I will update to night weekly update of world markets.

Just watch S&O 500 Candle stick charts

Looking for reliable and free forex tips? Look no further than Moneymunch! We provide intraday and positional signals, technical analysis, research reports, and daily or weekly charts on major forex pairs, commodities, and cryptocurrencies to help you make informed trading decisions in the forex market. Subscribe now and stay ahead of the game! Start learning forex trading now!

I will update to night weekly update of world markets.

Just watch S&O 500 Candle stick charts

My short-term scenario has proven to be wishful thinking. I was looking for a potential Zigzag down instead the bulls have once again aborted a pullback that in my opinion has been delayed but not removed from a pending outcome.

Regarding the long-term count, I maintain the scenario of a potential Ending Diagonal. If it pan out it will complete the Double Zigzag wave (X) off the March 2009 low establishing a major top.

But instead of an expecting a larger subdivision of the wave (III) maybe price is approaching the end of this wave.

If this is the case then once the wave (III) is in place in the next down leg, in order to be considered the wave (IV) of the Ending Diagonal, it will have to overlap below the peak of the wave (I).

The potential target for the wave (IV) could locate in the range 1463.76 – 1435.50.

In addition, if the Dow is unfolding the same ending pattern, then the wave (III) cannot exceed above 14089.64 therefore there is not much more upside left in order to maintain valid this option.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Moving Avg-Exponential Indicator:

Conventional Interpretation: Price is above the moving average so the trend is up.

Trend: Market trend is UP.

Mov Avg 3 lines Indicator:

Note: In evaluating the short term, plot1 represents the fast moving average, and plot2 is the slow moving average. For the longer term analysis, plot2 is the fast moving average and plot3 is the slow moving average

Conventional Interpretation – Short Term: The market is bullish because the fast moving average is above the slow moving average.

Additional Analysis – Short Term: The market is EXTREMELY BULLISH. Everything in this indicator is pointing to higher prices: the fast average is above the slow average; the fast average is on an upward slope from the previous bar; the slow average is on an upward slope from the previous bar; and price is above the fast average and the slow average.

Conventional Interpretation – Long Term: The market is bullish because the fast moving average is above the slow moving average.

Additional Analysis – Long Term: The market is EXTREMELY BULLISH. Everything in this indicator is pointing to higher prices: the fast average is above the slow average; the fast average is on an upward slope from the previous bar; the slow average is on an upward slope from the previous bar; and price is above the fast average and the slow average.

Bollinger Bands Indicator:

Conventional Interpretation: The Bollinger Bands are indicating an overbought market. An overbought reading occurs when the close is nearer to the top band than the bottom band.

Additional Analysis: The market appears overbought, but may continue to become more overbought before reversing. Given that we closed at a 45 bar new high, the chance for further bullish momentum is greatly increased. Look for some price weakness before taking any bearish positions based on this indicator.

Volatility Indicator: Volatility is in a downtrend based on a 9 bar moving average.

Momentum Indicator:

Conventional Interpretation: Momentum (1000.11) is above zero, indicating an overbought market.

Additional Analysis: The long term trend, based on a 45 bar moving average, is UP. The short term trend, based on a 9 bar moving average, is UP. Momentum is indicating an overbought market, and appears to be slowing. A modest downturn is possible here.

Rate of change Indicator:

Conventional Interpretation: Rate of Change (7.69) is above zero, indicating an overbought market.

Additional Analysis: The long term trend, based on a 45 bar moving average, is UP. The short term trend, based on a 9 bar moving average, is UP. Rate of Change is indicating an overbought market, and appears to be slowing. A modest downturn is possible here.

Comm Channel Index Indicator:

Conventional Interpretation: CCI (170.27) recently crossed above the buy line into bullish territory, and is currently long. This long position should be liquidated when the CCI crosses back into the neutral center region.

Additional Analysis: CCI often misses the early part of a new move because of the large amount of time spent out of the market in the neutral region. Initiating signals when CCI crosses zero, rather than waiting for CCI to cross out of the neutral region can often help overcome this. Given this interpretation, CCI (170.27) is currently long. The current long position position will be reversed when the CCI crosses below zero. Adding bullish pressure the market just reached a 45 bar new high.

RSI Indicator:

Conventional Interpretation: RSI is in neutral territory. (RSI is at 66.70). This indicator issues buy signals when the RSI line dips below the bottom line into the oversold zone; a sell signal is generated when the RSI rises above the top line into the overbought zone.

Additional Analysis: RSI is somewhat overbought (RSI is at 66.70), but given the 45 bar new high here, greater overbought levels are likely.

MACD Indicator:

Conventional Interpretation: MACD is in bullish territory, but has not issued a signal here. MACD generates a signal when the FastMA crosses above or below the SlowMA.

