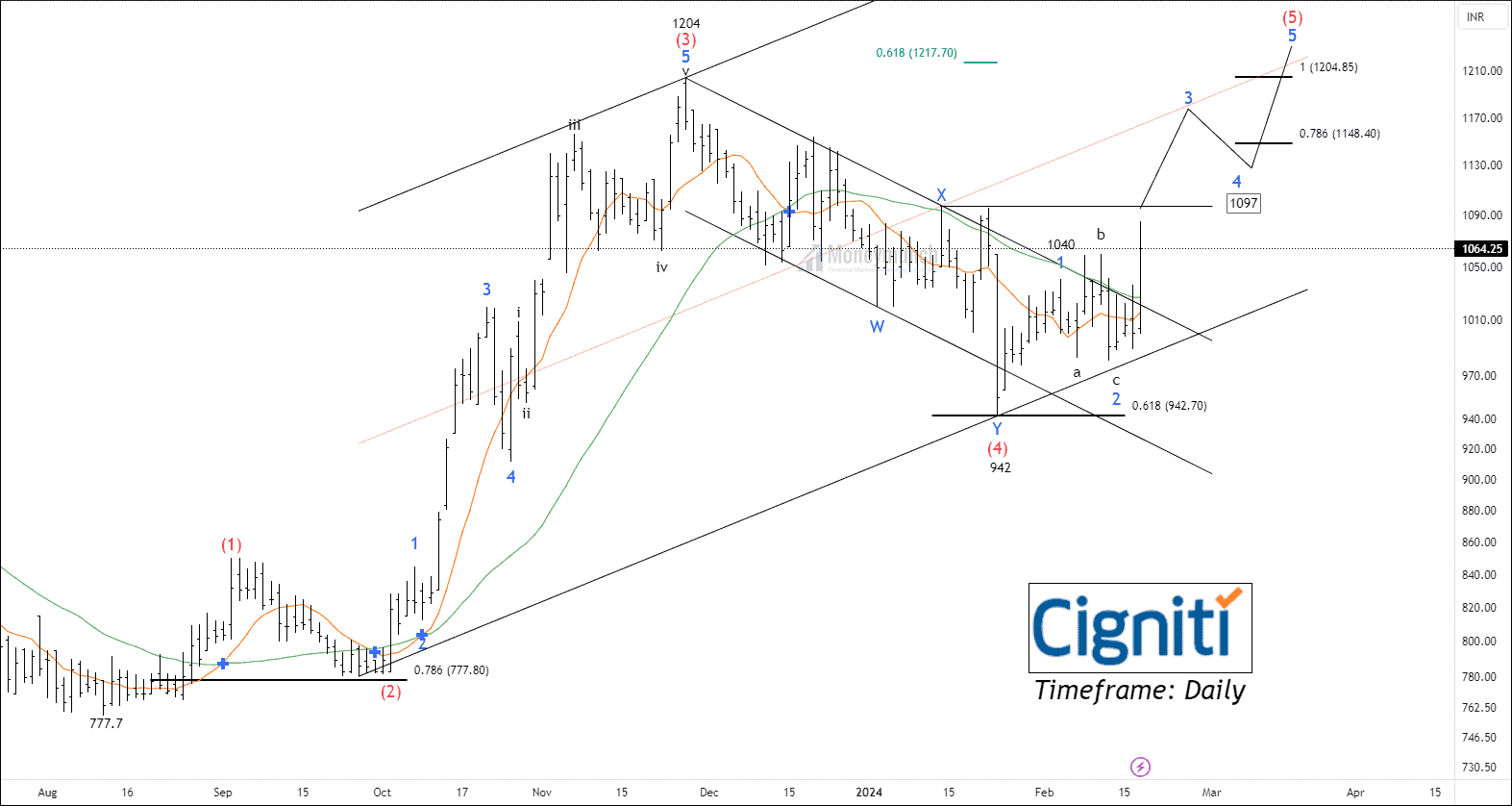

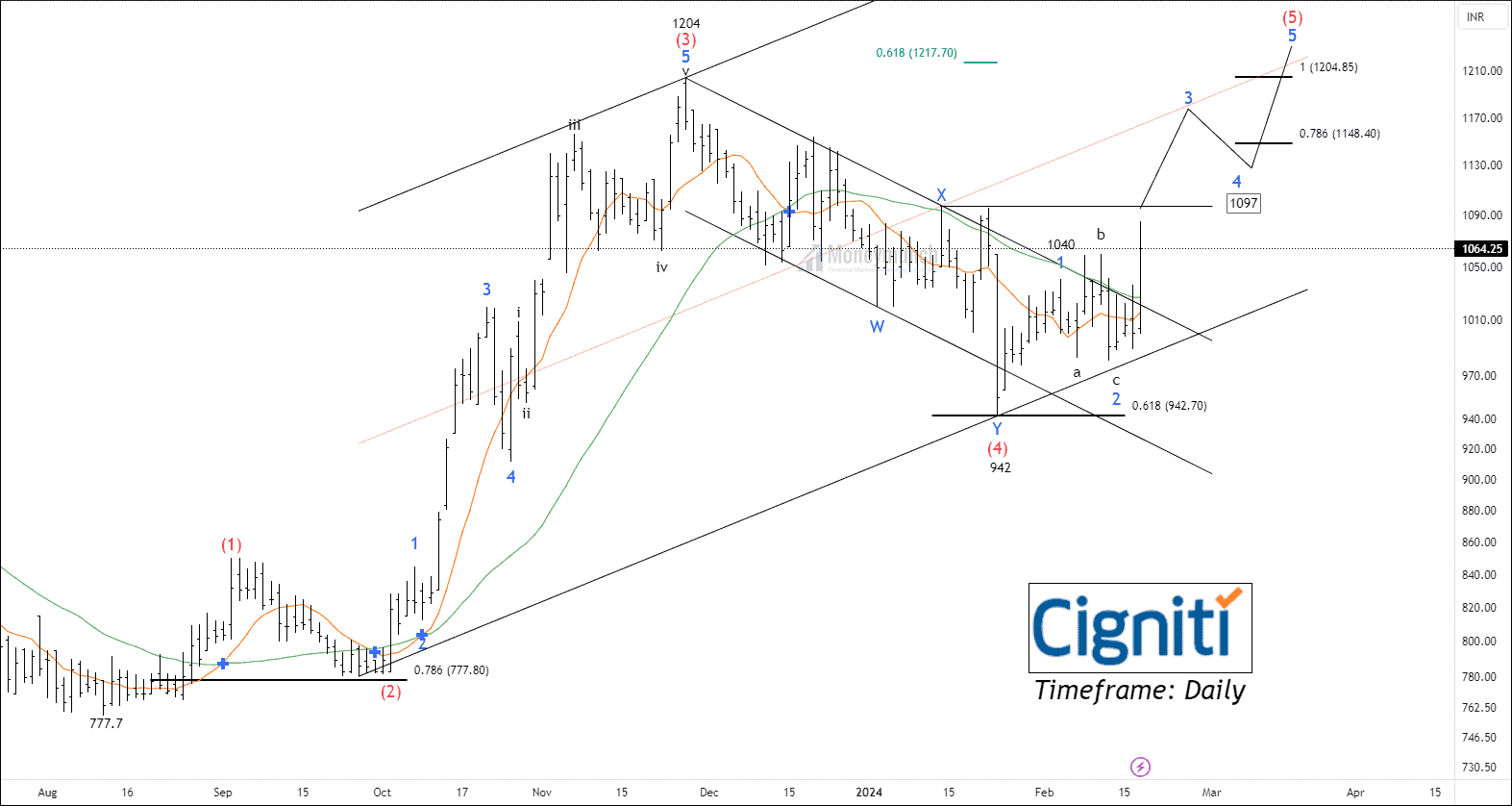

Do you remember NSE CIGNITITEC Wave projection?

Visit here: Trade Setup – BANCOINDIA, BHARTIARTL, CIGNITITEC & More

NSE CIGNITITEC – Trading Insights & Updates

BEFORE

BEFORE

Looking for reliable and free stock tips? Look no further than Moneymunch! We provide intraday and positional trading calls, technical analysis, research reports, and daily or weekly charts to help you make informed trading decisions in the stock market. Subscribe now and stay ahead of the game!

Do you remember NSE CIGNITITEC Wave projection?

Visit here: Trade Setup – BANCOINDIA, BHARTIARTL, CIGNITITEC & More

BEFORE

BEFORE