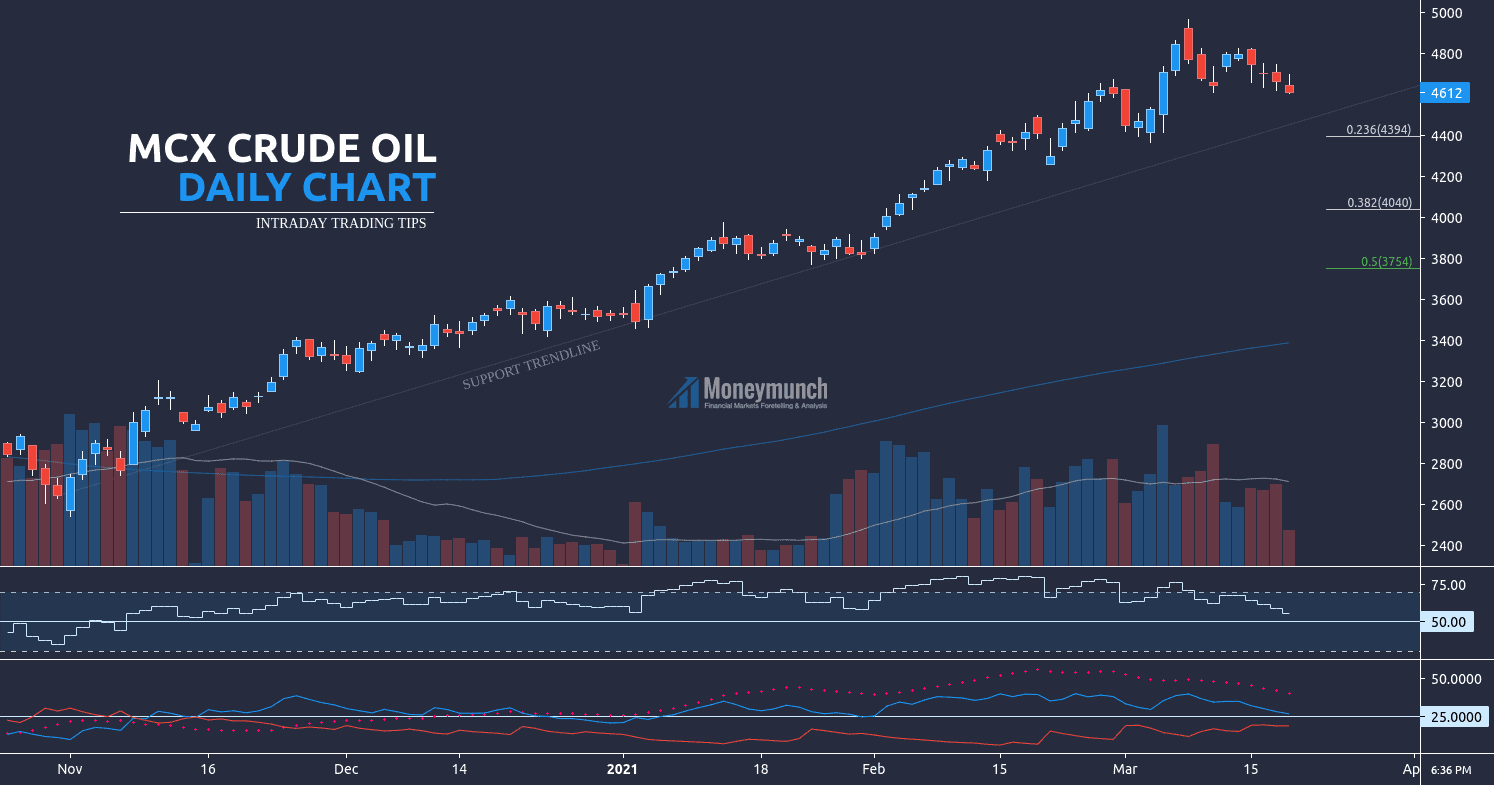

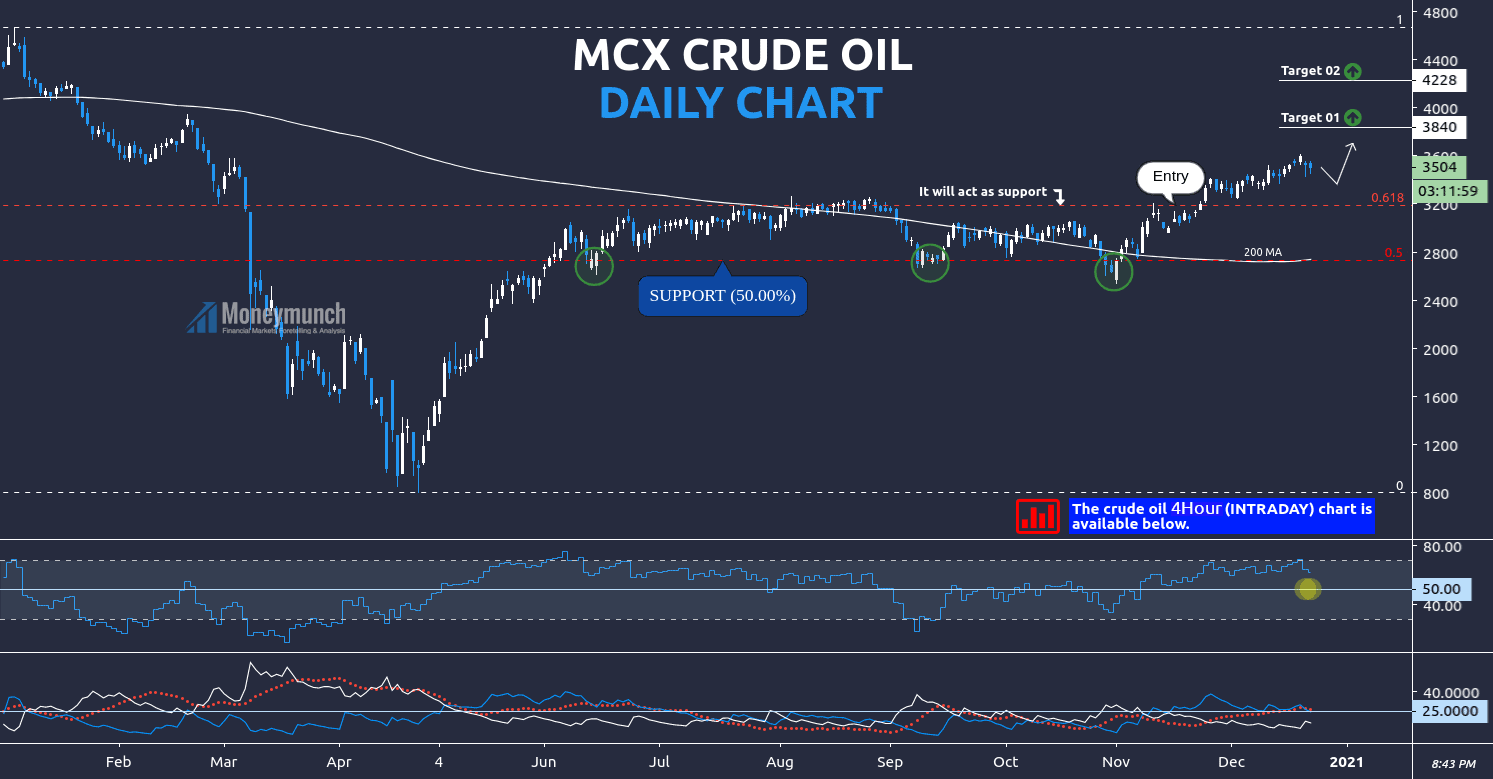

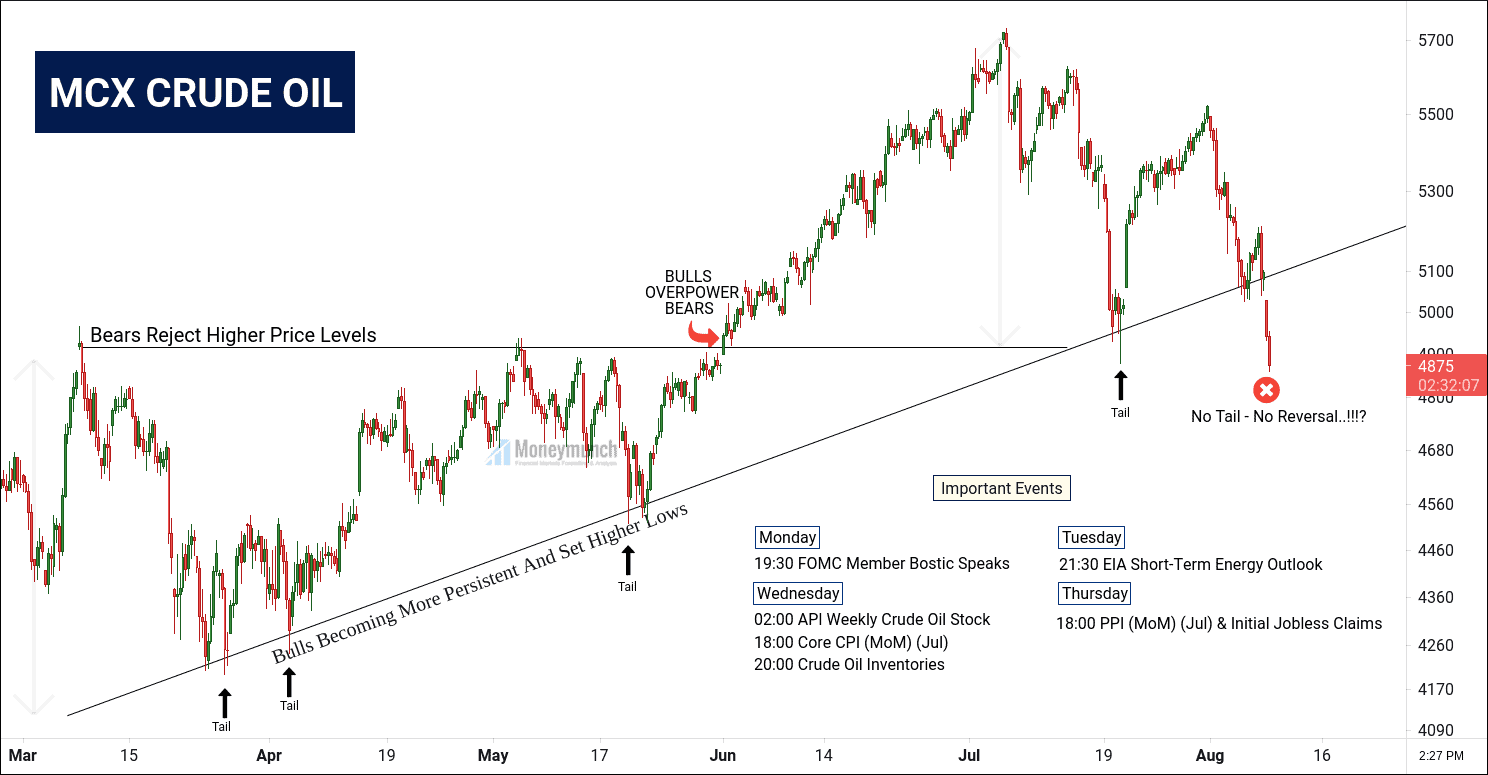

Crude oil has broken March 2020 support trendline today. That is indicating a direct sell signal. If crude crossover & closes above to 5160 levels, then it can come out from the downtrend. And we may see 5300 – 5500 again.

According to the current breakout, MCX crude oil may hit the following levels: 4800 – 4760 – 4660 – 4590

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock