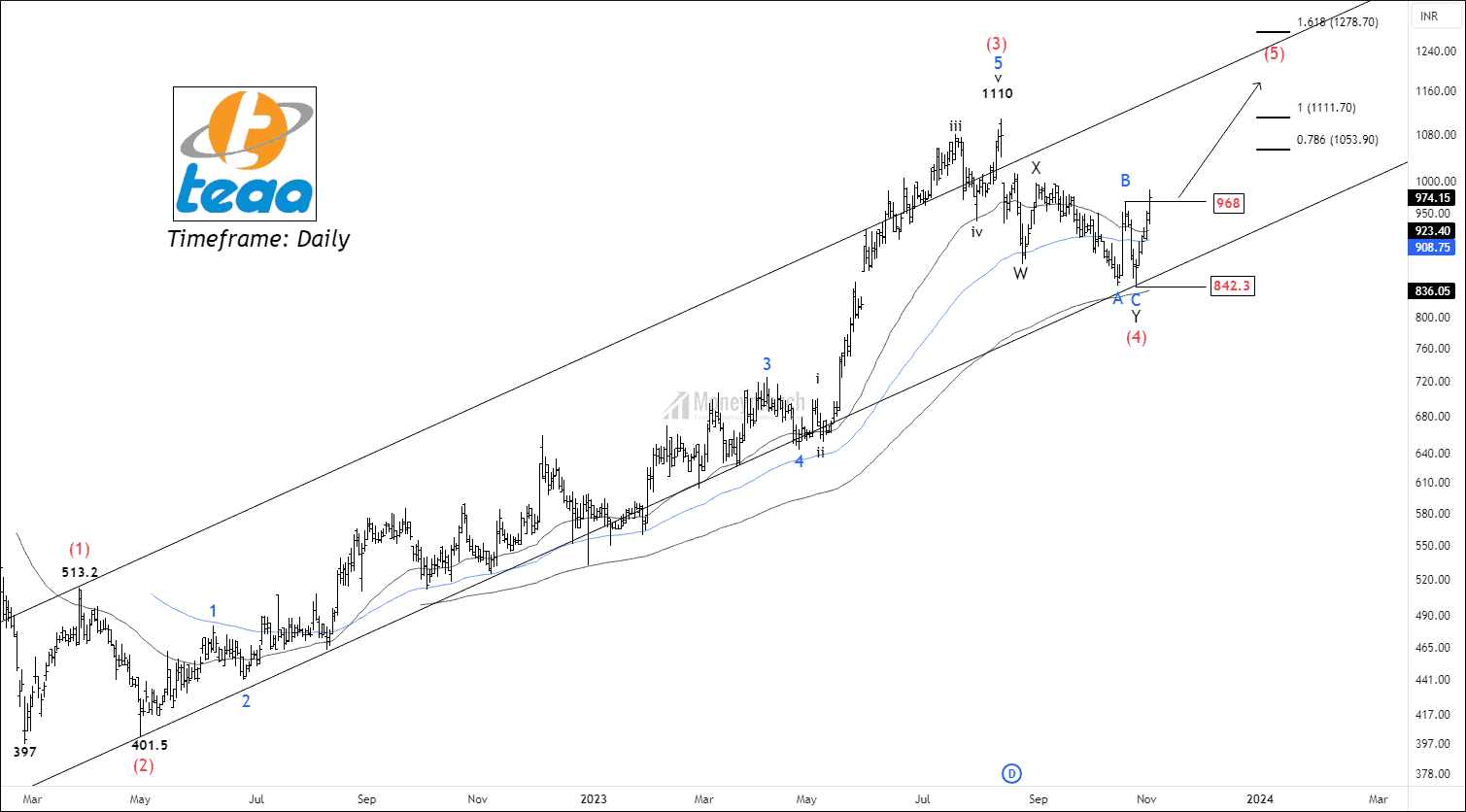

NSE TEGA – Elliott Wave Projection

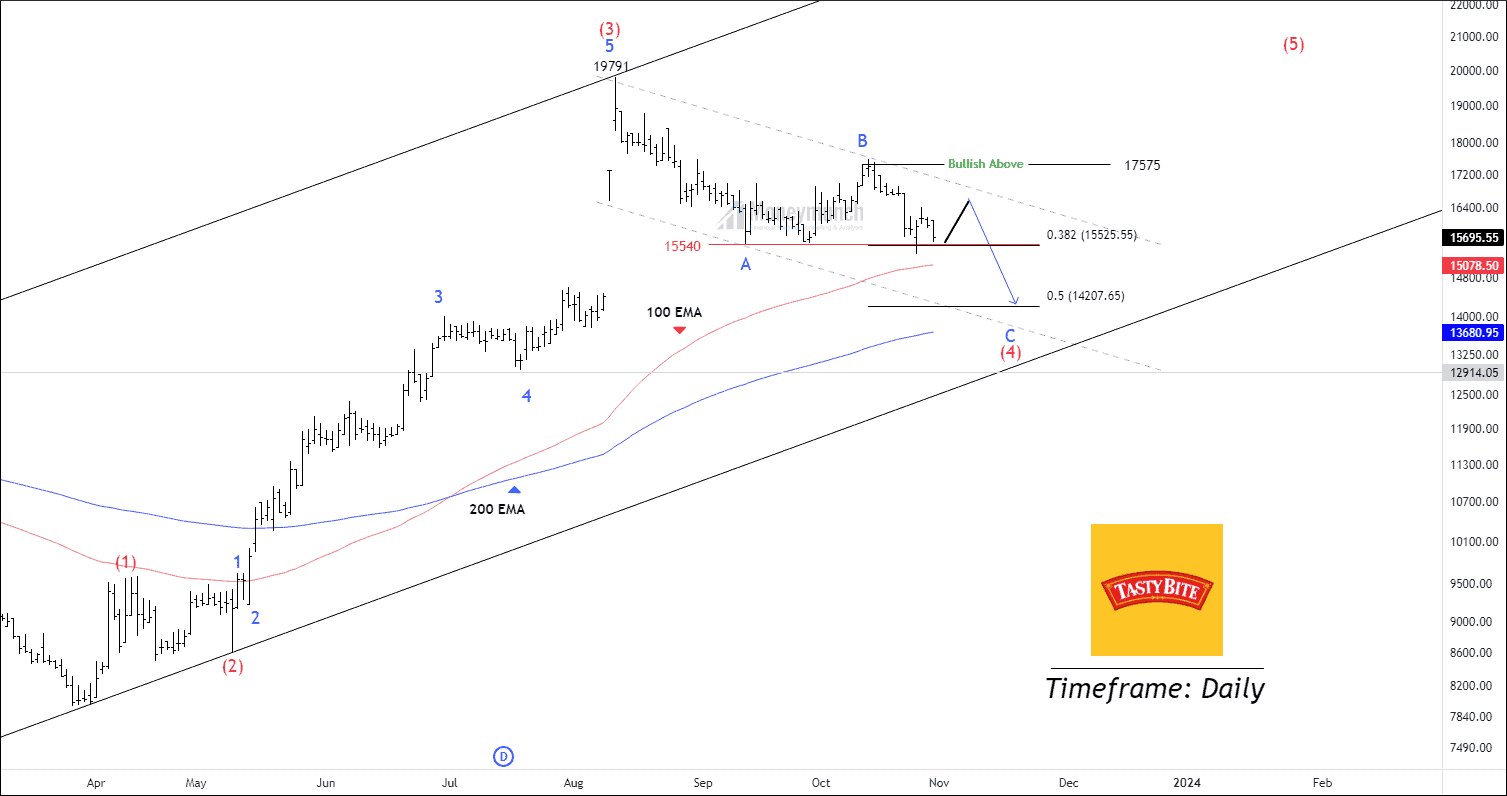

