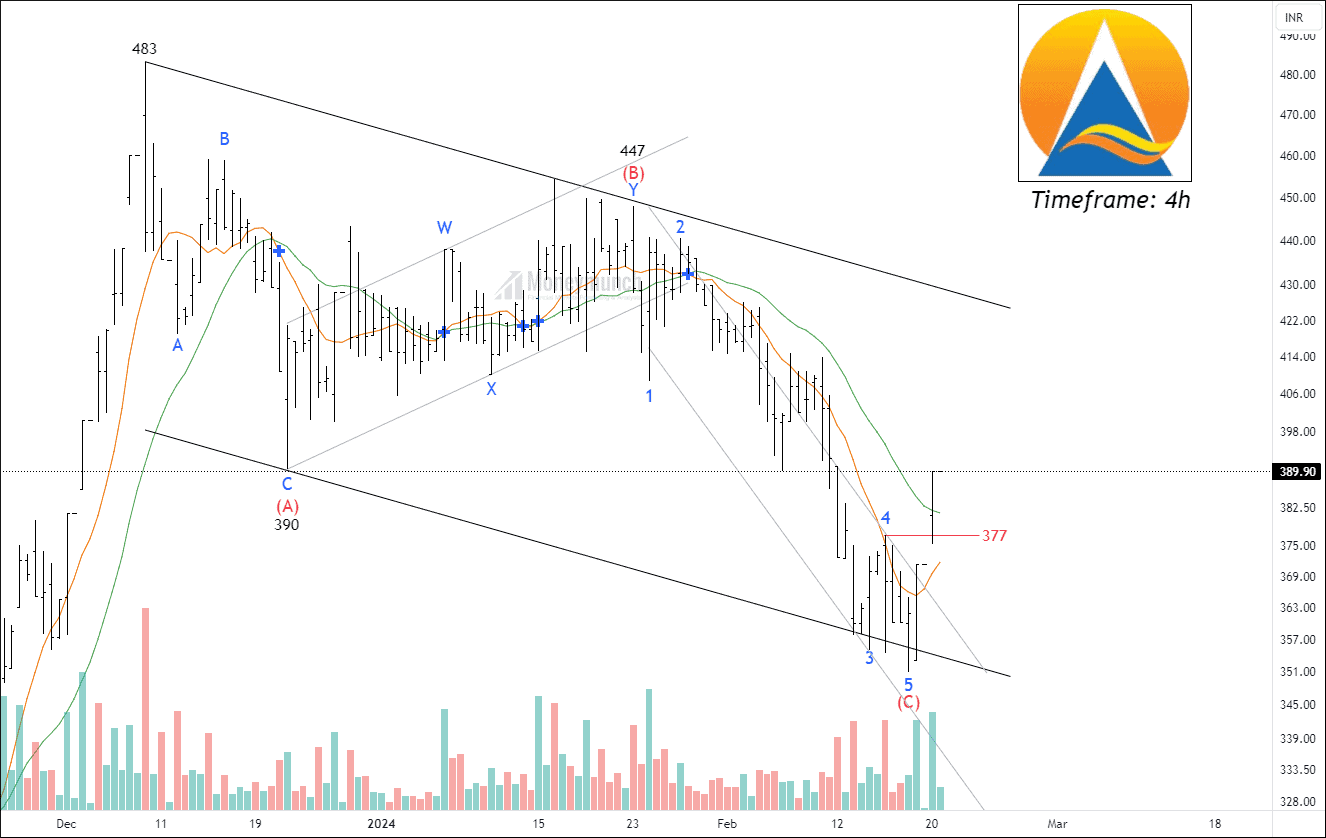

Timeframe: Daily

After reaching a low of 777.7, the price began to form an impulse structure. It is currently trading above its 35, 50, 100, and 200-day moving averages. The average true range (ATR) of the price increased to 42, although the average directional index (ADX) is not showing a consistent upward trend.

As per the Elliott wave analysis, the price has accomplished complex correction of wave (4) with 61.8% retracement of wave (3) at 942. The security formed sub-wave one at 1040, followed by sub-wave two at 980.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

