Have you traded NSE CUB price action analysis?

Click here: NSE CUB – Price Action Analysis

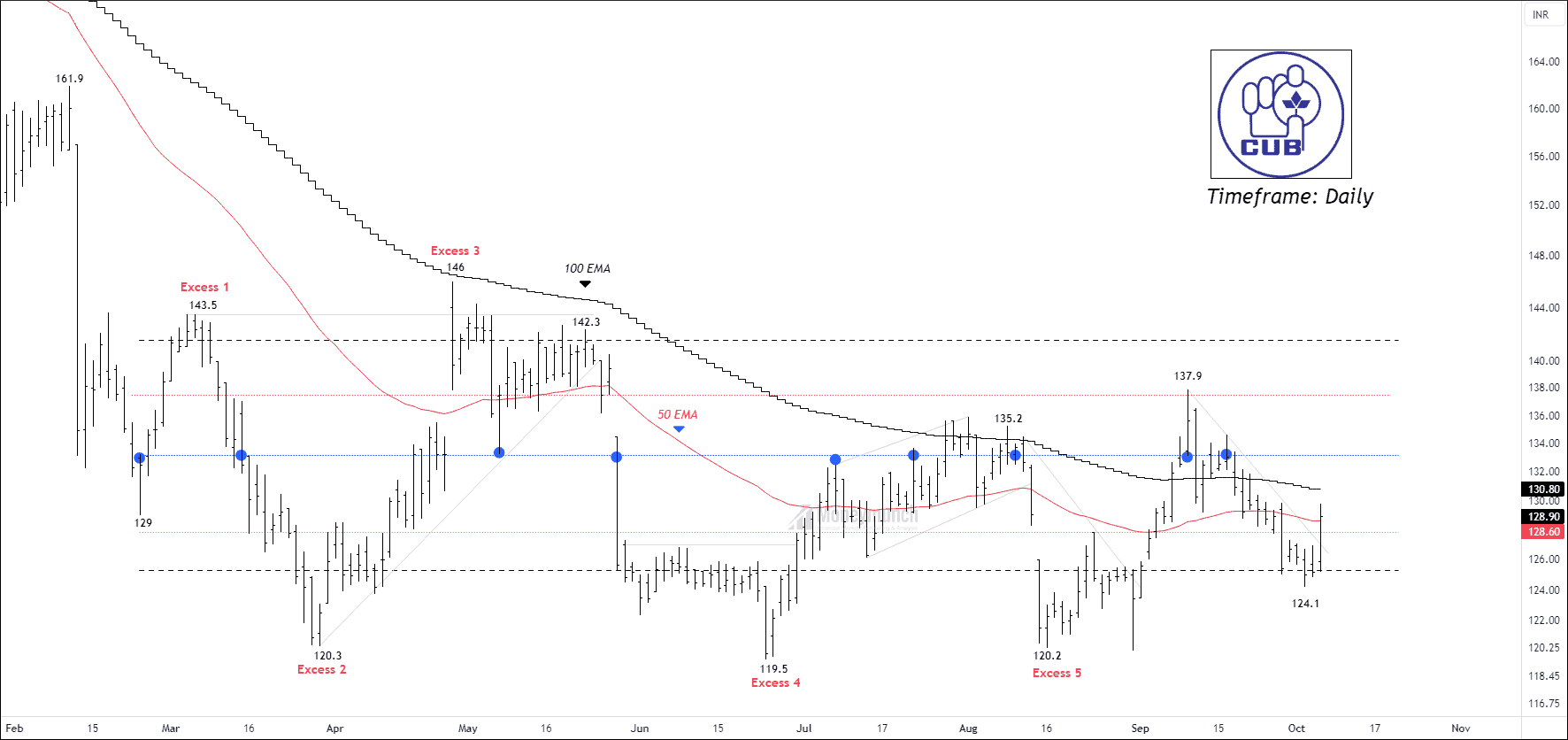

BEFORE

BEFORE

We had written clearly, “If the price sustains above the lower band, traders can set the following targets: 132 – 137 – 142.”

