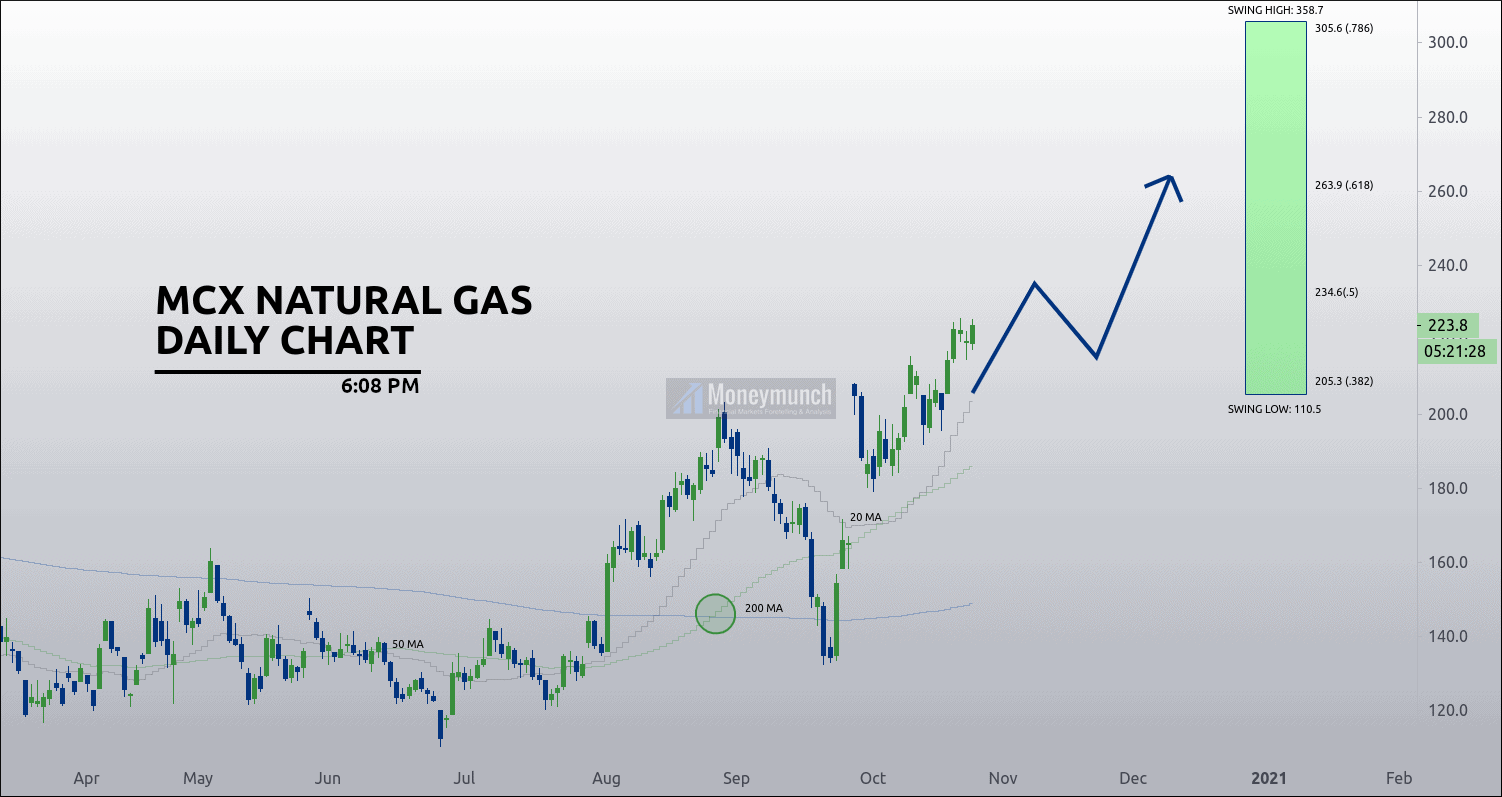

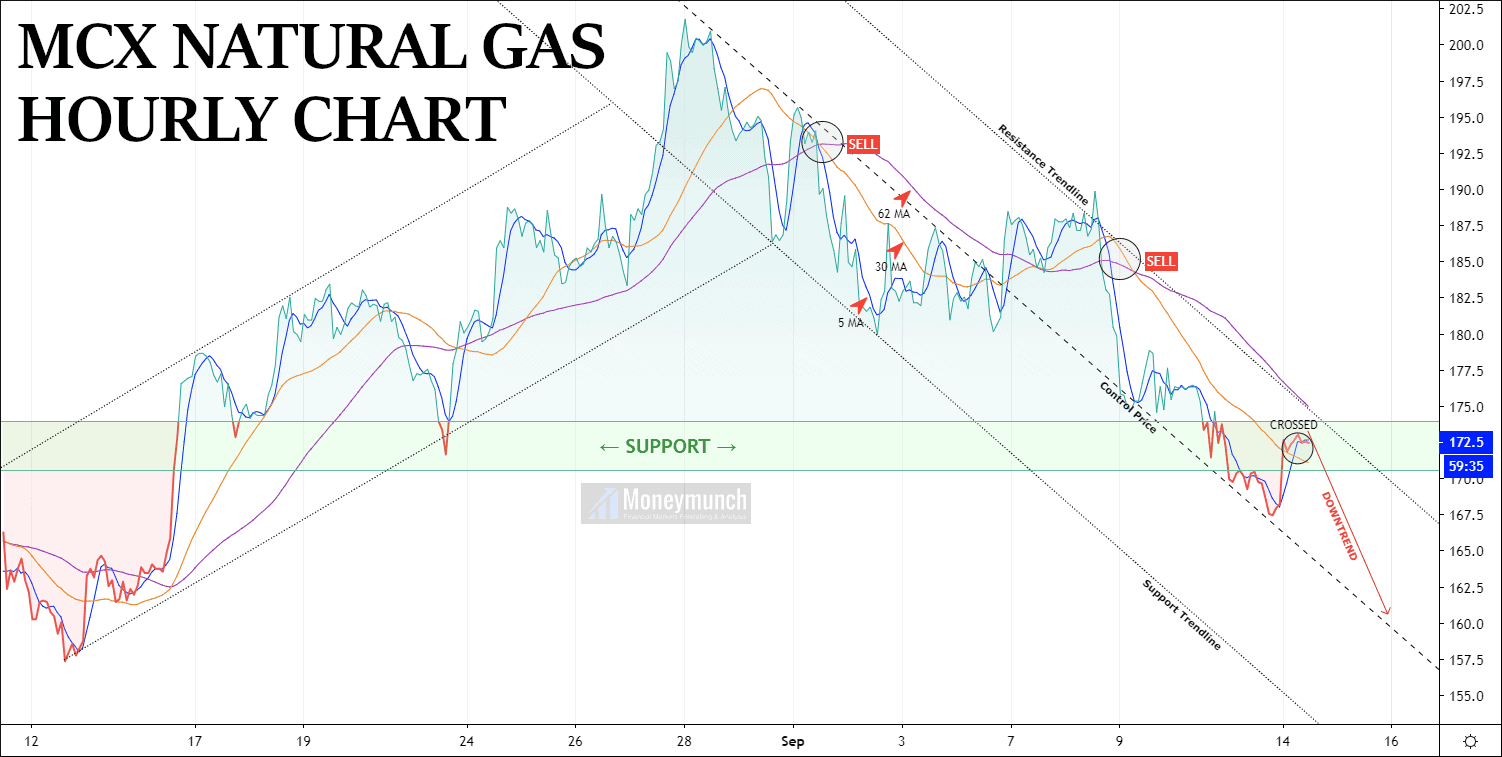

According to this chart, MCX Natural gas is further advance. We may see the following levels after a reversal.

Targets: 234.6 – 263.9 – 305.6

Intraday traders can run with 20 & 50 MA crossover. And long-term traders should stick with 200 MA to maximize profits.

