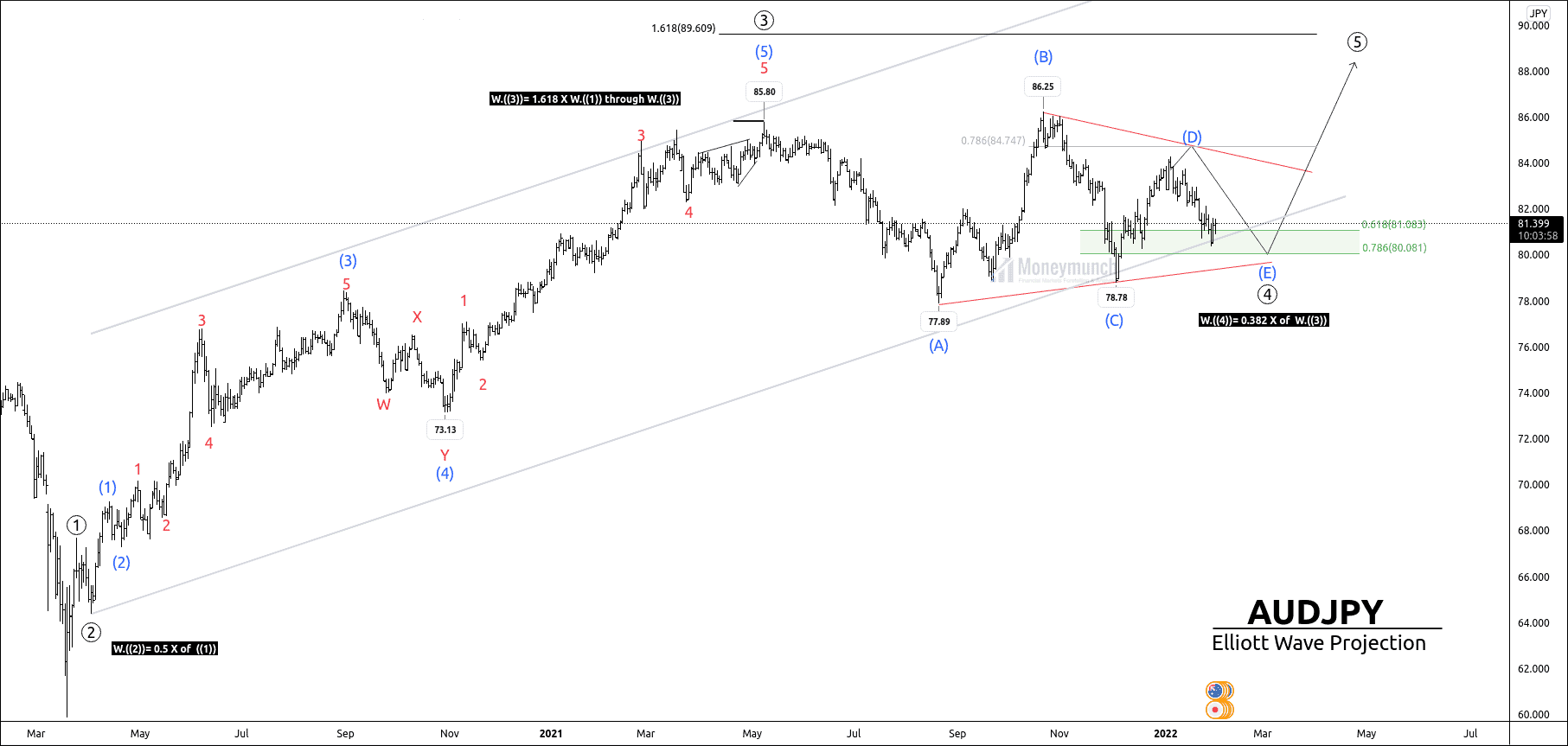

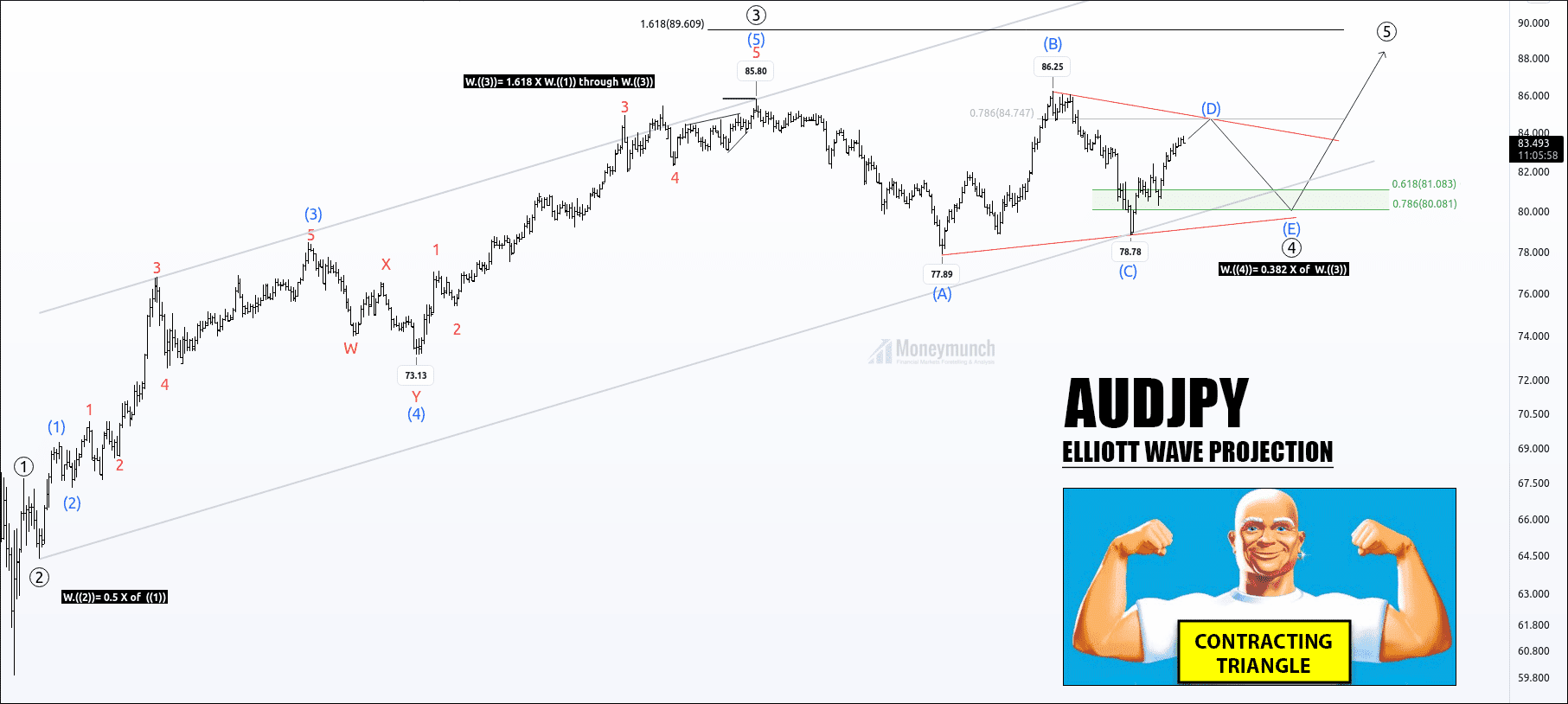

AUDJPY is forming a contracting triangle. Price had completed the (D) wave, and I have given the short-term selling targets of wave (E) of wave ((4)).

In my previous article, I have mentioned that “Wave (E) can complete between 0.618 to 0.786% Fibonacci levels. That’s why a trader can expect the following targets for wave (E) 83.44-82.50-81.03 as targets of wave E”.

Price has reached all of these targets.

Click Here to read the previous article.

The ending point of wave (E) is the starting point of an impulsive cycle.

Due to bearish sentiments, the price may touch the A-C trend line and start the bullish move.

Safe traders can enter after price make an excess on the lower band of the channel.

They can expect the following targets 82.565 – 83.850 – 84.185+.

Invalidation: Breakdown of the A-C trend line.

Lock

Lock