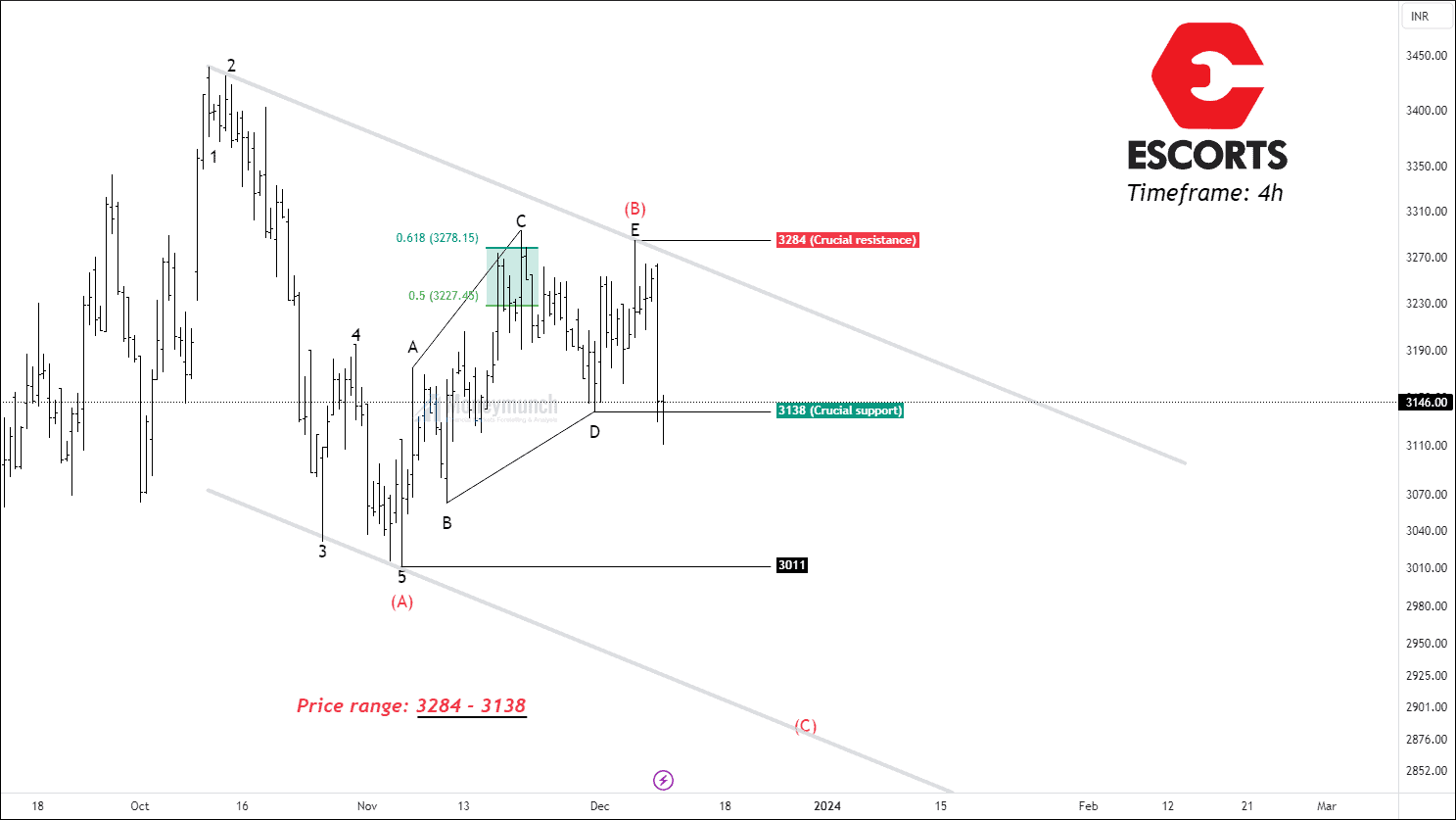

NSE SBICARD & EIHAHOTELS – Trade Setup

