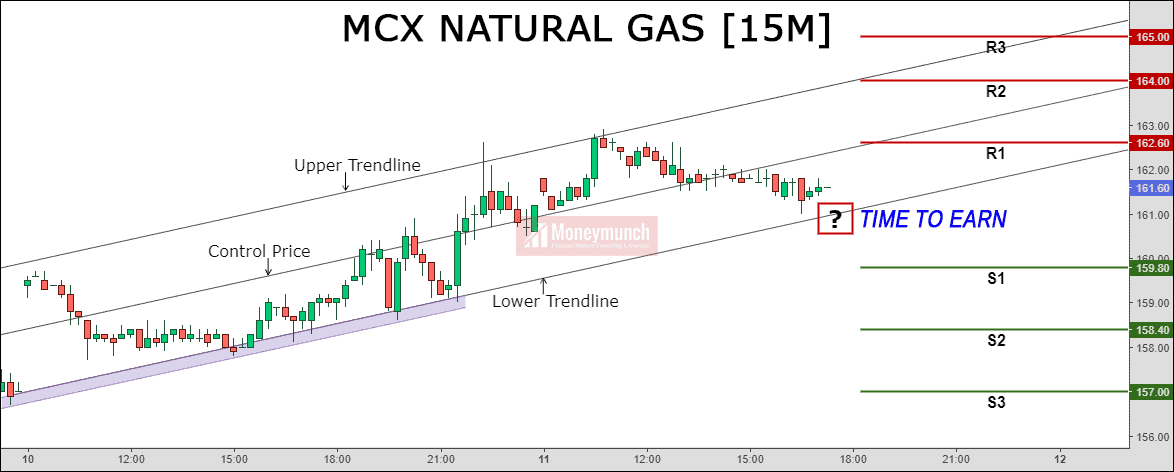

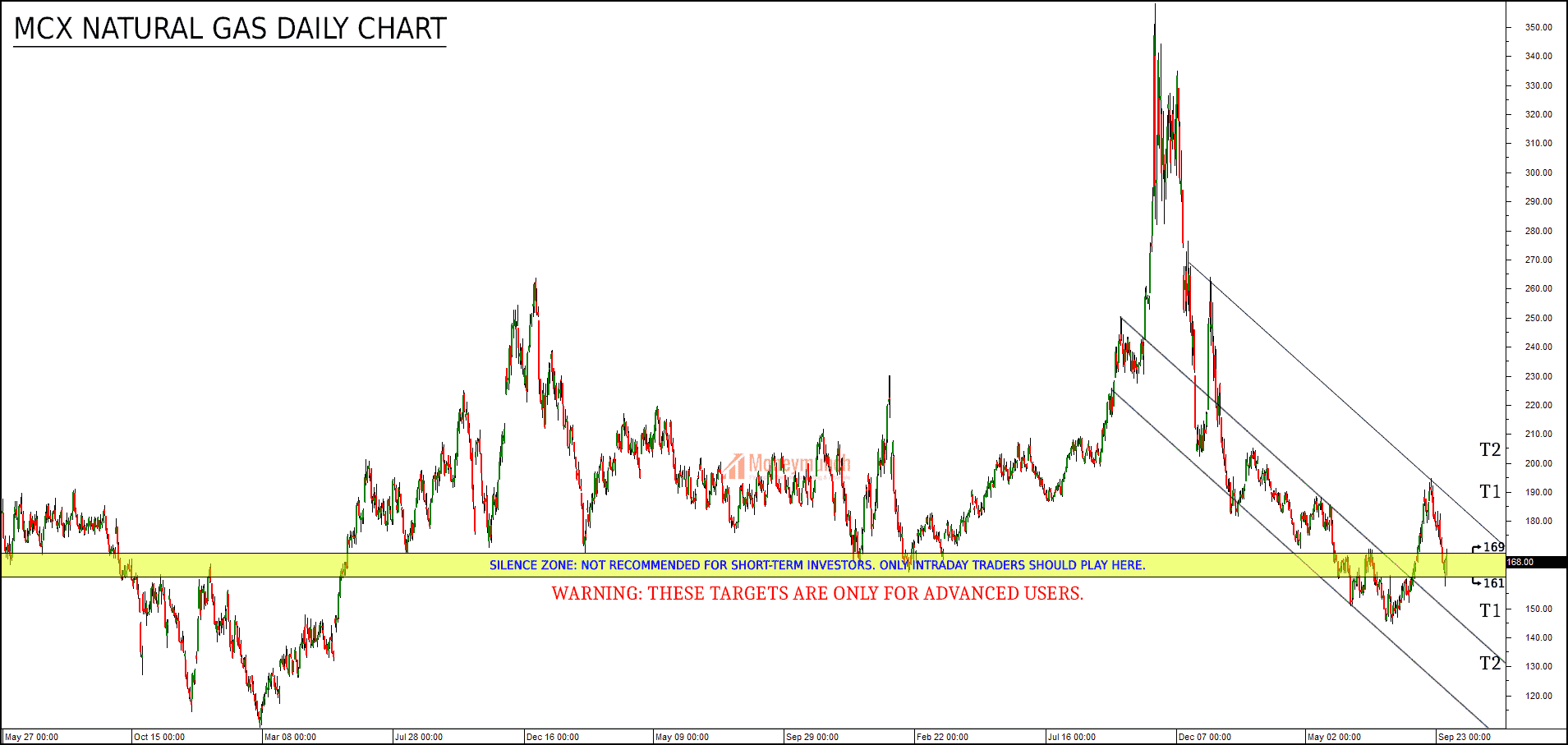

Since the market opening bell, natural gas sharply moving up as per the above chart [5:20PM]. Do you think it will keep upward rally?

To become a subscriber, subscribe to our free newsletter services. Our service is free for all. you can apply the following trading strategy to earn a profit.

