Last Friday I suggested that price was involved in unfolding a terminal pattern: “Maybe price is unfolding a Triangle that should establish a bottom with the last thrust down, who knows if at the 0.618 retracement the PPT will step in.”

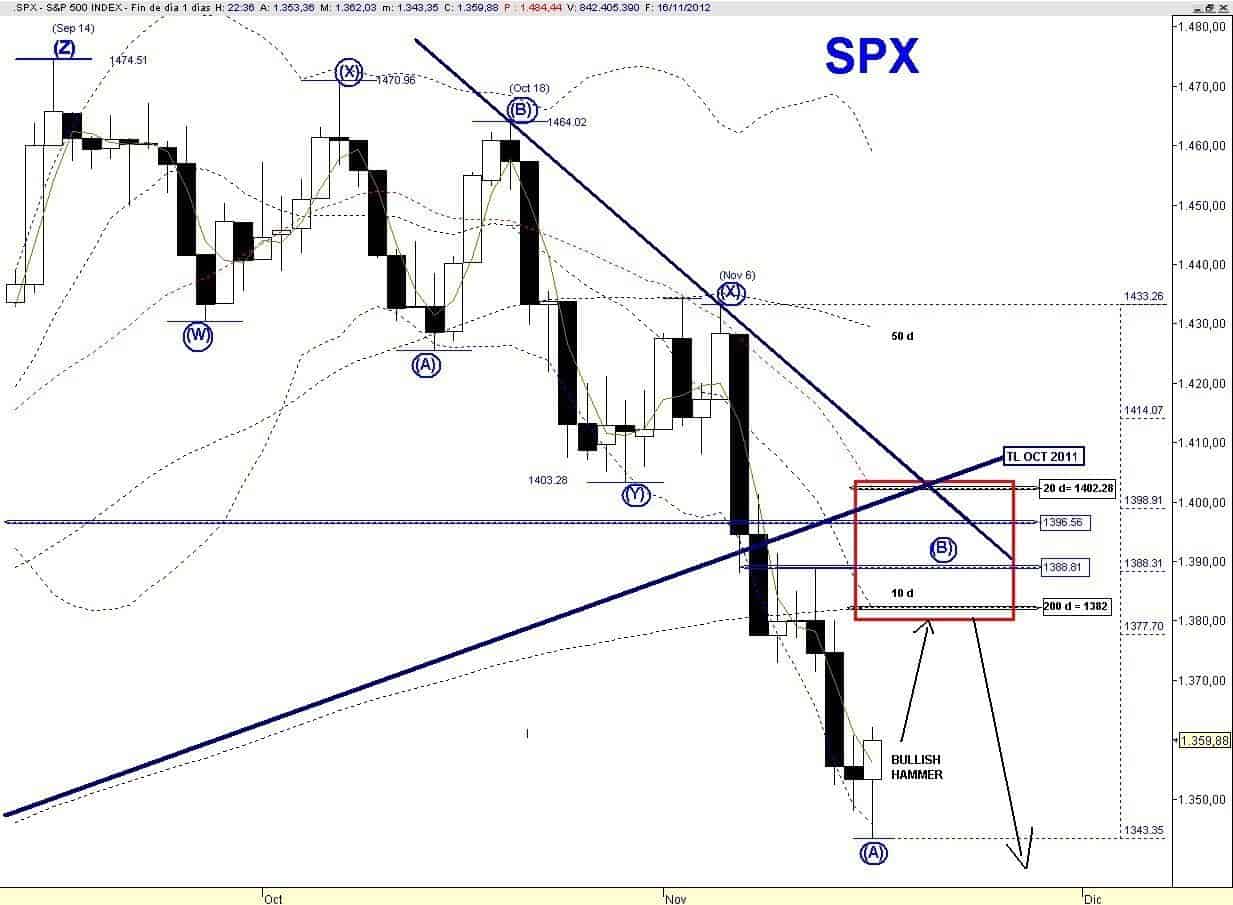

Instead of a Triangle price traced an Ending Diagonal, some good news came form Washington and price after testing the 0.618 retracement reversed to the upside, leaving in the daily chart a bullish hammer.

Therefore the wave structure off the November 6 peak is most likely over. This down leg, if my preferred count is correct, is the wave (A) of the last Zig Zag from the September 14 high. Therefore I am expecting a multi-day bounce followed by a lower low that should complete the corrective EWP (Recall that I am working with a Triple Zig Zag) from the September 14 high with positive divergences.

The internal structure of this bounce at the moment suggests that price may unfold a Double Zig Zag, in which case the common extension targets are:

1 x 1 = 1369 1 x 1.618 = 1380

A counter trend bounce always entails risks since the EWP can easily morph into something else, so next Monday I would like to see follow through to the upside or at least price should not breach the initial higher low at 1351.06.

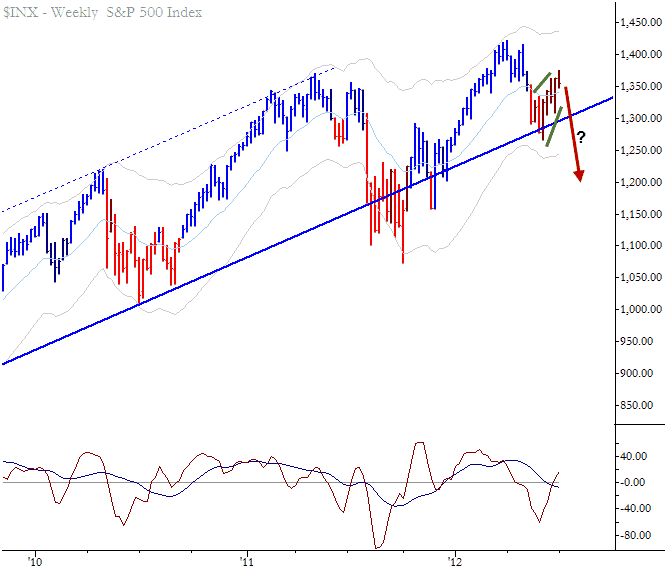

In order to keep the ball running to the upside, bulls need price above the 50 wma = 1366.85 by next Friday, theoretically it looks like an easy task.

Therefore the extreme oversold readings of breadth & momentum Indicators + logical level for a short-term bottom (0.618 Retracement) + reversal pattern are the “ingredients” that should allow a multi-day rebound.

In the daily chart below I highlight the target box for the assumed wave (B) countertrend bounce with a range 1382 – 1402.

A weak bounce should fail at the 200 dma while a strong one will go deeper inside the box and two trend lines resistance could come into play.

So the good news for the short-term bullish case is that there are enough technical reasons that auspicate a larger rebound.

But the negatives are still more overwhelming, since in addition to an incomplete EWP there is no sign of a major bottom from breadth-momentum indicator, VIX and sentiment.

Bulls also have the bullish seasonality of a shorter Thanksgiving week, while volume is expected to shrink.

In any case we know the two potential catalyst that are needed for the resumption of the intermediate up trend:

- US political agreement of the “Fiscal Cliff”

- Spanish Bailout

In addition since the Operation Twist ends in December, the next FOMC meeting on December 12 will be a major risk event and could be another detonator for a Major Bottom of the equity market.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.