IDBI Bank has a piece of Bollywood’s 100-year-old history, but no one seems to be interested in it. The only one who found it worthwhile is broke and has been ordered to shut down. The plot on which stood the Minerva theater in South Mumbai, known as the Pride of Maharashtra, which crated history by running Amitabh Bachchan-starrer Sholay for five straight years, is now on the books of IDBI Bank. And the lender does not know what to do with it…

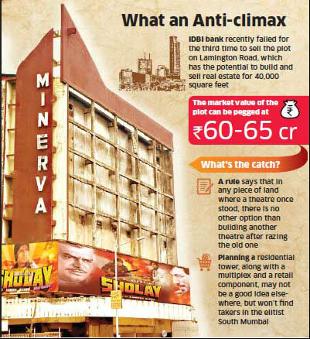

The state-run bank recently failed for the third time to sell the plot on Lamington Road, which has the potential to build and sell real estate for 40,000 square feet. That’s as much a surprise as it is a shock in a city where the fight for land can take many twists and turns. If a mouth-watering deal for real estate developers is going with no attention, what’s the catch?

Like an impediment for most other economic activities – it is an archaic law. A rule says that in any piece of land where a theater once stood, there is no other option than building another theatre after razing the old one. “We have not decided what we will do with it,” says RM Malla, chairman and managing director at IDBI Bank. “It has to have a screen. Even a mini screen will do.”

For IDBI, it was funding an exotic idea that went sour.

In 2006, it lent about Rs 40 crore to Neville Tuli, the pioneer of art investing in India, through Osian’s Connoisseur’s Art, to build a theater and an exhibition center named OSIANAMA. The idea was to bring international movie experience to India. Reality did not unfold the way it was forecast to. The economy collapsed, value of assets tumbled and so did the fortune of Osian. All that stands now is a barren land with the once iconic structure pulled down.

Dues rose to Rs 84.8 crore in the period. First, IDBI decided to auction it at Rs 70 crore, that failed. Then, reduced the asking price to Rs 61 crore – still no takers.

Osian’s Connoisseurs of Art is having its own difficulties with the regulator Securities & Exchange Board of India (Sebi), which is directing it to wind up for violating securities laws.

Osian’s “is directed not to access the capital market and is further restrained and prohibited from buying, selling or otherwise dealing in the securities market till its collective investment schemes are wound up and all the monies mobilised through them are refunded to the investors,” the Sebi order said.

Planning a residential tower, along with a multiplex and a retail component, may not be a good idea elsewhere, but won’t find takers in the elitist South Mumbai.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.