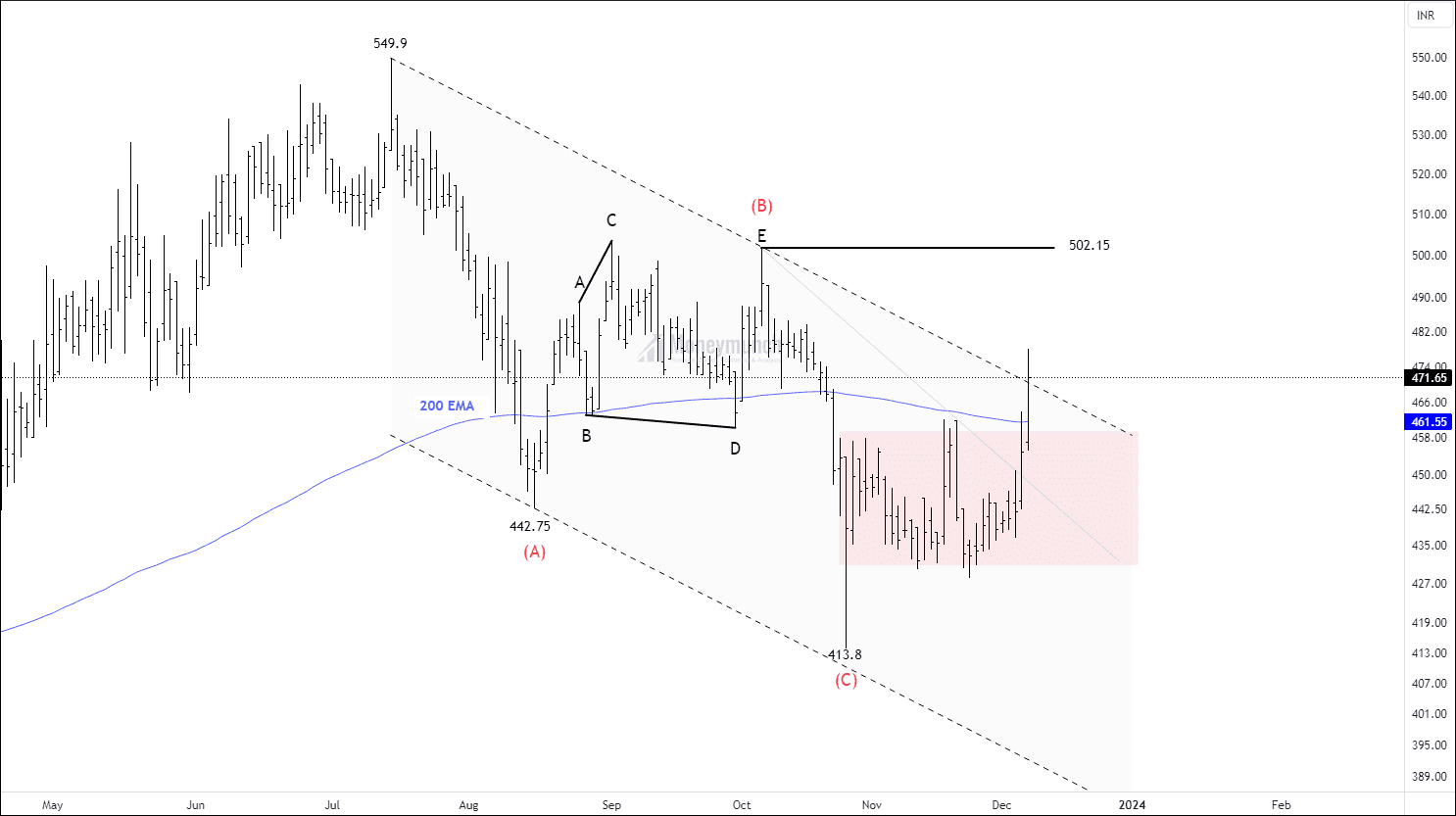

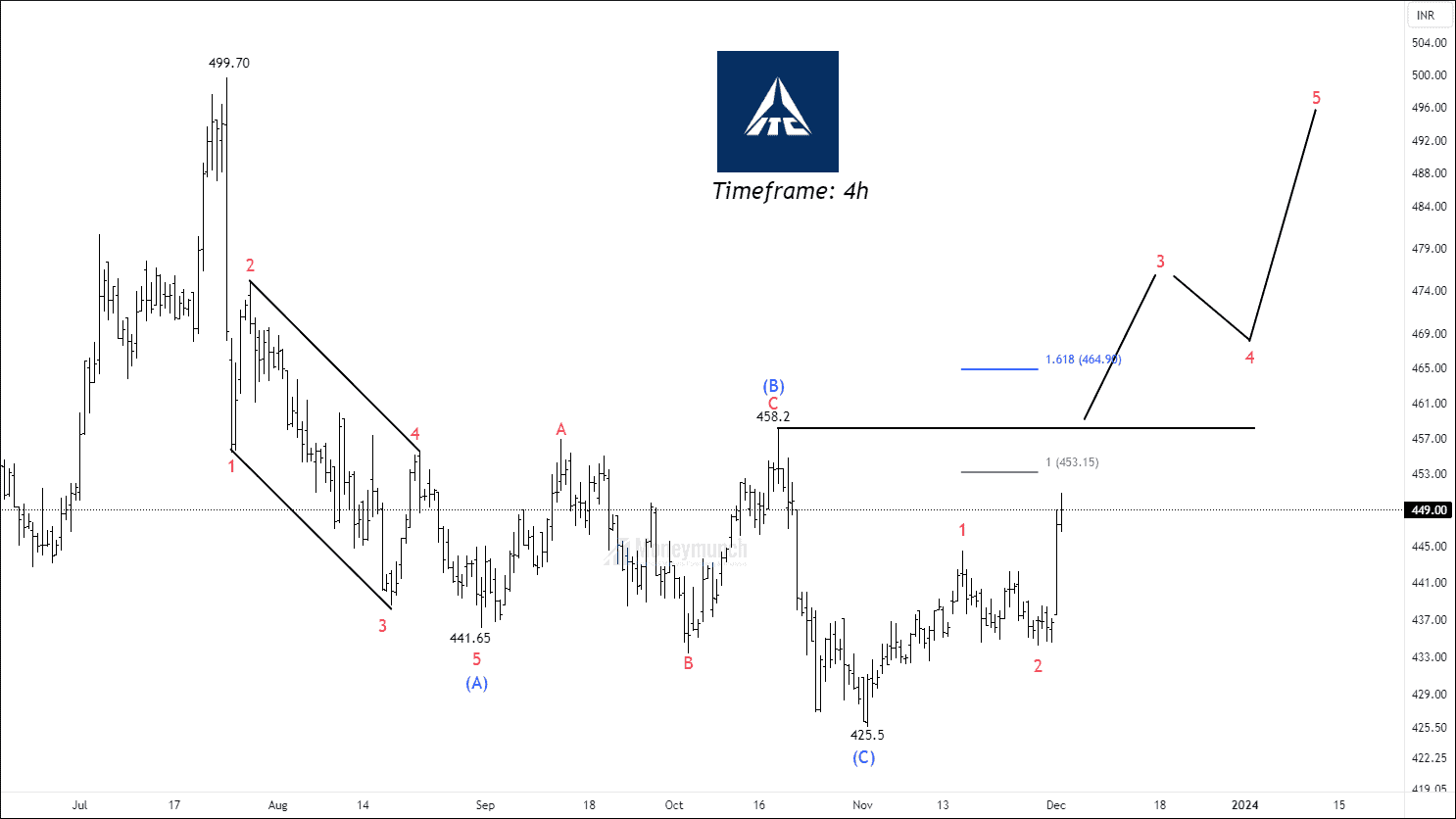

NSE ITC & CEAT – Swing Setup

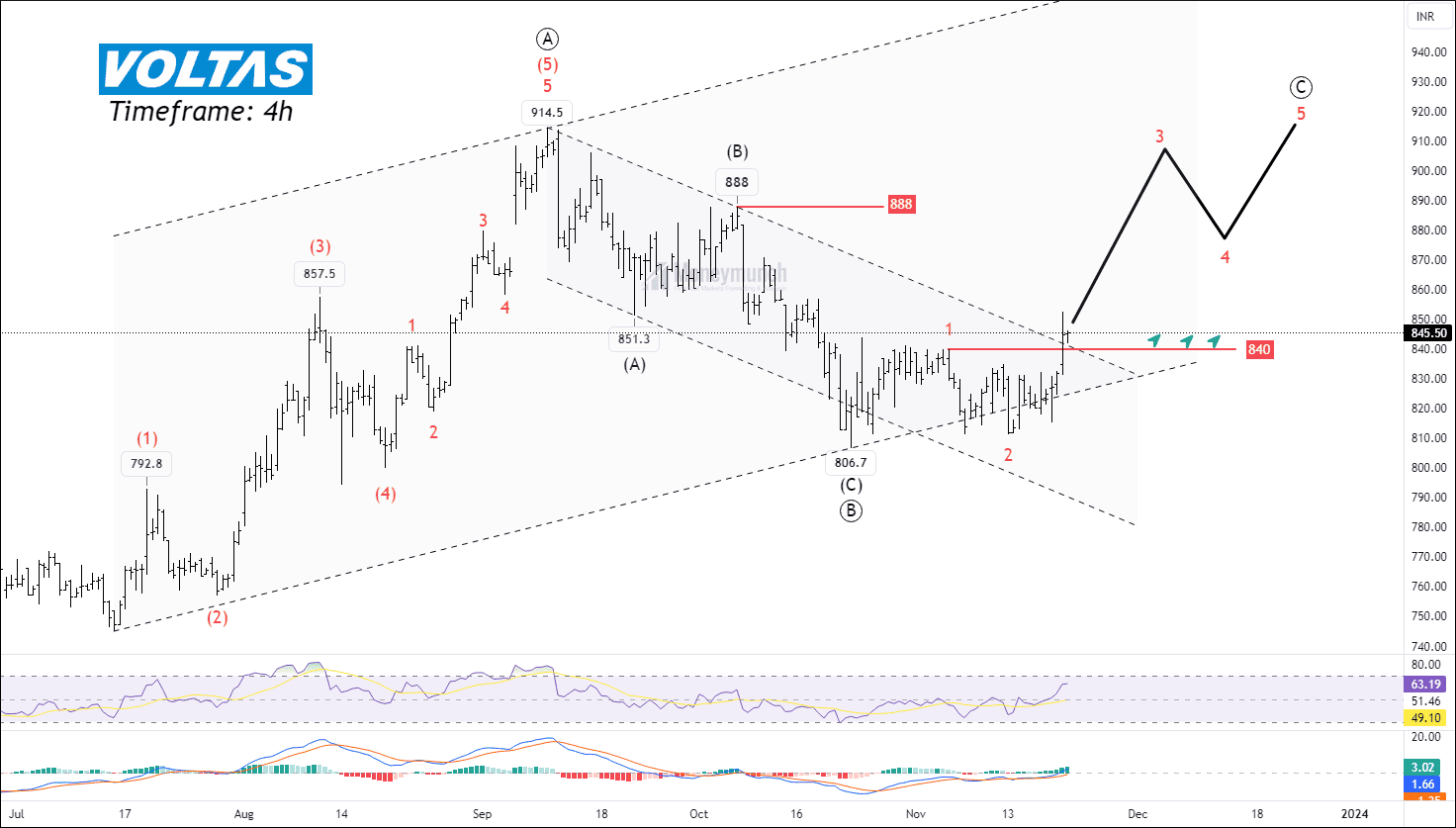

NSE VOLTAS Is Getting Ready For The Last Move (C)

