Did you read the 26 Jan 2021 article on Gold?

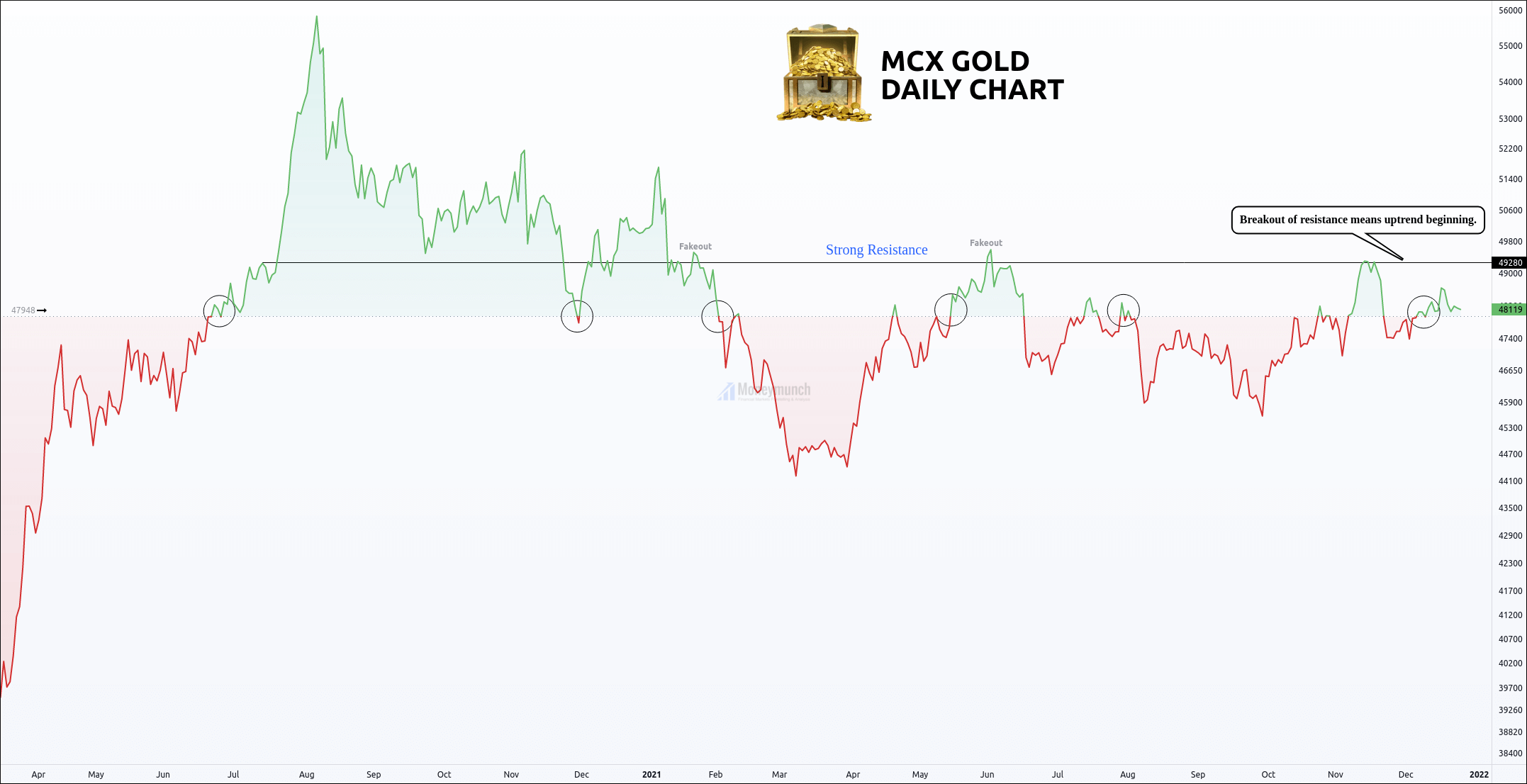

Article: Don’t Get Yourself Into a Bull Trap With MCX Gold

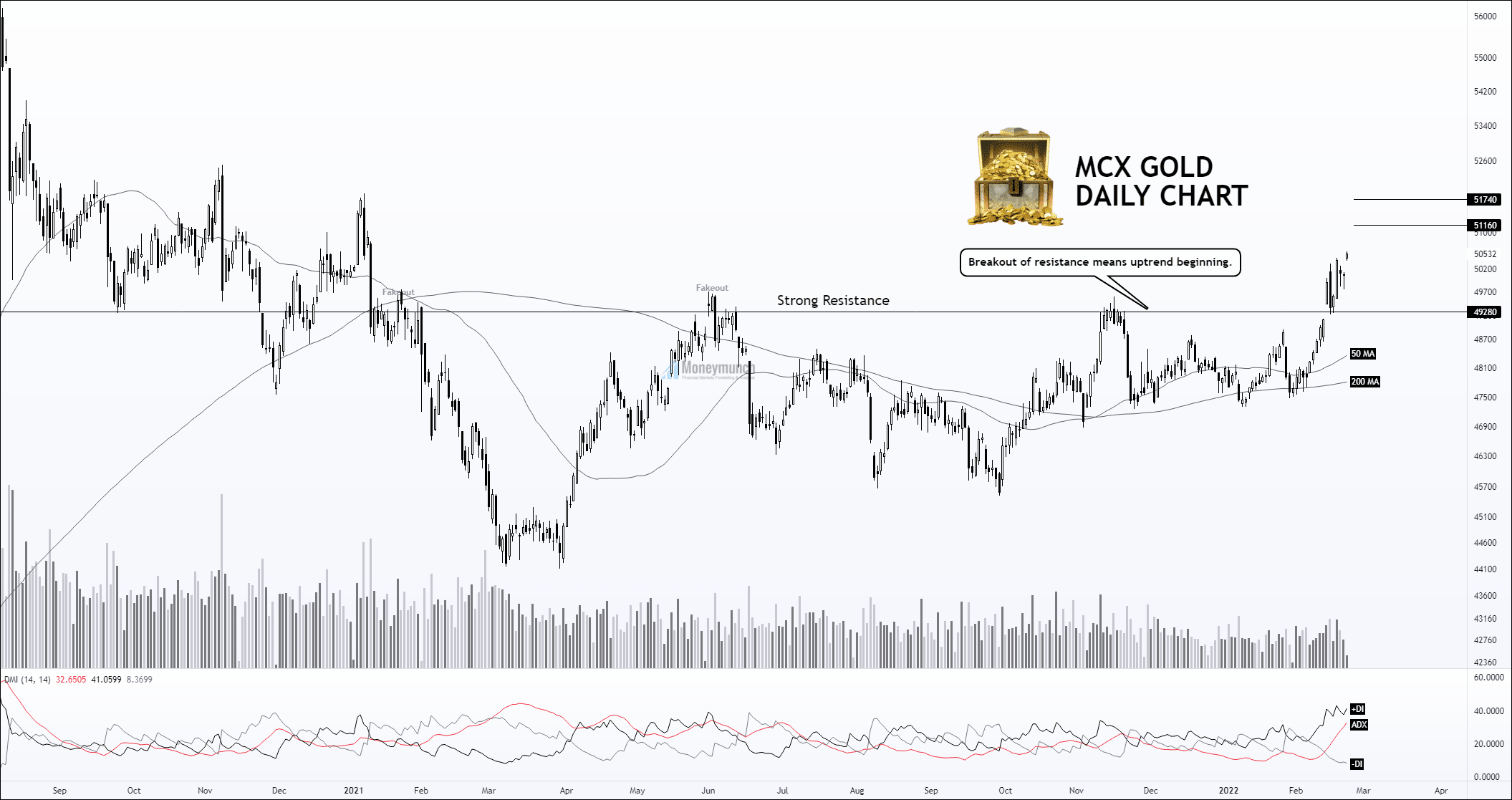

Wherein I have highlighted a strong resistance (SR) which is 49280. It has broken down on 14 Feb 2022. That indicates the MCX gold uptrend is unfolding here. If it consecutively remains above the SR, we will see the gold price above 51160 – 51740.

The following indicators have been indicating impending advance:

ADX, DMI, and MA

Watch significant releases or events that may affect the movement of gold, silver, and crude oil.

Tuesday, Feb 22, 2022

19:30 S&P/CS HPI Composite – 20 n.s.a. (YoY) (Dec) – Medium Impact

20:15 Manufacturing, Markit Composite, & Services PMI (Feb) – Medium Impact

20:30 CB Consumer Confidence (Feb) – High Impact

Thursday, Feb 24, 2022

03:00 API Weekly Crude Oil Stock – Medium Impact

19:00 GDP (QoQ) (Q4), and Initial Jobless Claims – High Impact

21:00 Natural Gas Storage – Low Impact

21:30 Crude Oil Inventories – High Impact

22:30 FOMC Member Mester Speaks – Medium Impact

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock