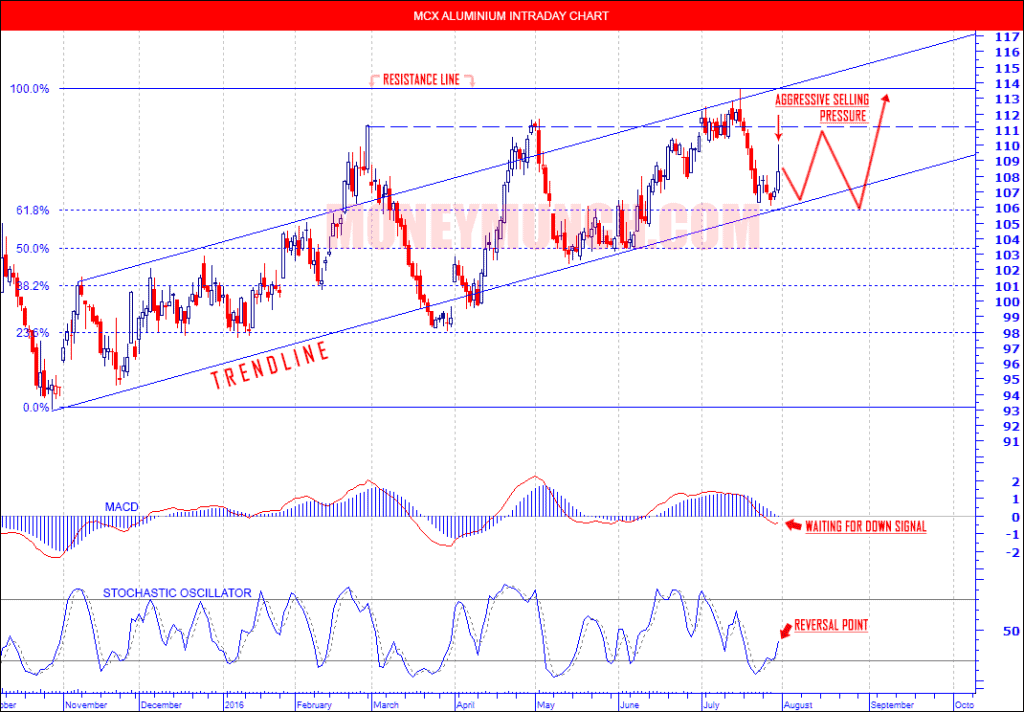

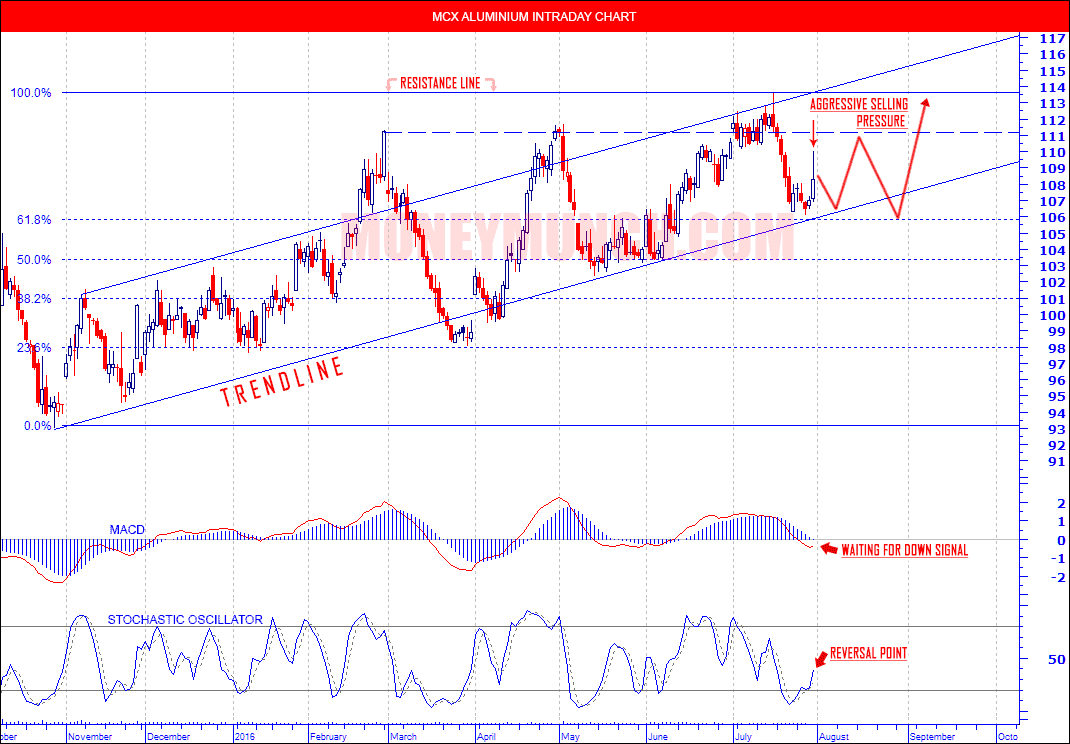

MCX Aluminium tried well to recover previous week loss. Overall this week it gained only .65 rupees (last month contract). As per above chart, you can see it overall trend is upside, but last trading candle shows weakening, so it will continue to drill downwards.

