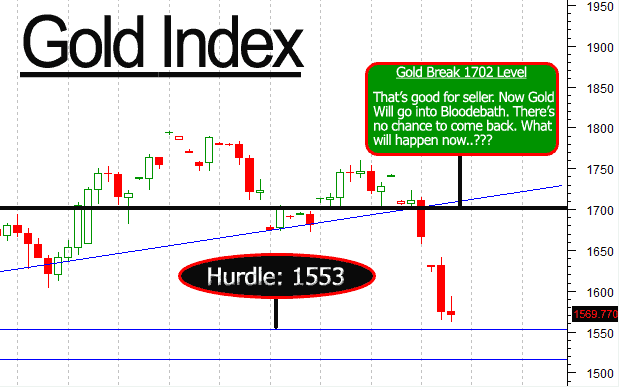

What I had written on 16th Dec 2011 about Gold?

CLICK HERE TO SEE IT

I said, “ONCE GOLD WILL BREAK AND CLOSE BELOW TO 1553 HURDLE THEN IT’LL TOUCH 1516 AND BELOW…” but as I said, it is not crossed to my hurdle and moving Upside day by day.

Yesterday, what I had written about Crude Oil in Password Protected mode?

I said, “Crude Oil will run upside continue, and it’ll touch 5051+ level”

Now you get, what’s my subscribers getting?

Today, I’m going to write more about Crude Oil / Silver / Mentha Oil / GuarGum / GuarSeed soon!

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock