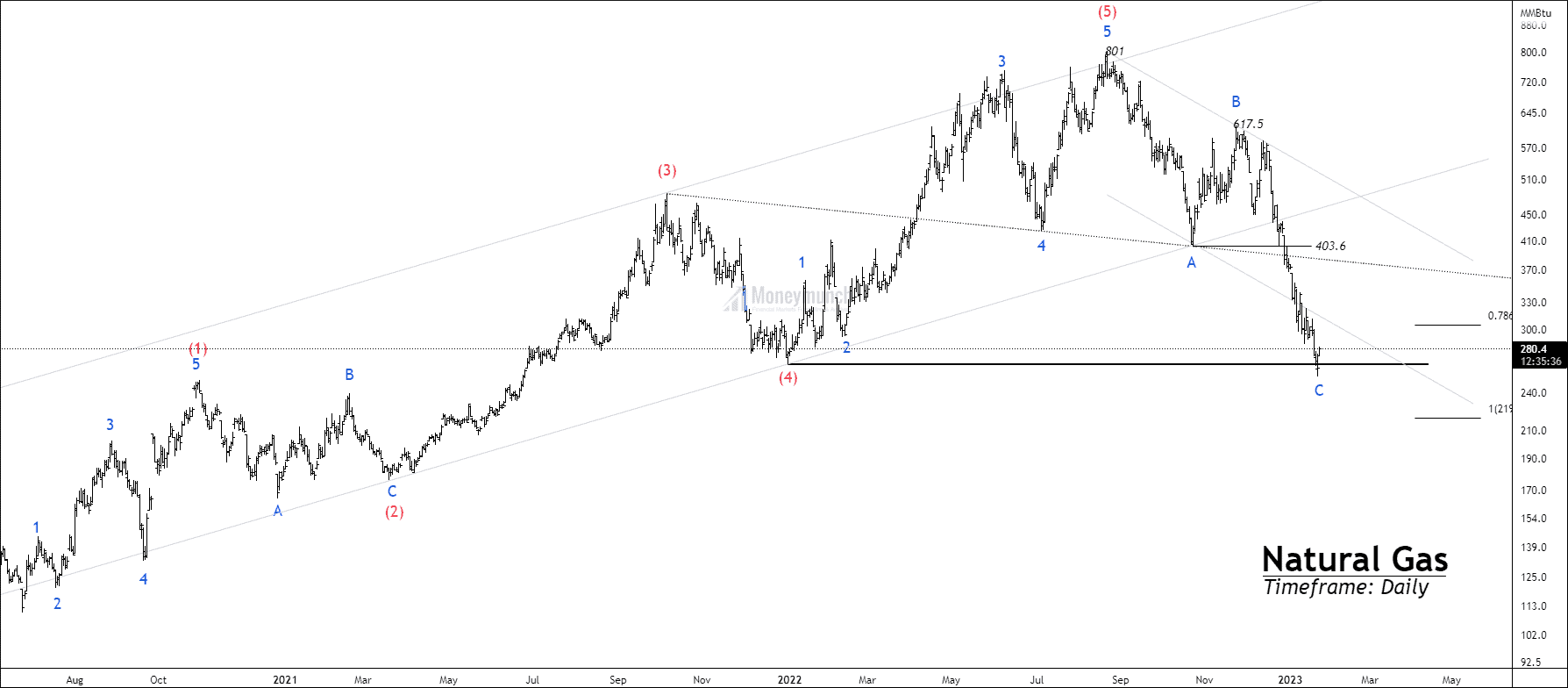

EWT – Is Natural Gas Prepared for a Reversal?

In our previous article, we discussed impulsive wave C and its continuation. On 20 January 2023, Price achieved our all given targets.

Click here: MCX Natural Gas – Elliott Wave projection

Continue reading

Continue readingMCX Gold – Tips & Update

Did you read MCX Gold’s Previous Research Report?

Click here: Will gold’s uptrend survive till the 60000 level?

I have written clearly, I don’t see any reversal sign still yet. Hence, we can expect 56800 – 57000 – 57200+ levels.”

Timeline:

[20 January 2023]

- 01:34 PM – Price touched the first target of 56800.

