We all know the following scenarios (especially at the beginning of our trading career):

- Compulsively trying to interpret every movement

- Stick to the chart and observe the trades placed

- Constantly open the trading platform with your cell phone to see how the trade is going.

- Only thinking about trading or the trades you have placed in everyday life

Trading has its good and bad sides, we know it’s good, and that is most likely why you started trading. Financial, geographical, and temporal freedom through trading.

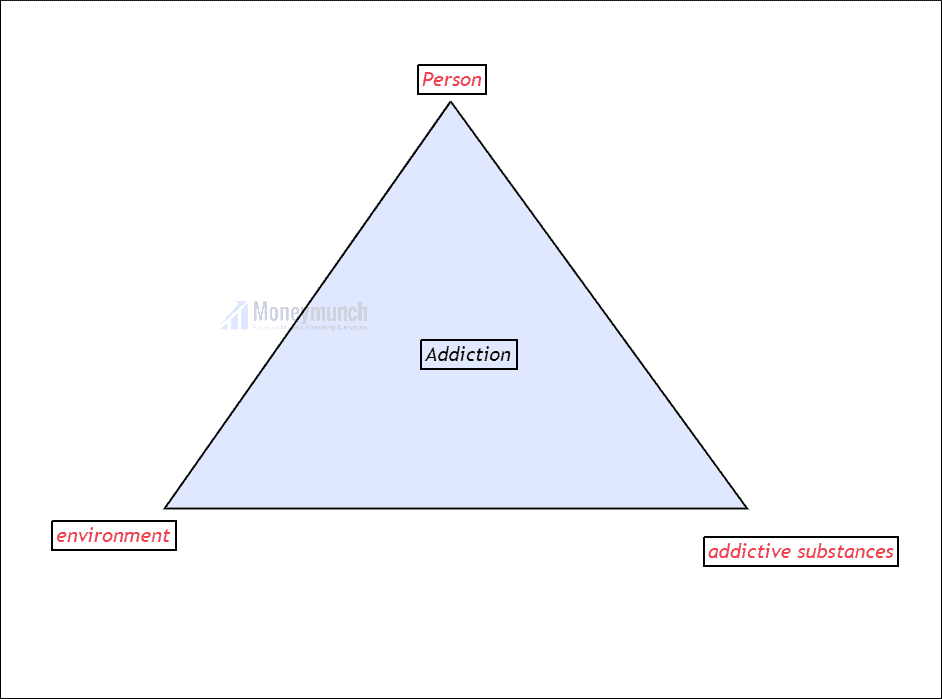

His bad ones are mainly emphatic mental stress and addiction.

But is trading addictive?

- Can you stop trading overnight?

- Can you take a month’s break from trading overnight?

The answers to the questions vary, of course, but I can assure you that both answers occur. Let’s assume that you can’t just stop trading, that you have to trade every day, that you are no longer passionate about it, and it feels like an oppressive burden ⇉ If that’s the case, then you don’t have the trading any more under control but trading you!

The problem with this is that trading creates stimuli to take a trade, calculate your profit and see if it works or not. Anything in our life that is stimulating can be addictive. The trading addiction can also come from not wanting to miss a trade and therefore having to be on the charts all the time because then that one entry can come that you don’t want to miss. We let our addiction drive us. In the case of alcohol addiction, for example, you spend money to buy more alcohol. Applied to trading, this means that you pay in more and more money in the event of losses and thus gamble away savings or, in the worst case, money that you need to survive. The only money that is not needed to sustain the trade should be traded. The likelihood of addiction is reduced if you know this from the start and behave professionally accordingly.

- If you e.g. know that staring at your phone every minute to see how the trade is going is rather counterproductive, then you delete the app.

- If you know that not every price movement is to be interpreted, you close your analysis platform after placing a trade.

- If you know that regular breaks are pleasant and productive, you can take a break once a month for X days and not deal with the stock market.

Trading addiction only occurs when one resists unnecessary pressure, compares oneself, constantly wants to be right, and/or initially has/received a lack of knowledge regarding the stress factors involved in trading.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Nice information