Additional Analysis: The long term trend, based on a 45 bar moving average, is UP. The short term trend, based on a 9 bar moving average, is UP. MACD is in bullish territory. And, the market just put in a 45 bar new high here. Look for more new highs.

Open Interest Indicator: No open interest value in the database for this bar. Note: Open interest not available for all data types.

Volume Indicator:

Conventional Interpretation: The current new high is not accompanied by increasing volume, suggesting that the current move lacks broad participation. Look for a retracement soon.

Additional Analysis: The long term market trend, based on a 45 bar moving average, is UP. The short term market trend, based on a 5 bar moving average, is UP.The current new high is not accompanied by increasing volume, suggesting that the current move lacks broad participation and the market may be overbought. A retracement is possible here.

Stochastic – Fast Indicator:

Conventional Interpretation: The stochastic is in overbought territory (SlowK is at 96.91); this indicates a possible market drop is coming.

Additional Analysis: The long term trend is UP. The short term trend is UP. Even though the stochastic is signaling that the market is overbought, don’t be fooled looking for a top here because of this indicator. The stochastic indicator is only good at picking tops in a Bear Market (in which we are not). Exit long position only if some other indicator tells you to.

Stochastic – Slow Indicator:

Conventional Interpretation: The stochastic is in overbought territory (SlowK is at 94.33); this indicates a possible market drop is coming.

Additional Analysis: The long term trend is UP. The short term trend is UP. Even though the stochastic is signaling that the market is overbought, don’t be fooled looking for a top here because of this indicator. The stochastic indicator is only good at picking tops in a Bear Market (in which we are not). Exit long position only if some other indicator tells you to.

Swing Index Indicator:

Conventional Interpretation: The swing index is most often used to identify bars where the market is likely to change direction. A signal is generated when the swing index crosses zero. No signal has been generated here.

Additional Analysis: No additional interpretation.

Important: This commentary is designed solely as a training tool for the understanding of technical analysis of the financial markets. It is not designed to provide any investment or other professional advice.

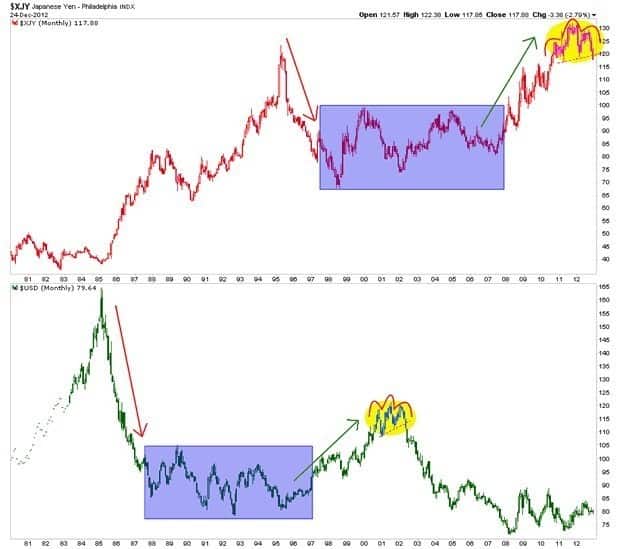

Japan is following in the footsteps of the man who laid the groundwork for the greatest global inflationary operation of the modern era. We see the Yen in the top panel of the chart below forming a similar pattern to that which USD made from 2000 to 2002 as an epic bubble in credit expansion was being fomented in the US.

The similarity in the charts (with a decade stagger) is striking and it is probably no coincidence that Japan has chosen to leverage its currency – which had been chronically strong since the 2007 beginnings of the US-triggered global financial meltdown – just as the US did with the once strong ‘King’ dollar in and around 2001.

Challenging the strong resistance at

111.44/111.60.

• EUR/JPY’s rise is overextended but, yesterday,

it managed to make new highs. It is now

challenging the strong resistance at

111.44/111.60. Given the general overbought

conditions, we favour a phase of weakness in the

next few days.

• EUR/JPY has moved above its long-term

downtrend (linking the October 2009 top with

the April 2011 top). Monitor the test of the key

resistance at 111.60 (31/10/2011 high).

Short 3 at 111.30, Objs: 110.35/108.10/106.10, Stop: 112.25

Await fresh signal.

Bouncing on support at 1.2875.

• EUR/USD has successfully tested the key

support at 1.2875. Resistances for a bounce are

given by 1.2973 (07/12/2012 high) and 1.3046

(04/12/2012 low).

• The underlying trend is negative (see the

succession of lower highs since May 2011 peak).

Therefore we expect limited upside potential

given the strong resistance at 1.3172 (17/09/2012

high) and the overall overbought conditions.