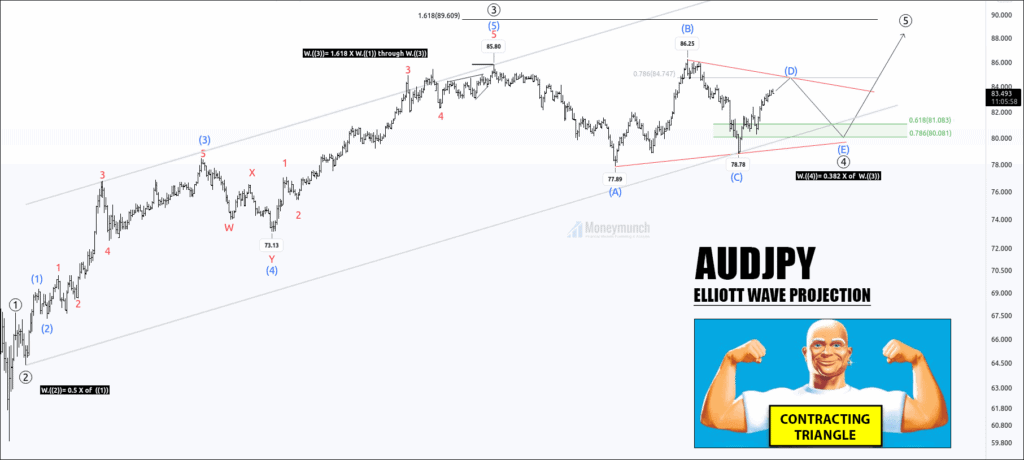

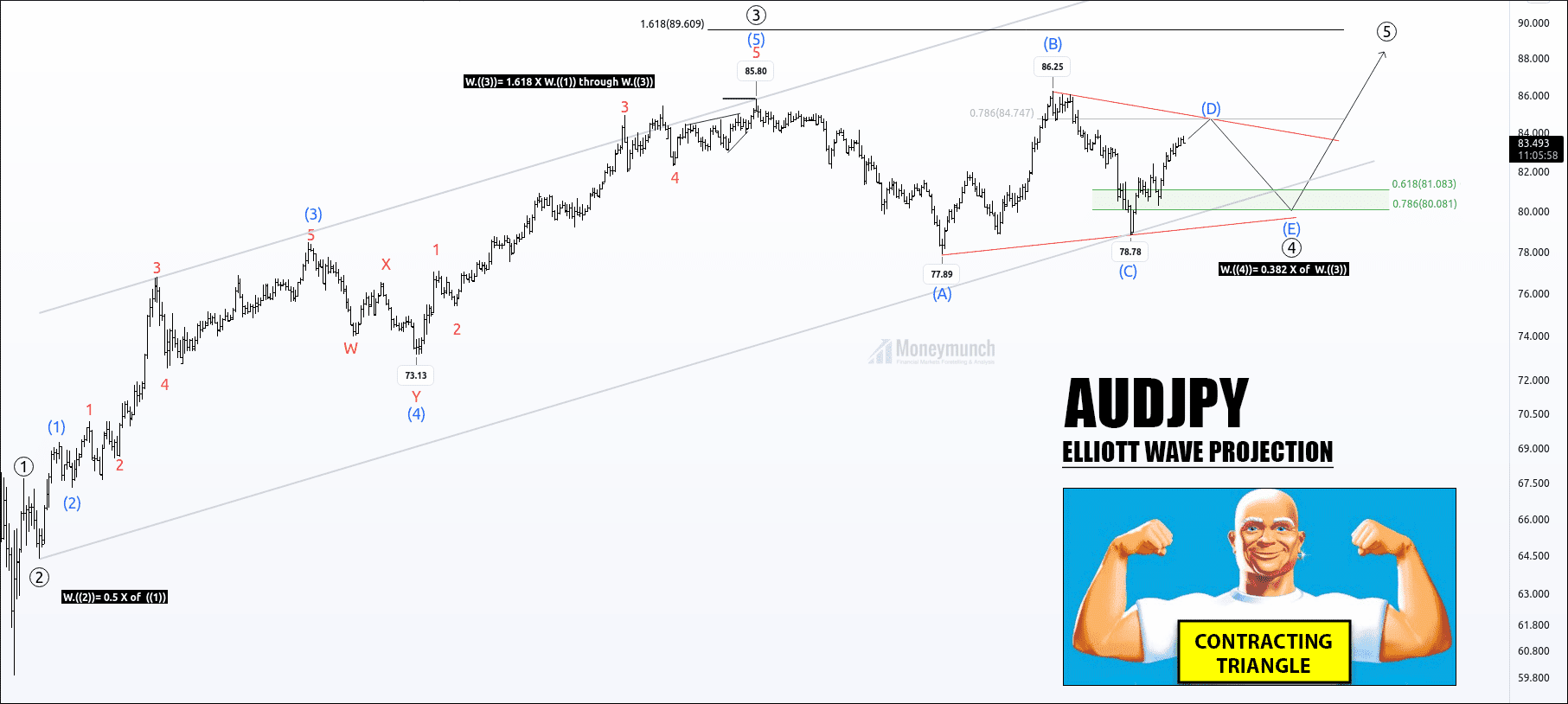

Currently, AUDJPY is forming a contracting triangle on the corrective wave ((4)). Price has completed sub-wave (C), and sub-wave (D) is in progress.

After completion of the (D) wave, the terminating wave sub-wave (E) will break the B–D trendline of the contracting triangle.

Wave (D) can end nearby 78.6% retracement of wave (B).

If the price breaks the B–D trendline, It can move to 85.35 – 86.25 – 88 – 89. The traders should put protective stop loss at 78.78.

wave (5) may end at 89.609, which is inverse Fibonacci retracement 1.618% of wave (4)

Wave (E) can complete between 0.618 to .786 Fibonacci levels.

That’s why a trader can expect the following targets for wave (E) 83.44 – 82.50 – 81.03 as targets of wave E. If you want to trade wave (E), then you should have a trailing stop due to the high volatility of wave (E).

Get free forex & currency ideas, chart setups, and analysis for the upcoming session: Forex Signals →

Want to get premium trading alerts on GBPUSD, EURUSD, USDINR, XAUUSD, etc., and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Forex Signals

Premium features: daily updates, full access to the Moneymunch #1 Rank List, Research Reports, Premium screens, and much more. You΄ll quickly identify which commodities to buy, which to sell, and target today΄s hottest industries.

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Hey Dev, Your wave count is acceptable for me.

It is helpful in cross confirmation.

Beautiful!