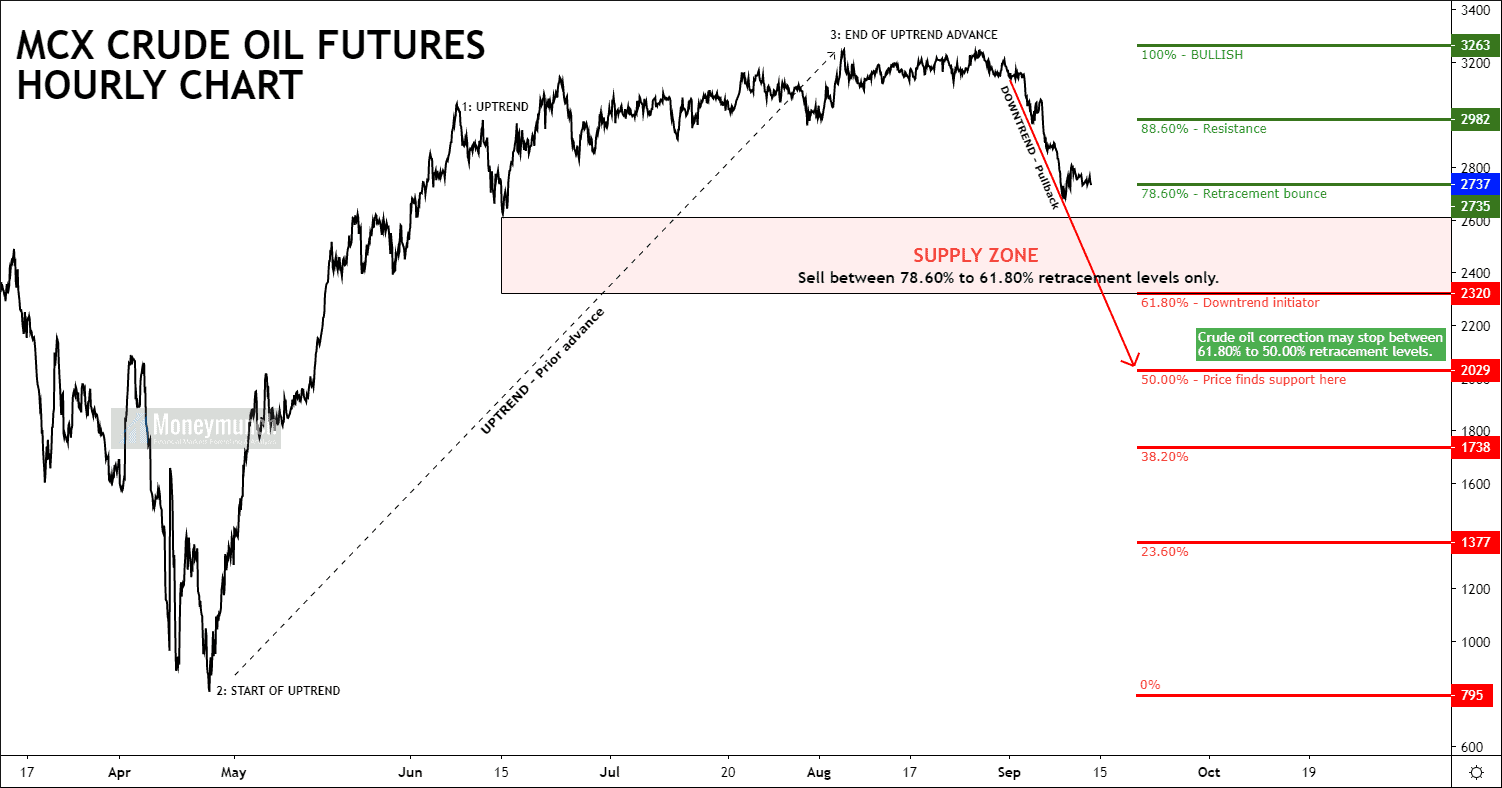

Significant releases or events that may affect the movement of natural gas on Wednesday, Oct 28, 2020:

- 02:00: U.S. API Weekly Crude Stock

- 20:00: U.S. Crude Oil Inventories

- 20:00: EIA Weekly Refinery Crude Runs

- 20:00: U.S. Crude Oil Imports

- 20:00: U.S. Cushing Crude Oil Inventories

- 20:00: U.S. Gasoline Production

- 20:00: U.S. Heating Oil Stockpiles

- 20:00: U.S. Gasoline Inventories