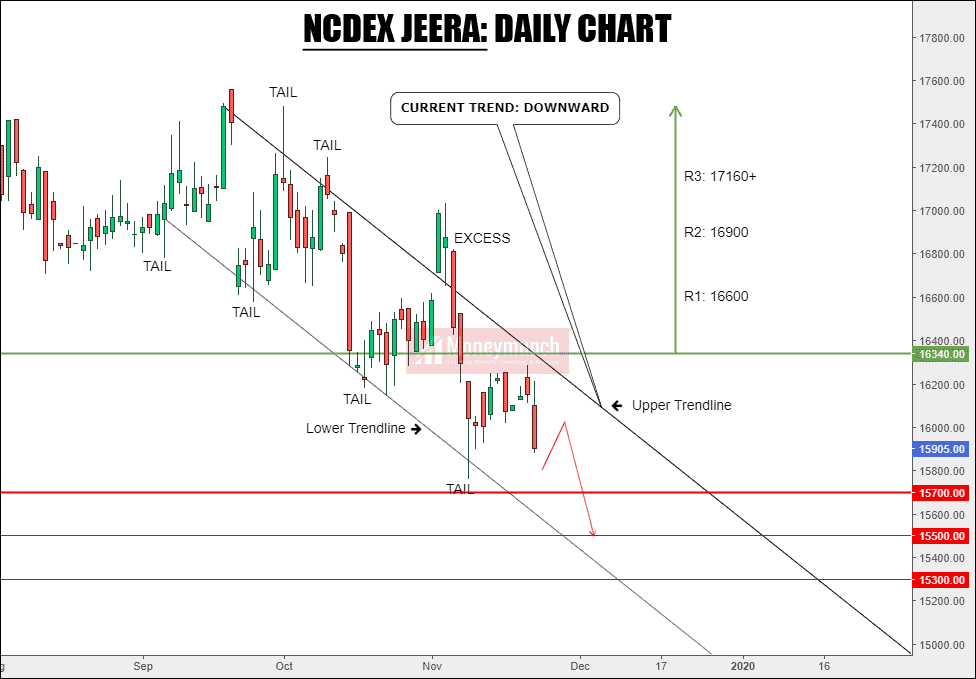

Use these support & resistance as targets:

↑ Long positions above lower trendline with targets at 160.60 – 164 – 165+ in extension.

↓ Below this lower trendline looks for further downside with 159.80 – 158.40 – 157 as targets.

Entry-level + Stop loss + Targets = For subscribers only!

Lock

Lock