Will MCX GOLD reach the final target of 57200? I will update further information soon.Continue reading

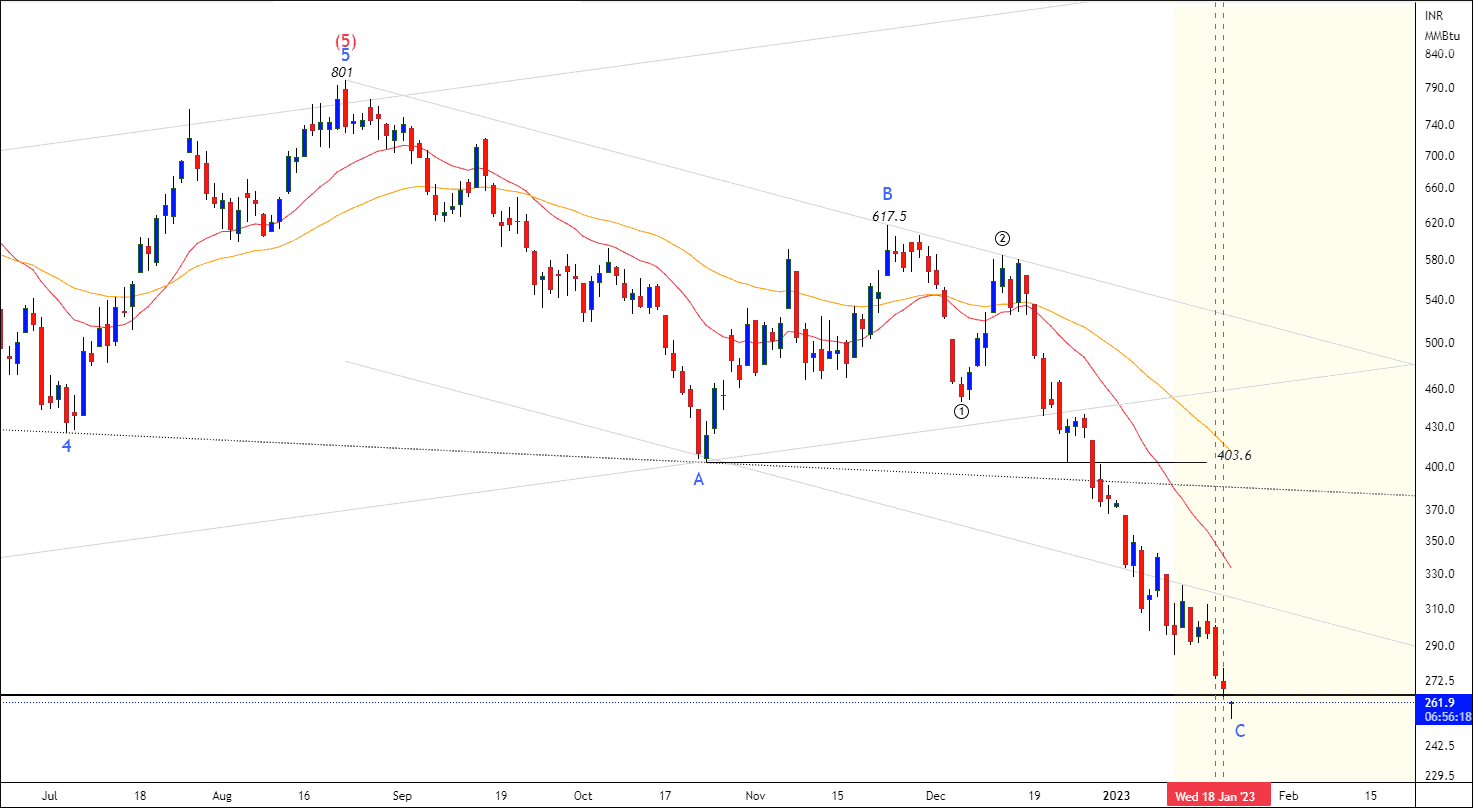

MCX Natural Gas – Tips & Updates

Do you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”

MCX Natural Gas – Tips & Updates

Do you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”