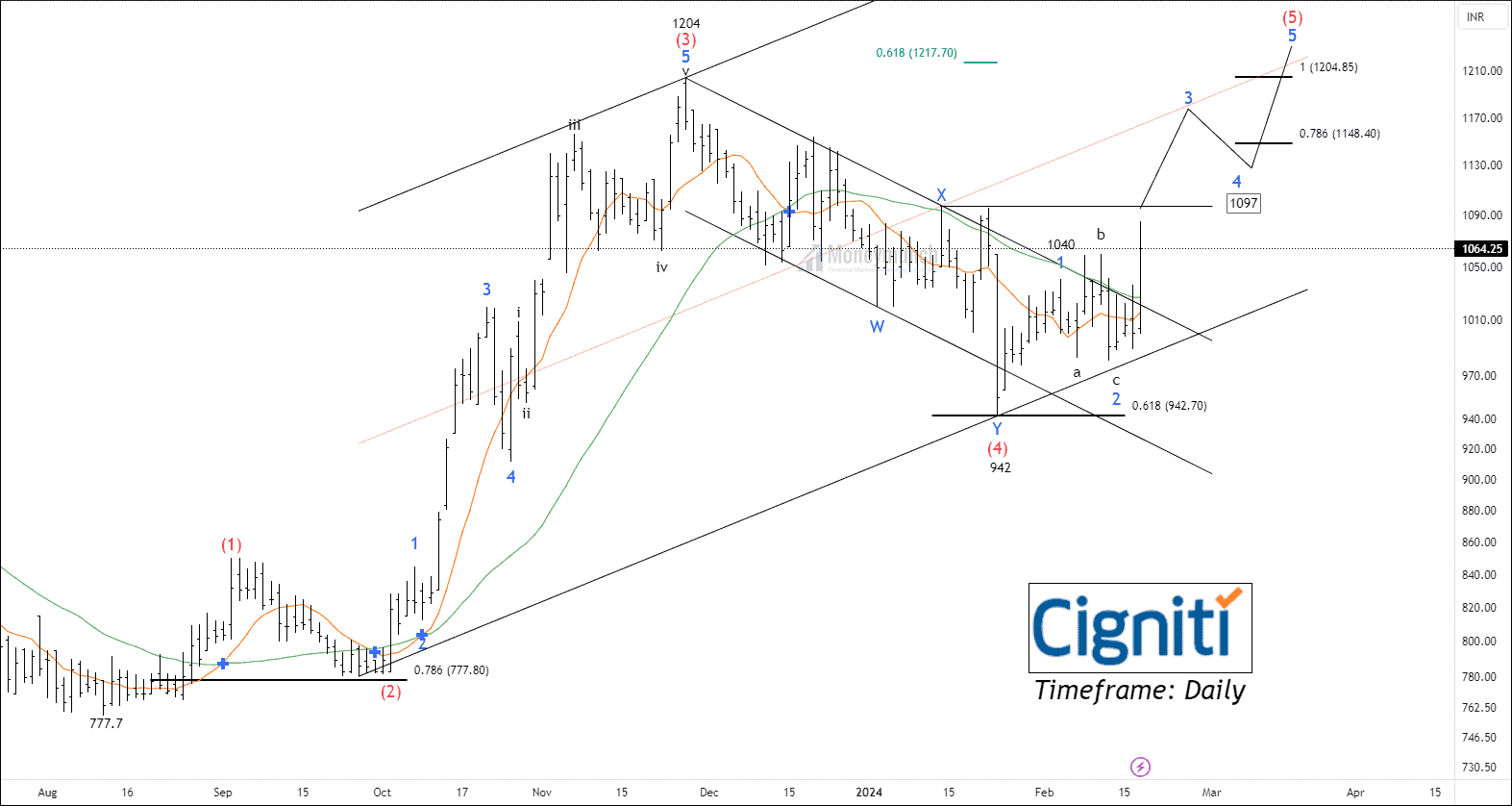

NSE BANCOINDIA: Breakdown Potential Analysis

NSE BANCOINDIA looks weak on the daily timeframe. Price recently broke down a crucial support level of 675 and started falling. ATR of the price reached 31.19.

Security has broken down the 10/50 moving average that signals bears are taking control over the bulls. If the price sustains below 675, traders can short for the following targets: 665 – 652 – 636+. Free subscribers can take the previous day’s low as an invalidation level.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

Is the Grip of Bears Loosening on NSE BHARTIARTL?

NSE BHARTIARTL has given a strong move in the previous trading session. The ATR of the price reaches 25, and ADX shows strength by being above 30. The price is above 10/35/50 Moving average

It Looks like the price has broken our flat corrective structure on the daily timeframe chart. If the price sustains above 1130, traders can trade for the following targets: 1143 – 1158 – 1176+. The target can be extended following an aggressive breakout of 1144.

Free subscribers can take the previous day’s low as an invalidation level.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

NSE FIEMIND – Correction Breakout

NSE FIEMIND broke out of wave B of the correction at 2434. The price is currently trading above the 35, 50, 100, and 200-day moving averages. Following the breakout, the average true range (ATR) has begun to trend upward.

The slope of the move appears impulsive, and the breakout from the flat pattern occurred with a large candle. If the price manages to sustain above 2435, traders may consider trading for the following targets: 2494 – 2556 – 2636+. Free subscribers can take previous day’s high as invalidation level.

Premium subscribers will have excess to further information.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

Lock

Lock