If you would like to buy Aluminium Aug contract then wait for 110.2 levels above closing because once it will crossover for only 1-2 hours then it can fly up to 111.2-112.2-113 levels.

But 110.2 is the hurdle, so the seller can keep continuing selling below the hurdle for 108.2-107.3 below levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

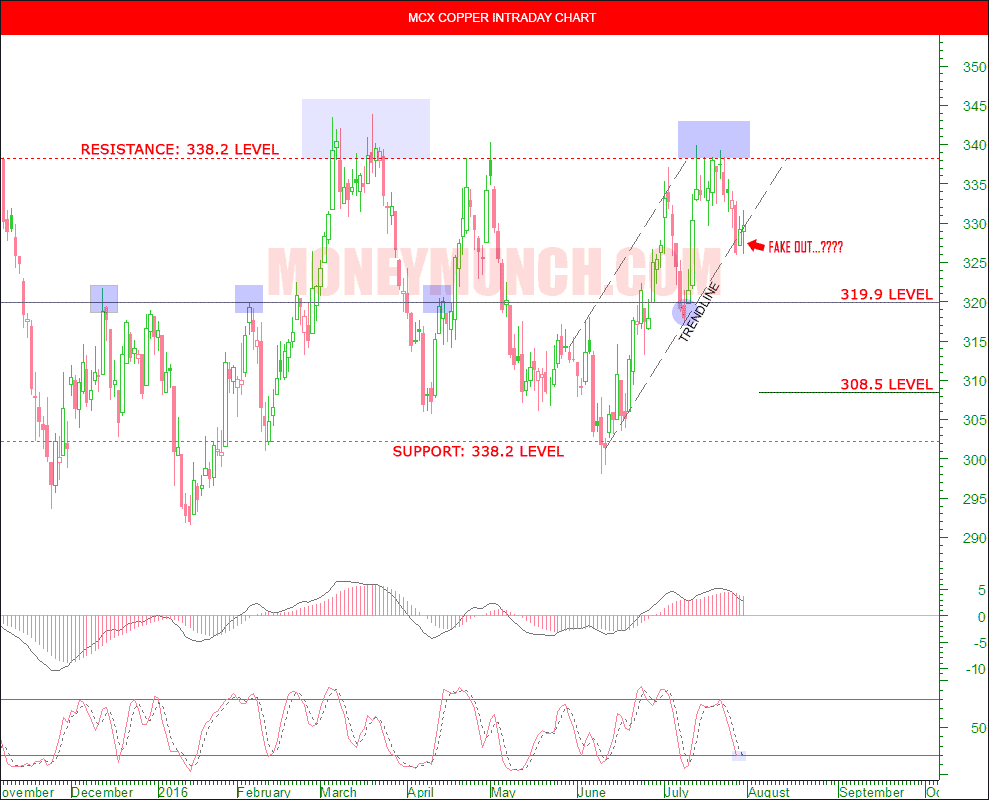

Look at MCX Copper intraday chart, 3 trading sessions back copper had closed below to the trendline. It was fake out or down signal generated? Copper at the turning point now. If you see copper above the 331 levels for 2-3 hours, then this week copper will go upside and hit 335-339 above levels. It will break July high in August month!

But keep your eyes on 325.5 levels. It’s very crucial level and if the copper will test this level then we will see a big downtrend. It may drop up to 319-309 below levels.

If zinc will go to 149.6 levels and hold for 1-2 hours, then traders may sell without any worry for 147.8-146.6 levels.

Don’t forget it’s strongly bullish to 150 levels, and it can hit 152-154 levels in just a few hours. Before sell, I would recommend keeping patience for minimum hours while it breaks the 149.6 levels.

Subscribe now: Get metals sector commodities calls during markets hour by SMS with exact entry level, stop loss and targets.

CPO is the best for intraday trading. It’s raising up over 3 weeks and continues looking upside. Crude palm oil will touch 966-978-986 levels on next week.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.