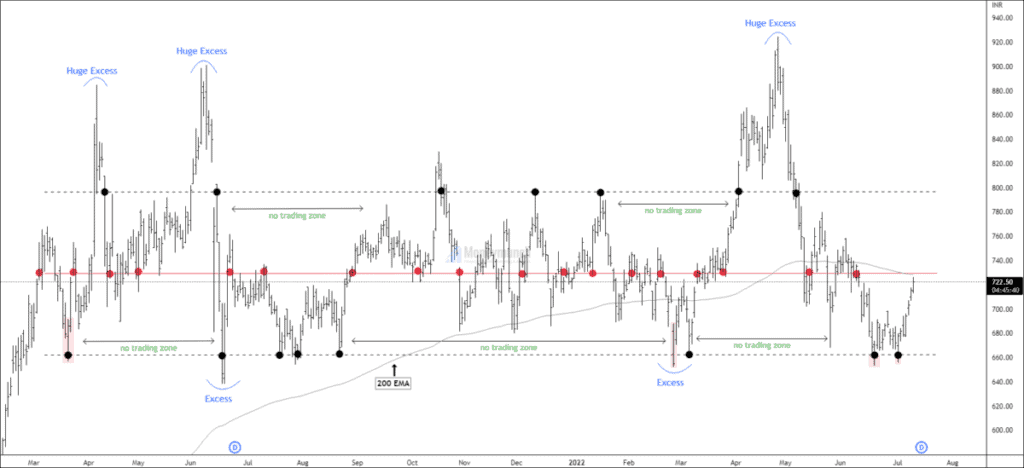

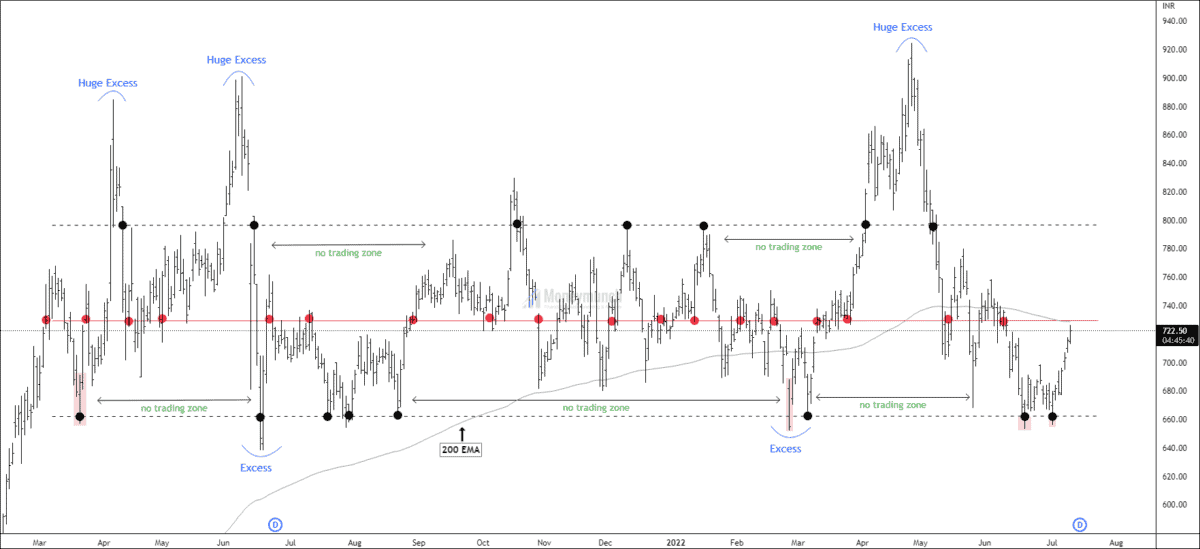

Timeframe: Daily

Adani Port has been forming in the corrective channel for more than 14 months. Adani port has given 18 touches to the control line. The lower band proved it as a strong demand zone.

Currently, the price is at the control line of the parallel channel.

If the price breaks the control line, traders can long for the following targets: 751 – 778 – 795.

However, Adani Port has reached nearly 200 EMA. It indicates that if the price fails to break the control line, it can fall for the following targets: 700 – 678 – 605.

Please note that 200 EMA indicates strong resistance to the price. But after the breakout, it acts as support.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for sharing your views. I think we can expect a bearish move within this month-end.

Your charts are beneficial for a retail trader like me. If anyone deserves thanks, it’s you

my long term investment :) hope it reaches 1000 soon