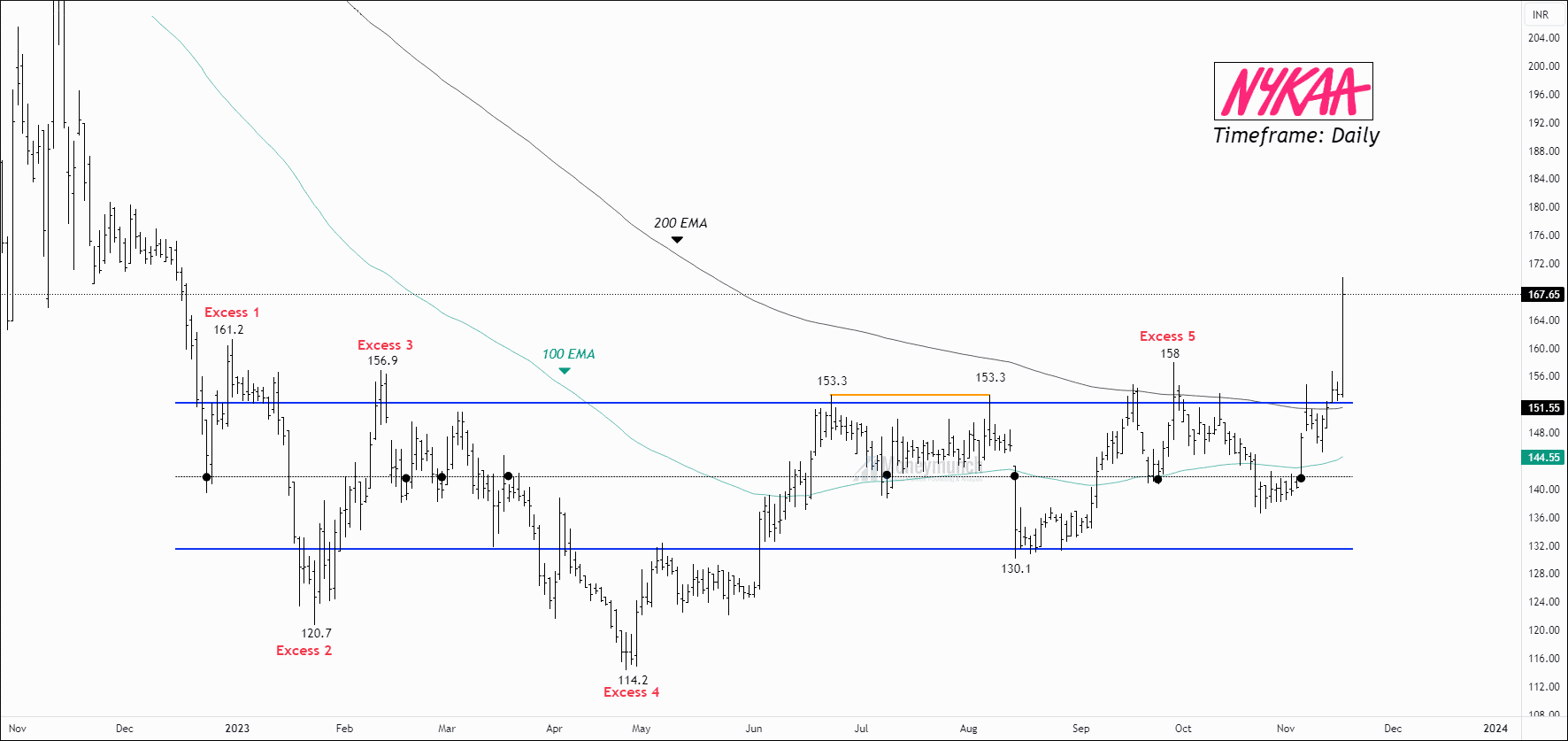

Market Analysis – NSE NYKAA, NIFTY & GIFT NIFTY

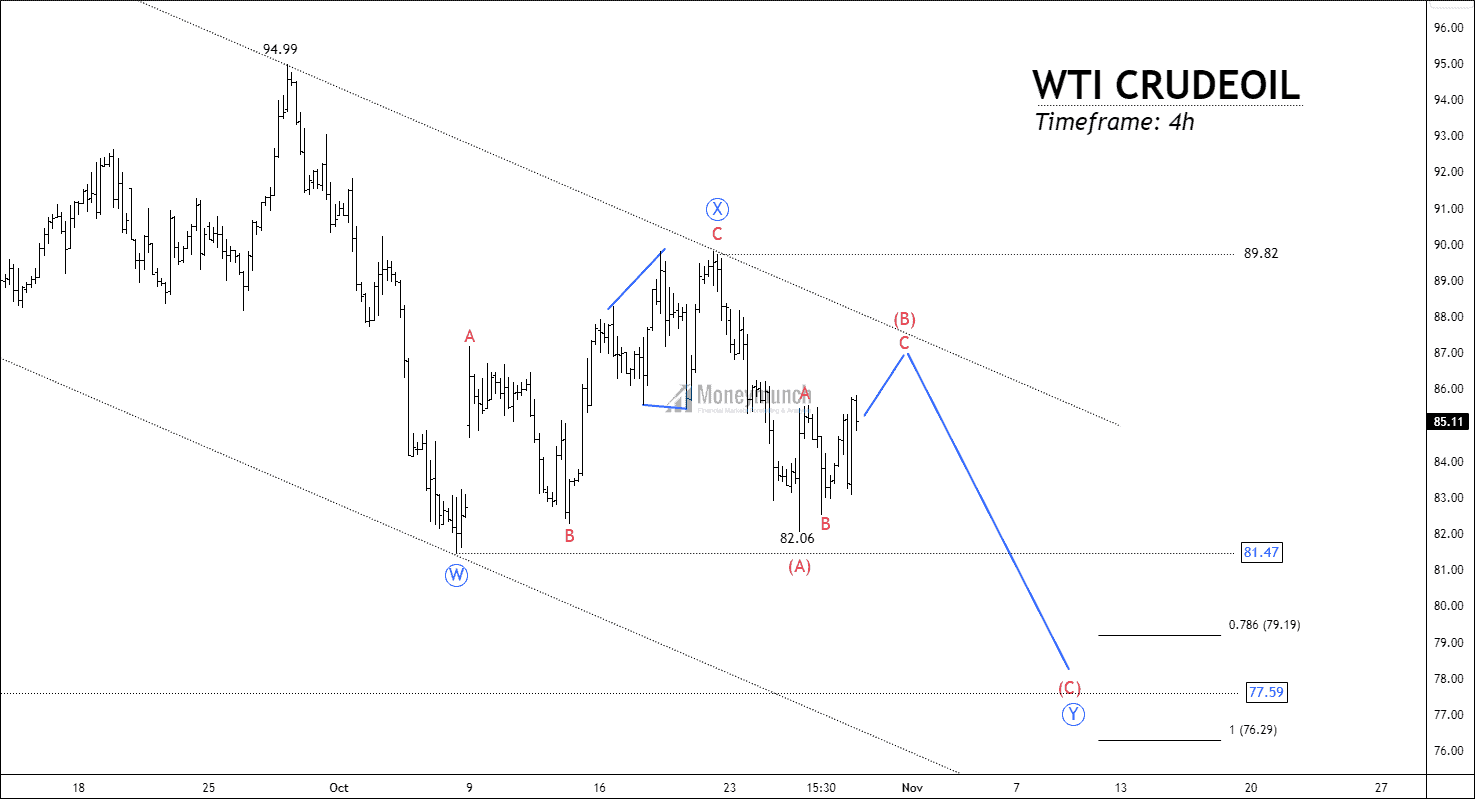

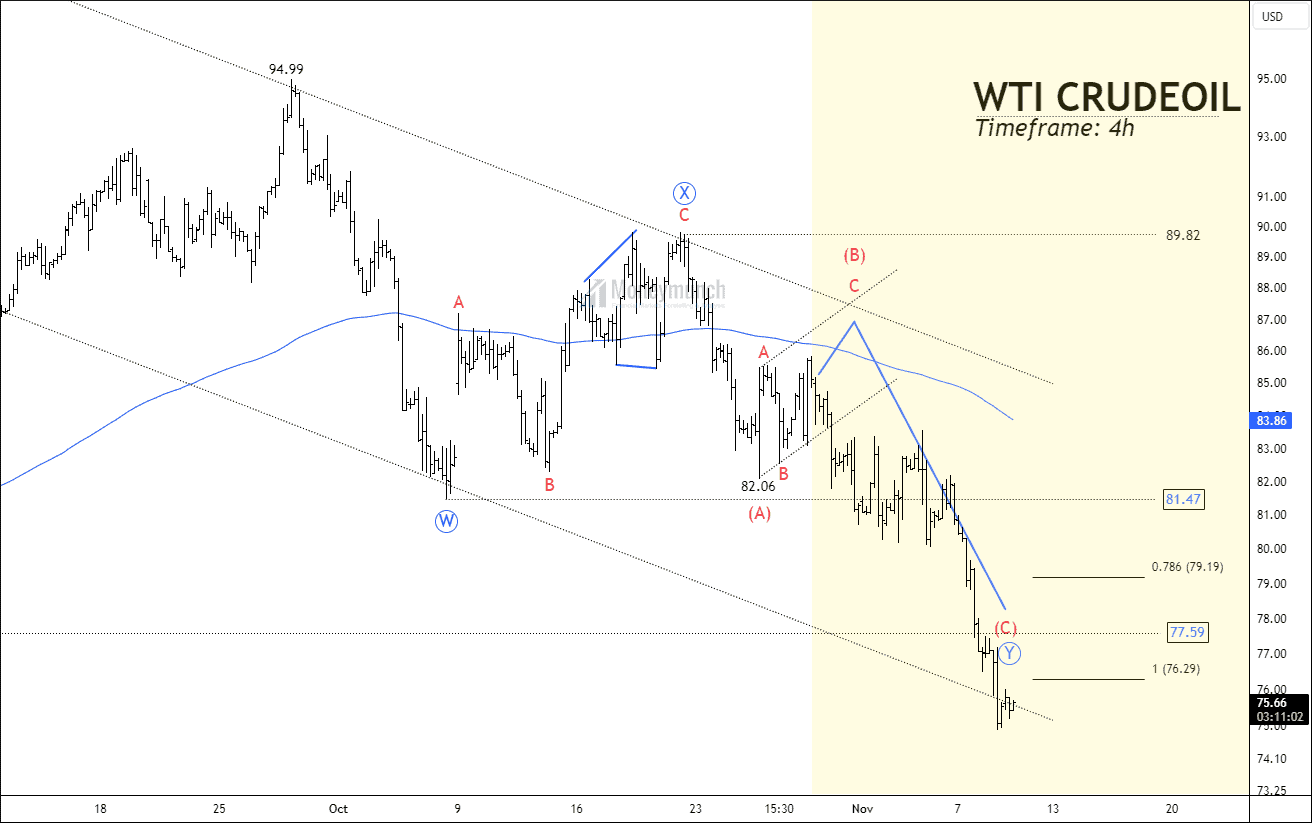

WTI CRUDEOIL – Trading Insights & Update

Did you trade WIT CRUDEOIL Wave Analysis?

Click here: WTI CRUDEOIL – Elliott Wave Forecast

BEFORE

BEFORE

We have mentioned to premium subscribers,”Crude oil correct upto 0.786 at 79.19, and 100% at 76.29. Traders must keep invalidation level ((X)) on mind.”

AFTER

AFTER