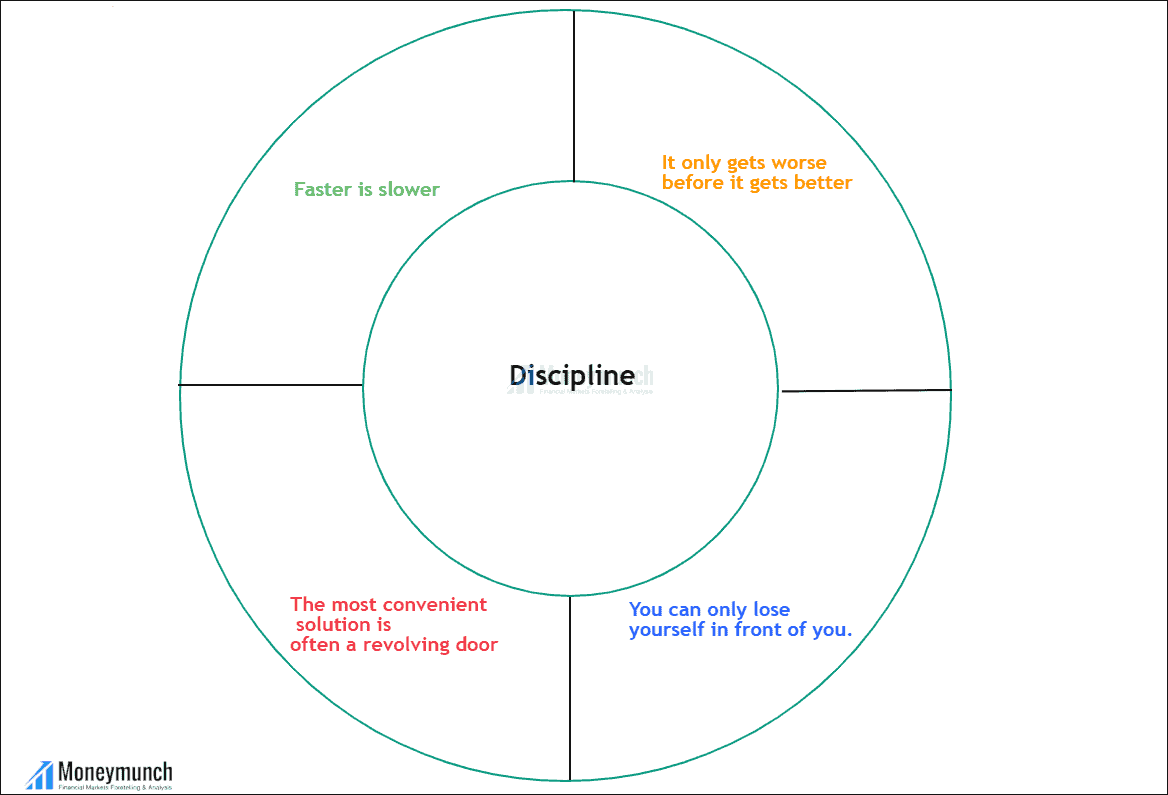

Discipline is nothing but self-control. Applied to trading, discipline is one of the most crucial factors on the road to profitability without discipline you will generally fail on the road to success! Because without discipline, you won’t stick to the rules, and you won’t continue to develop in the long run, you’ll do something productive here and there, but that’s not enough! If you want to develop discipline, you have to make your daily actions a habit.

How do you get disciplined?

The reason for action is crucial! Everyone started trading for a specific reason, be it to make extra money on the side, to be able to make a living from it in the long term, or for other reasons. It’s your “why” that has to drive you every day! Drive and continuity form a habit. Once a habit is formed, it becomes easier and easier to be disciplined.

I would say the reason for action combined with regularity leads to long-term discipline. See *neural network*. But the important thing is that you enjoy doing the activity, you have to like it, because then we combine the newly learned knowledge with emotions.

This leads to a stronger and faster neuronal connection, if we force ourselves to implement something, then we become very good slowly to no discipline build up. We also only gain discipline if we have a system with a fixed set of rules.

Implementation + continuity + habit = automatic discipline.

Is discipline the same as a discipline?

Just because someone goes to work every day does not mean that this person is disciplined, it makes a difference whether you have to do something (and get money for it directly) or whether you do something without first seeing results (although you know that if you do it with discipline and engage in income-producing activities, it will pay off).

The difference is you are in full control and have to reflect on yourself to get ahead, at work the boss does it for you, he tells you when you should work and usually gives you 30 days of vacation a year, which means you have 30 days a year that you can design yourself, the remaining 335 days (excluding weekends) you give control to the boss.

