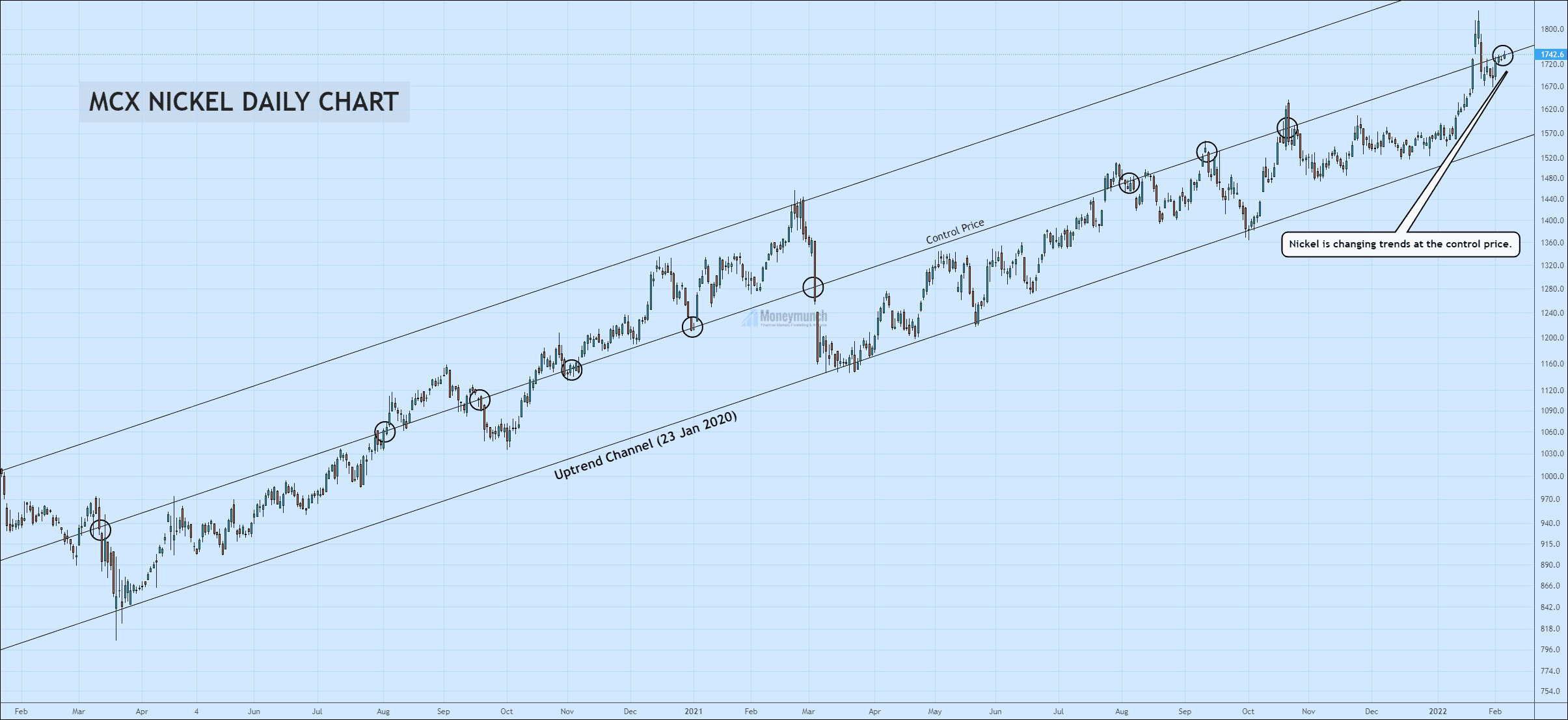

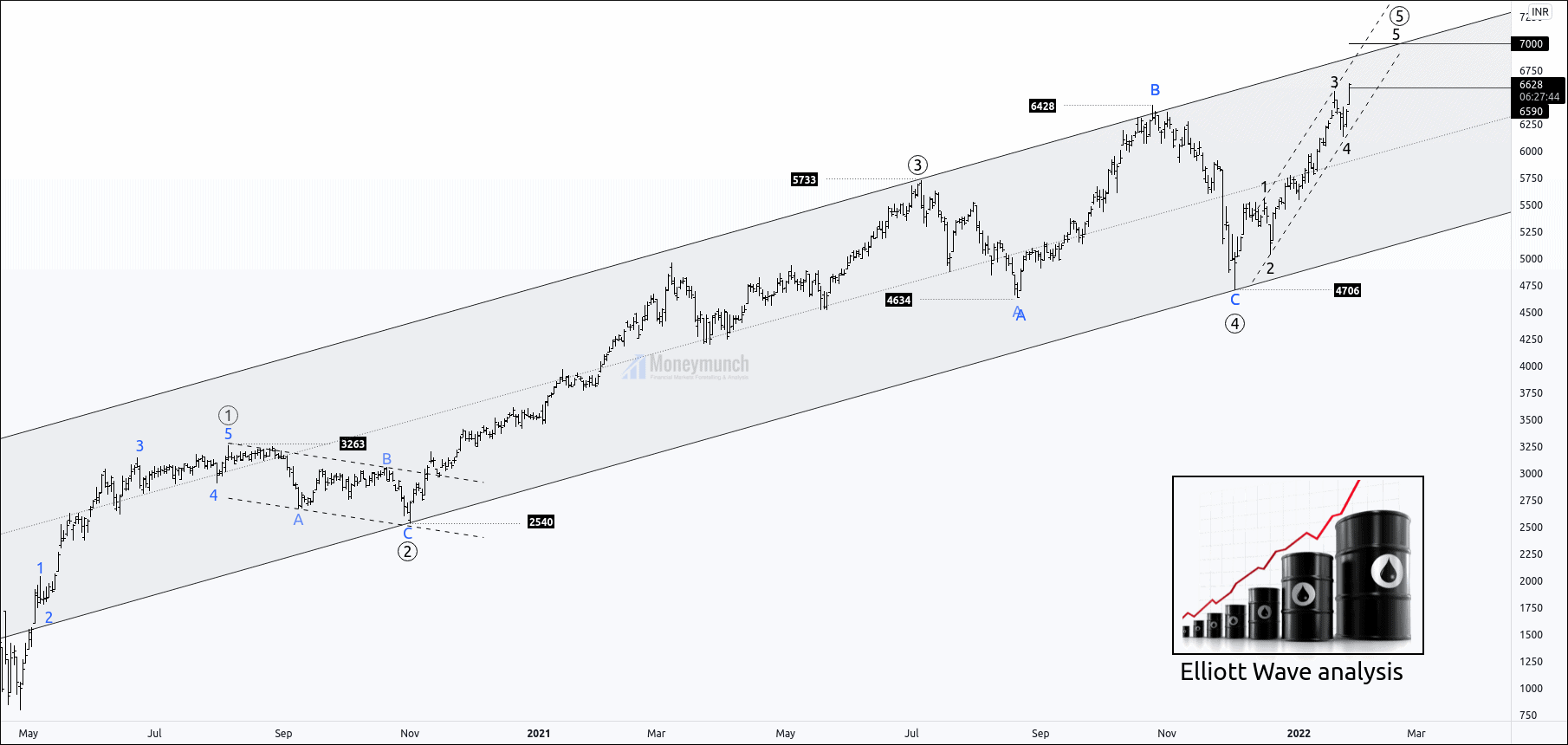

MCX Nickel is following the above uptrend channel from 23 Jan 2020. And making a good trade opportunity for commodity traders. Nickel’s upward trend is not over yet. But we may see a downfall below the control price, and it can be up to 1686 – 1620.

But what happens if it breaks the control price?

It’s a 100% sign for a buy signal. But intraday or short-term investors should confirm that breakout before proceeding. And they must look out for candle’s fakeout. Afterward, be ready for the targets of 1800 – 1840 – 1876+.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock