Automation and technology have wrecked havoc on labor markets the past 10-20 years, especially those in the developed West. Yes there are exceptions such as Canada and Australia who have resource rich environments (i.e. North Dakota) but for most economies these massive shifts have changed the landscape fundamentally, and will continue to do so. On the other hand, China has been the largest beneficiary of the shift in globalization but thus far has had little incentive for automation due to (relatively) low labor costs. But that has been changing of late with wage pressure rising – so now automation appears to be coming to China as well. Of course the balancing act of keeping enough work for hundreds of millions versus remaining competitive in cost structure is going to be one tough act for that country. But more broadly speaking it points to continued pressure globally on labor.

Via BusinessWeek:

- Step into the factory of Chinese SUV and truck maker Great Wall Motors, and it’s easy to forget you’re in the world’s most populous country. Swiss-made robots pivot and plunge, stamping metal door frames and soldering them to the skeletal vehicle bodies of a mini-SUV called the Haval M4. The blue-smocked workers in yellow hard hats are few and far between here in Great Wall’s largest factory complex, located in Baoding, some 90 miles southwest of Beijing.

- “With automation, we can reduce our head count and save money,” says Hao Jianjun, Great Wall’s general manager, who has invested $161 million into mechanizing four plants with 1,200 robots. The average price of a factory-floor robot is around $50,000 before installation. “Within three years, this cost will be completely paid for in savings from reduced worker wages,” says Hao. After the robots were added, the number of welders at Great Wall dropped from 1,300 to around 400.

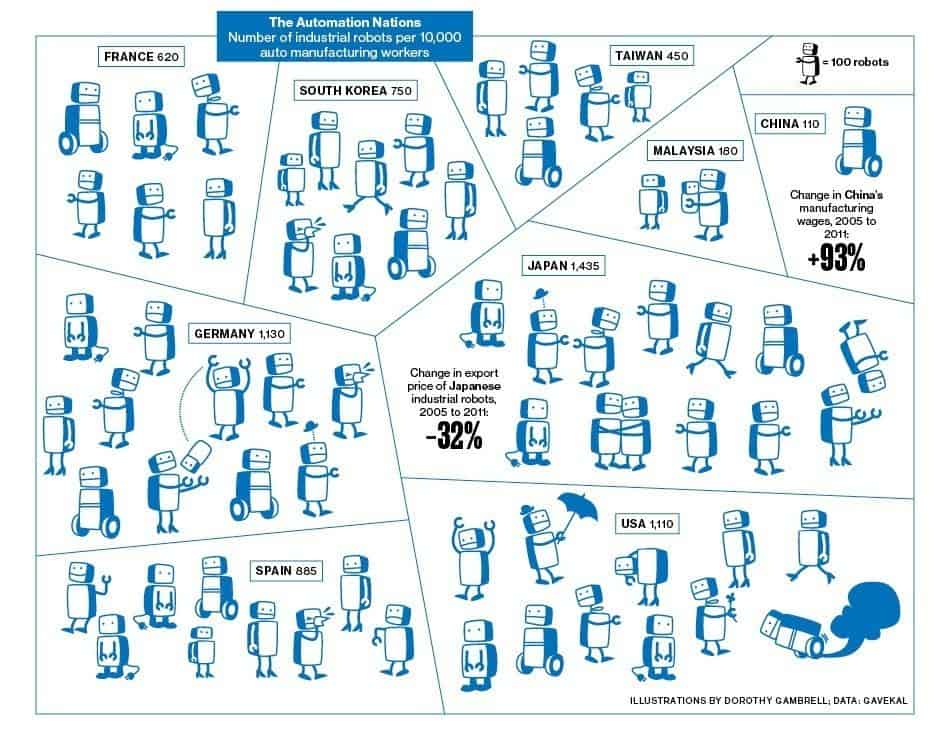

- Last year sales of industrial robots in China reached 22,577 units, up 51 percent over 2011. That puts China just behind Japan and South Korea, but ahead of Germany and the U.S., in the purchase of new robots. With robot sales quadrupling from 2006 to 2011, China is on track to become the world’s largest industrial cyborg market by 2014, predicts the Frankfurt-based International Federation of Robotics.

- China’s car industry has led the automation wave, particularly at its joint ventures with General Motors, Honda Motor, and Volkswagen. Consumer electronics, food and beverage processing, and the plastics and textile industries are following suit. “What we are seeing is robots increasing in a lot of industries where they are already common in the rest of the world,” says Yuchan Li, an analyst with economic consultancy GaveKal Research. “For China, there is still a lot of low-hanging fruit when it comes to automation.”

- One factor driving the switch to robots is demographics. Next year China’s labor force will peak at 1 billion before starting to shrink, in part because of the nation’s one-child policy. Labor shortages are already common and are driving wage inflation, up around 20 percent annually in recent years. Beijing is encouraging automation by forcing up minimum wages.

- For the textile industry, facing ever-narrower margins, automation may be the only alternative to shutting down or moving. While some factories relocated to lower-wage Cambodia and Vietnam, Hong Kong sweater maker Milo’s Knitwear International upgraded. After spending $1.9 million for 29 Japanese stitching machines, its Dongguan factory has reduced staff from 140 workers to six.