Discipline in trading

If you don’t show discipline when trading, you will most likely not have your emotions under control yet. The opposite of discipline is fear. A system can be set up rationally, with rules to follow, i.e. having the necessary discipline to follow those rules, an outburst of fear (e.g. too large a position size), and the discipline is gone! Fear is the discipline killer, especially at the beginning of a trading career, because it takes us a while (most people never make it) to get our emotions under control. Those who can control their fear when trading will find it easier to trade in a disciplined manner.

Tip: Question your fear triggers and find a solution to avoid them.

E.G:

I place a trade and look at the chart every minute, now I notice the trade is close to my SL, I widen the SL, close the trade or clear the SL entirely all for fear of being stopped and thereby losing money. Let’s assume you reflexively close the trade before it hits your SL, now (after you’ve already closed the trade) see it turn just before your SL and go up 100 pips (you could have been in).

Conclusion: You’re angry because you didn’t follow your rules again, and you don’t know why you did something senseless.

Solution: If you already know that you cannot control your emotions after placing a trade and want to constantly monitor the course of the trade and thereby unconsciously make changes, then place the trade and close the chart if you are still on the PC, otherwise leave go for a walk or go to another room and read or do something else. You can also open the chart from time to time. What I’m saying is, if you don’t know how your trade is going, don’t get nervous or afraid of losing.

“What you control will grow”, when applied to trading, means nothing other than that you have to constantly control yourself and your system to even know whether what you are doing is right or wrong. Keyword: error analysis. If you don’t control your system and your behavior, then you don’t know whether your winnings were reproducible or just based on luck or whether your losses were mistakes or valid losses that belong to it. This, too, will increase your discipline and reduce your sense of insecurity.

The feeling of insecurity is based on a lack of knowledge and a lack of experience, and you gain experience through DOING, for example learning from mistakes, but if you don’t question your mistakes (error analysis) you will never learn and therefore will not collect any new experience points. Everything has a connection.

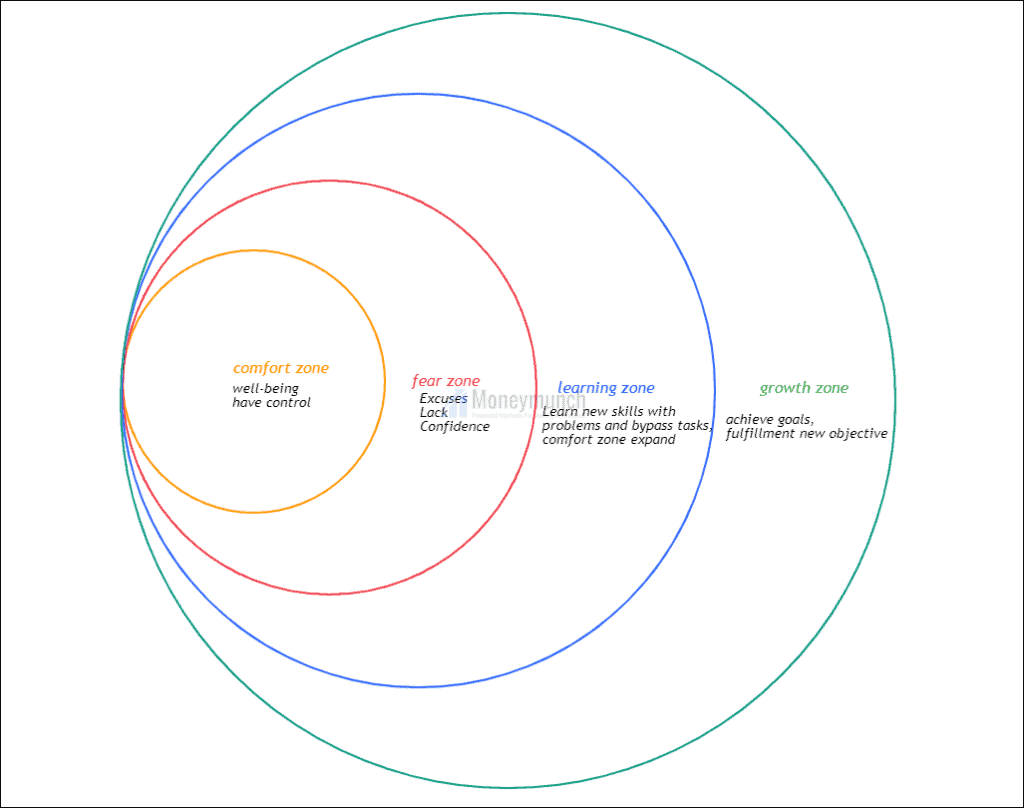

Discipline in general, being disciplined always means leaving your comfort zone.

It is the final article in this series, but it is not the end. We thank you for reading and wish you success in your trading.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.