Gold closed at $1228.8 (+$2.5) and Silver closed at $17.38 (+$0.06) its highest level since the beginning of March. Both gained 2% in the last week. The U.S. dollar index edged higher on political uncertainty, and it fell more than 1%. Gold remained up last week because the Fed’s interest rate (1.4%) trajectory remains unchanged.

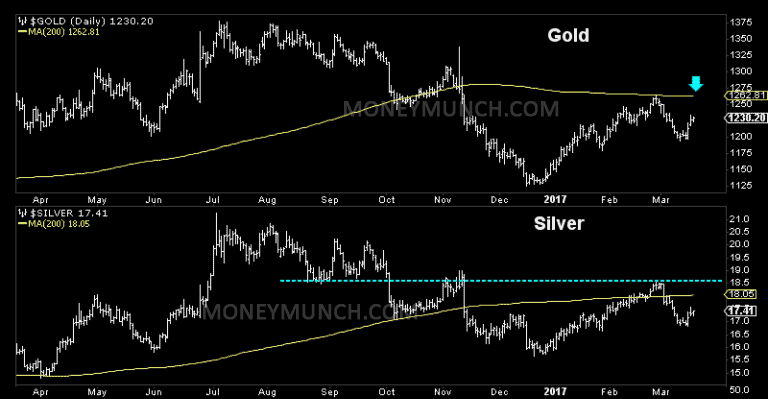

The gold & silver are throwing buy signal, but the cycle is down. A big correction is in progress.

This week MCX gold may try to test 28830 level. This is very crucial level for short-term investors. Above 28830 level closing confirm that gold will continue to move upside, and it can hit 29090 – 29400 levels in upcoming days.

Gold strong support is 28300 level. At the present time if gold will close below to 28300 levels then I recommend selling.

But I don’t recommend buying silver until it closes above to 42000 level. This week silver may try to keep rallying upside continue up to 41900 level. 41900 level is resistance so be careful.

Again, a big correction is in progress!

Subscribe us: Get live intraday trading alerts on Gold & Silver.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Outlook for silver n gold for this week