TRADESETUP – NSE TASTYBITE, JINDALSTEL & More

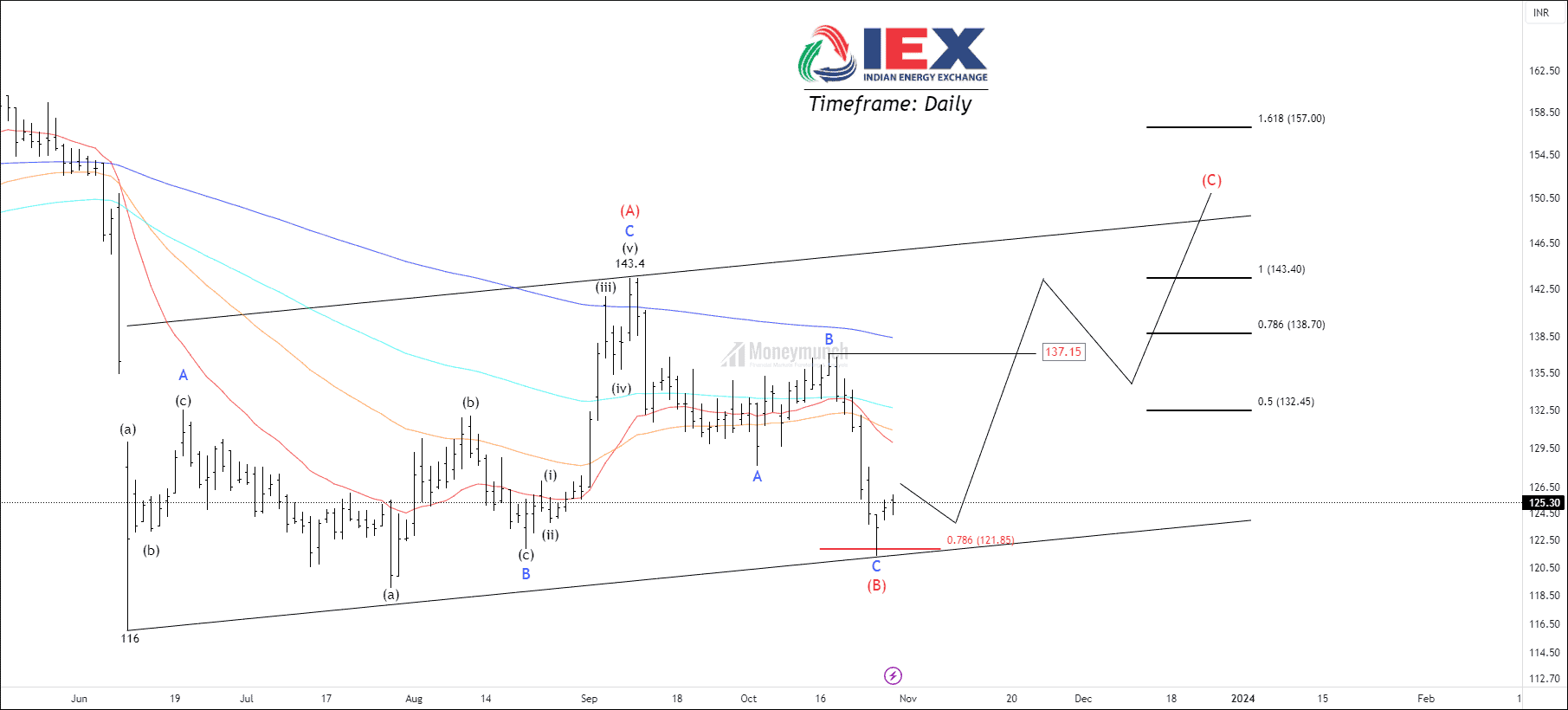

TRADE SETUP – IEX, ICICIBANK, TVSMOTORS & More

NSE DRREDDY – Bear Victory

Have you executed successful trades on NSE DRREDDY?

Visit here: NSE DRREDDY – Weakness Ahead

Continue reading

Continue reading