Have you executed successful trades on NSE DIVISLAB?

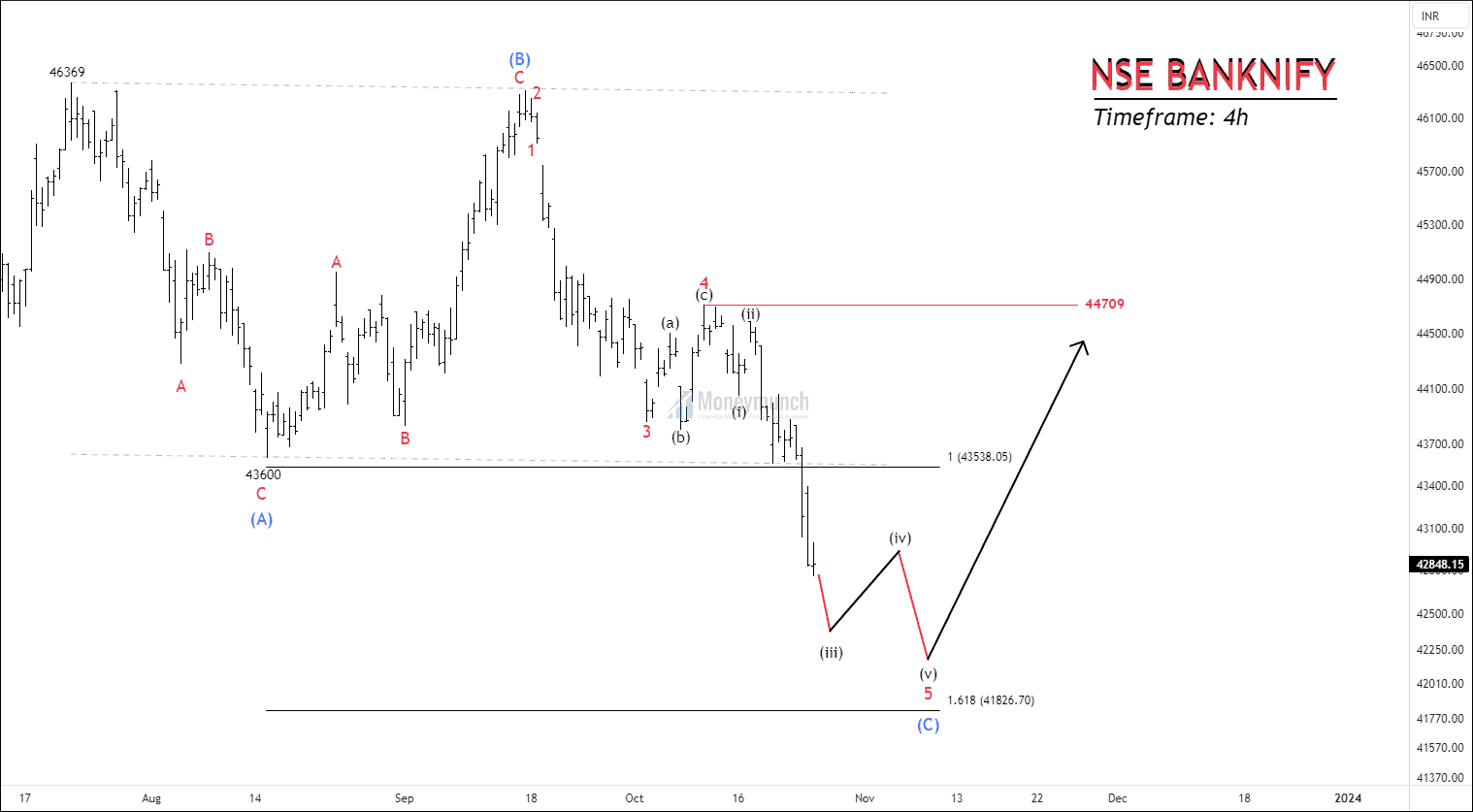

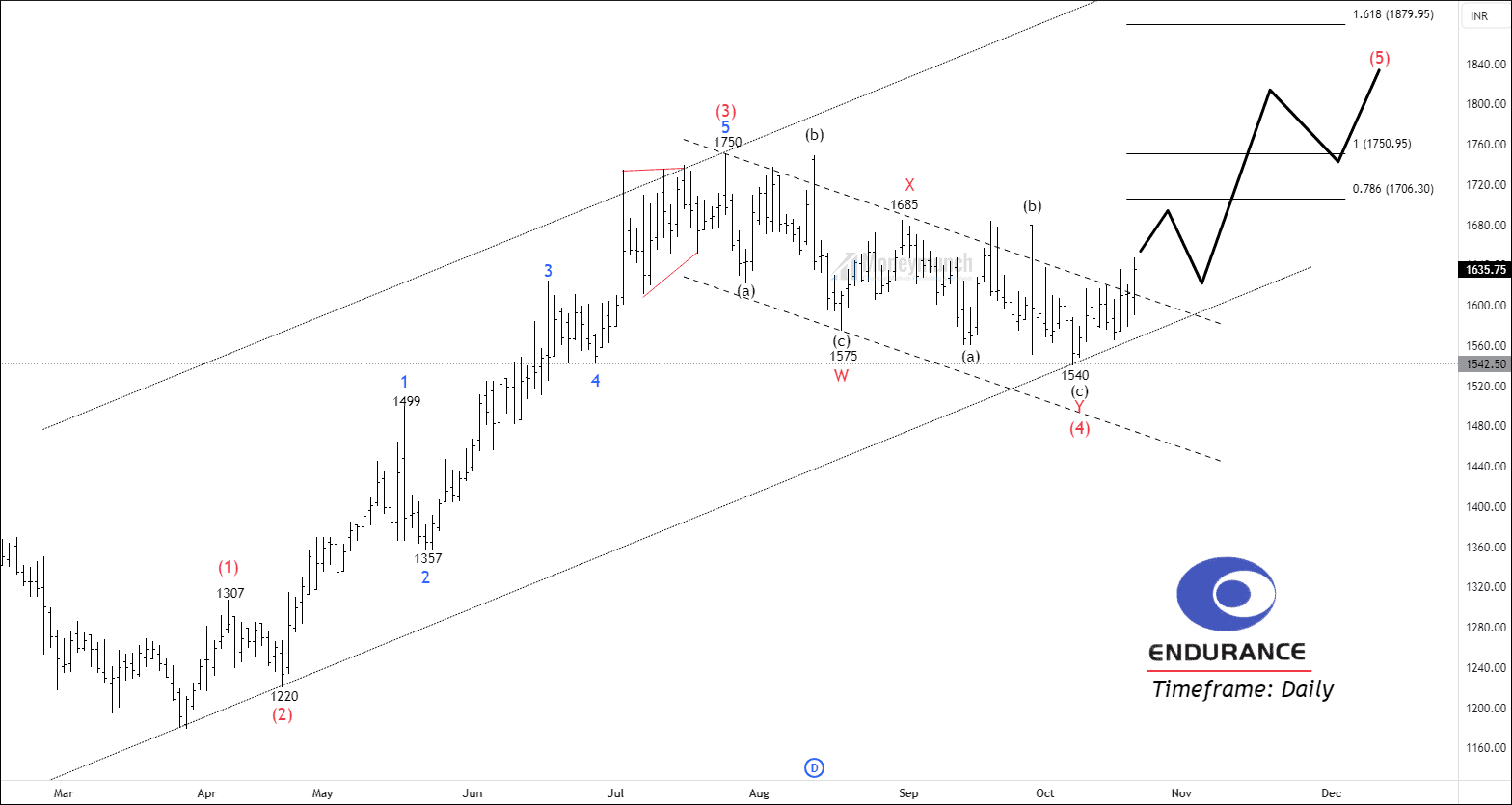

Visit here: TRADESETUP – BANKNIFTY, DIVISLAB, ENDURANCE & More

NSE DIVISLAB – Bear Victory

Continue reading

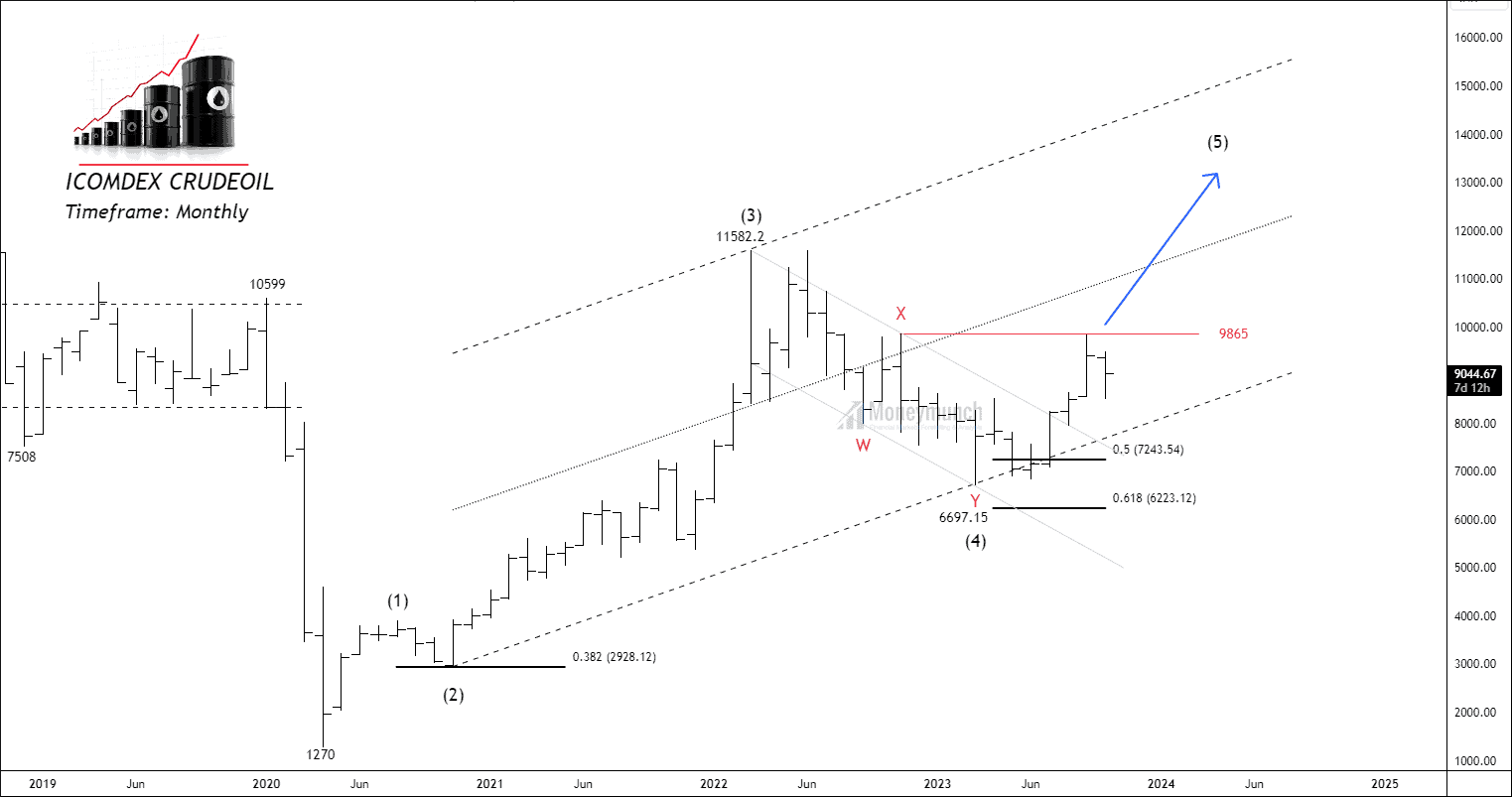

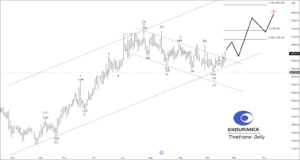

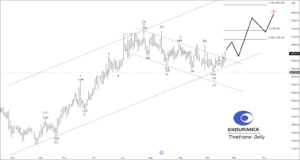

Continue readingICOMDEX & MCX CRUDEOIL – Bigger Picture Analysis

Will DIVISLAB Hit The Final Target?

Have you executed successful trades on NSE DIVISLAB?

Visit here: TRADESETUP – BANKNIFTY, DIVISLAB, ENDURANCE & More

Continue reading

Continue readingNSE DIVISLAB – Trading Insights & Update

Have you executed successful trades on NSE DIVISLAB?

Visit here: TRADESETUP – BANKNIFTY, DIVISLAB, ENDURANCE & More

Continue reading

Continue reading