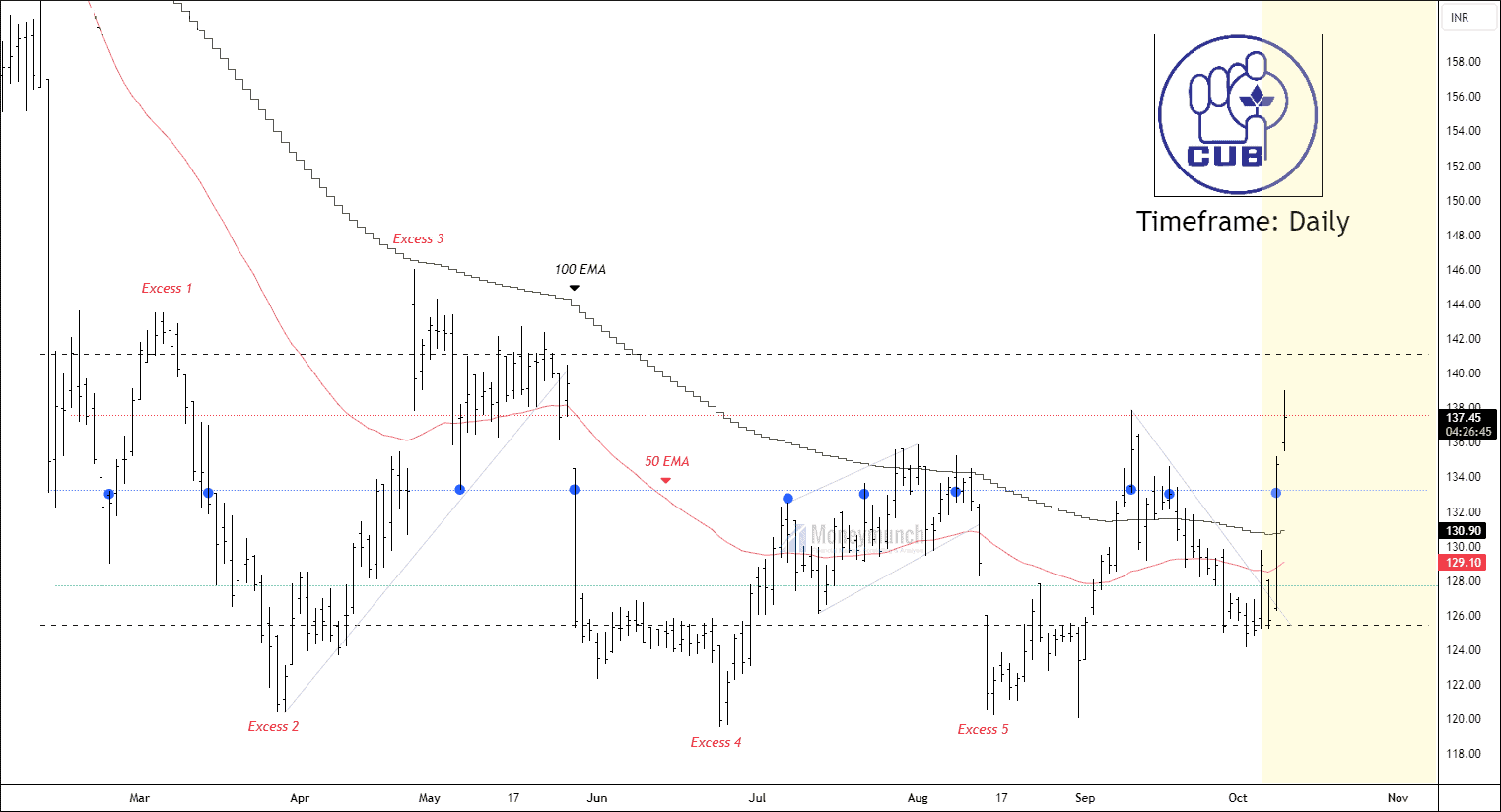

AFTER

AFTER

Get free share market NSE & BSE stocks, cash equity, futures, options, and all nifty trading tips and market research reports that enhance your knowledge and take your trading game to the next level.

Have you traded NSE CUB price action analysis?

Click here: NSE CUB – Price Action Analysis

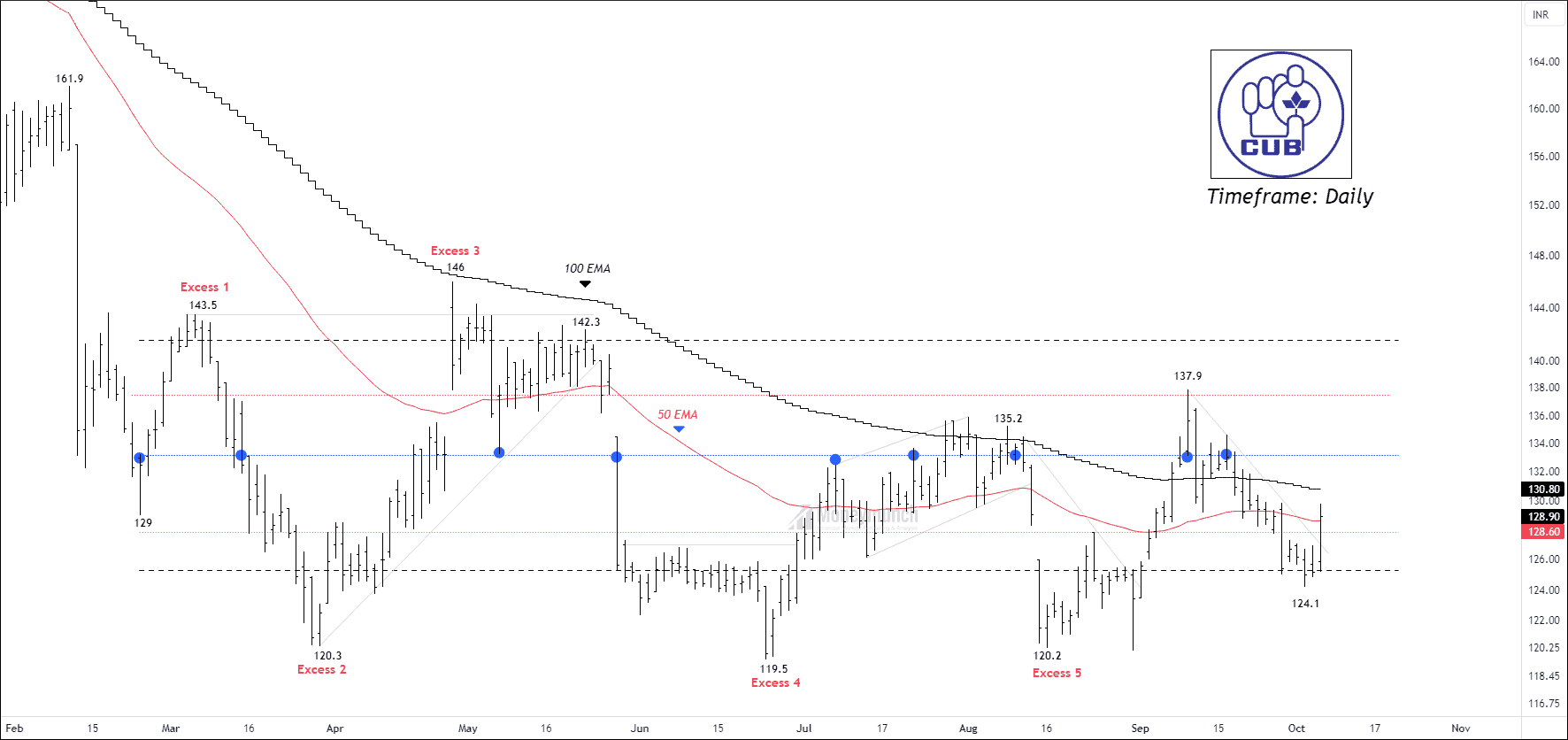

BEFORE

BEFORE

We had written clearly, “If the price sustains above the lower band, traders can set the following targets: 132 – 137 – 142.”

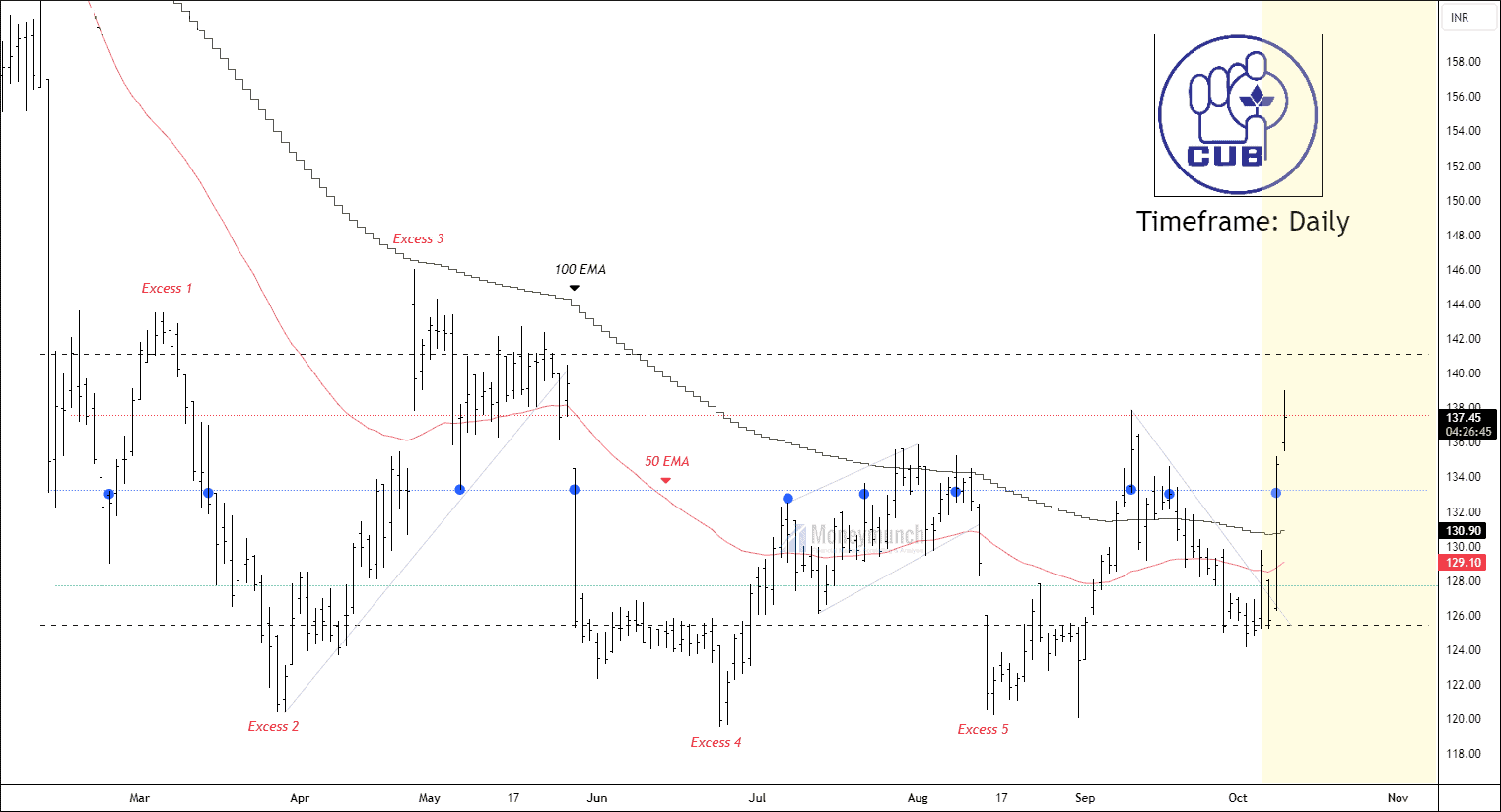

AFTER

AFTER

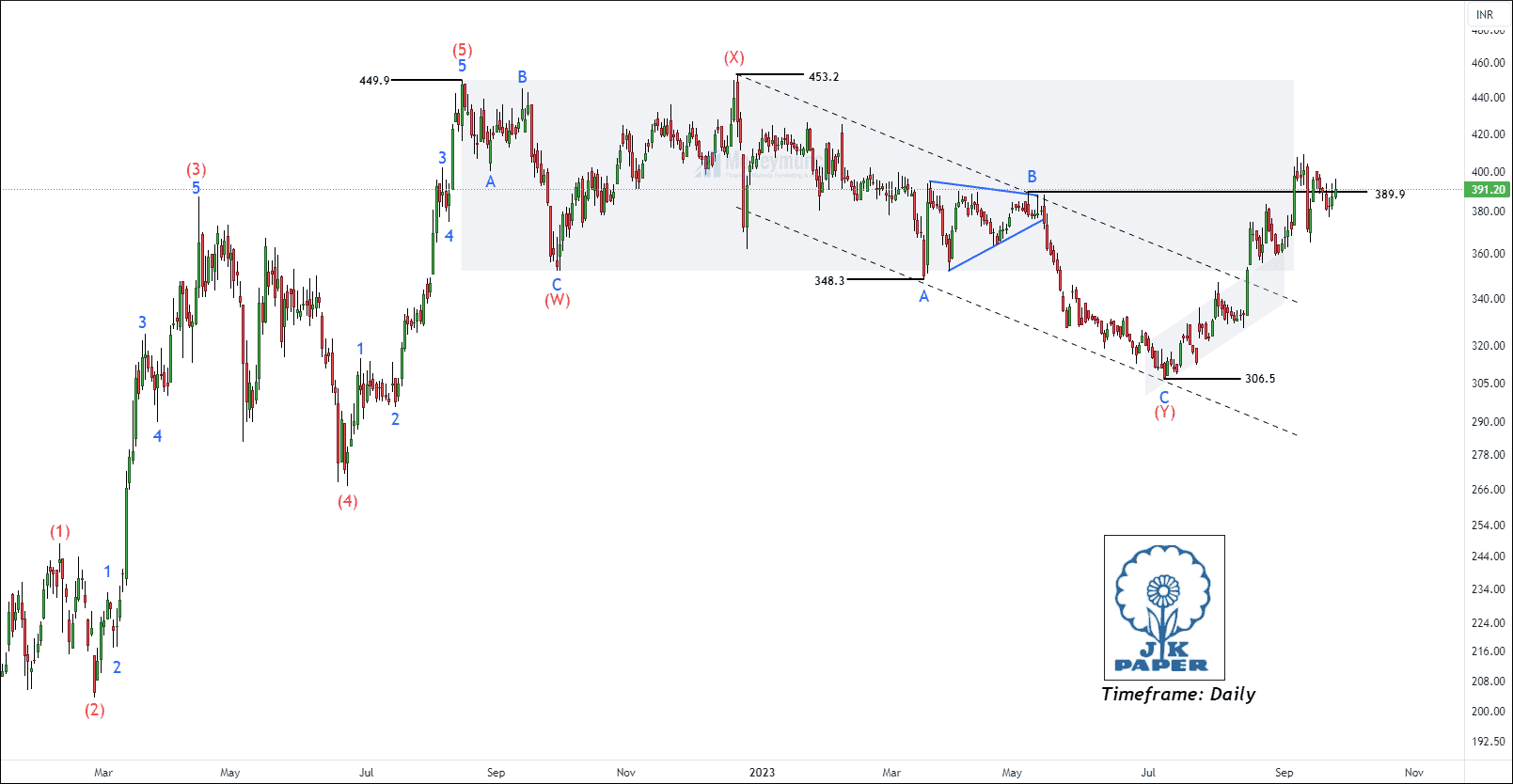

In the previous idea, we had traded the impulse wave after the completion breakout of the wave B. Short-term targets were achieved.

Visit here: NSE JKPAPER – Forecasting an Impulsive Pattern

Continue reading

Continue readingWe had written clearly,”If the price sustains above 1512, traders can trade for the following targets: 1727 – 1840 – 1975+.”

Timeline:

[12 September 2023]

If you have traded this setup for just first target, you could have made more than 15% in three months.