MCX Crude Oil: Will it Drop Below 5000 Before the Weekend?

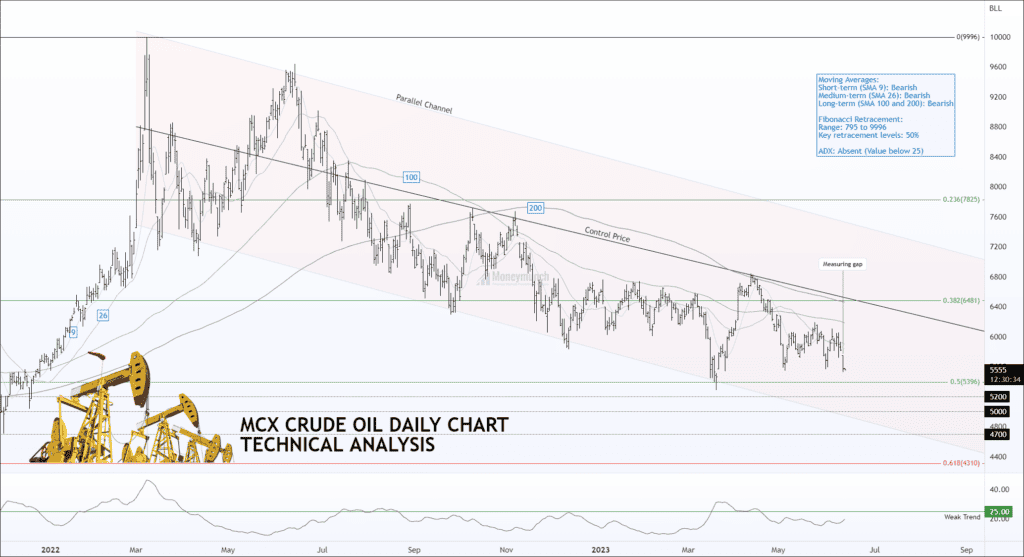

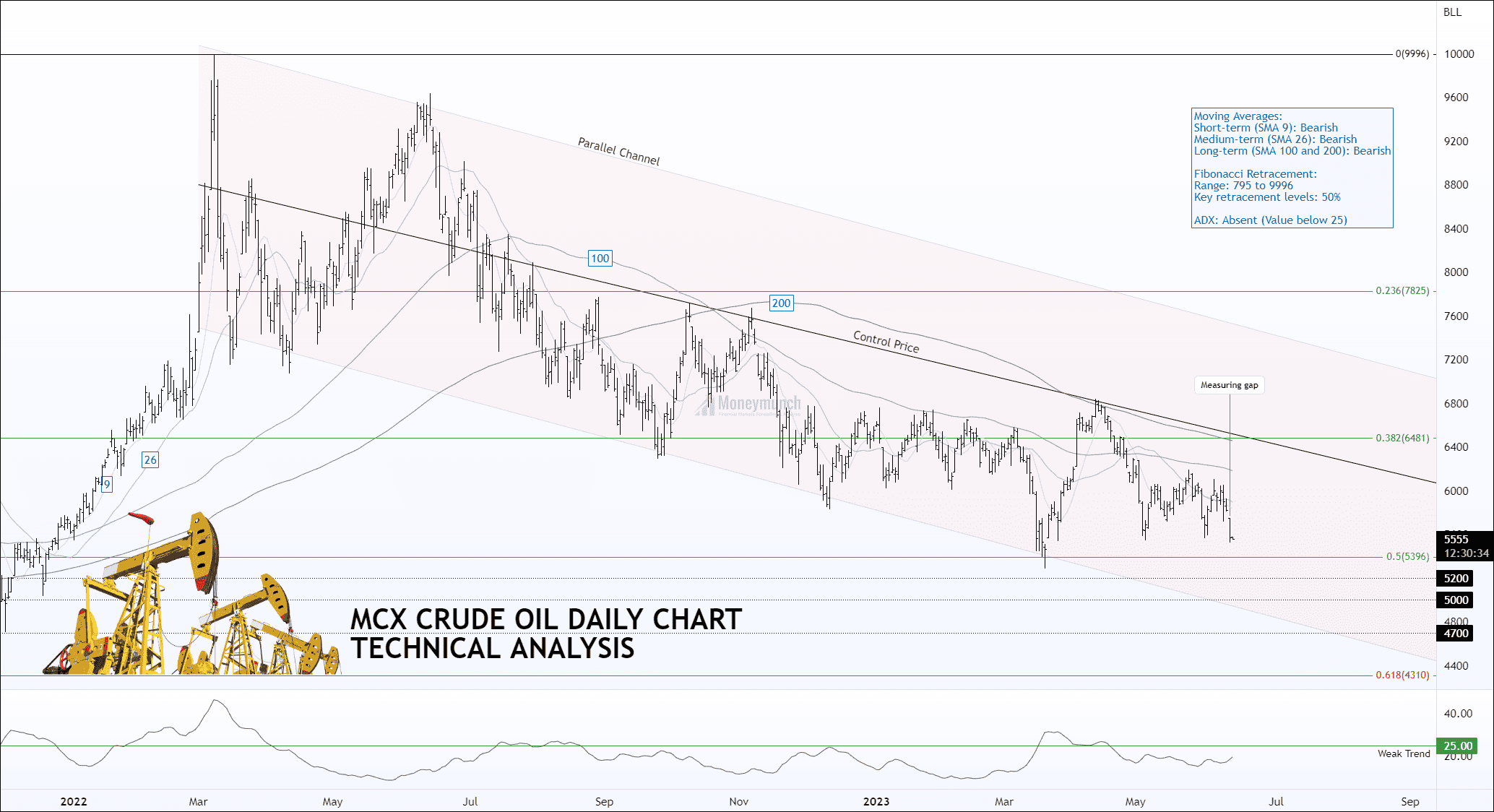

In the wake of the COVID-19 pandemic, crude oil prices experienced significant volatility, hitting a low of 795 and reaching a peak of 9996 on March 8, 2022. Currently, the price is undergoing a retracement, approaching the key level of 50%.

Following the peak, crude oil prices began to decline, forming a parallel channel pattern. The price has been trading below this channel for over a year. Based on moving averages data, crude oil is expected to reach the support level of 5396, which is currently acting as a strong support zone. A potential reversal may occur around the “control price line” from the 0.5 level of the Fibonacci retracement.

This report focuses on the downside possibilities and does not provide updates on upside potential, as this information will be provided soon.

If crude oil breaks the key retracement level and consistently closes below it, the following target levels may come into play: 5200 – 5000 – 4700.

To stay informed about market-moving events for this week that could impact the prices of gold, silver, crude oil, and natural gas, please visit my silver article: Silver Price Analysis: Exploring Resistance, Control Price, & Volume Dynamics

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Detailed analysis