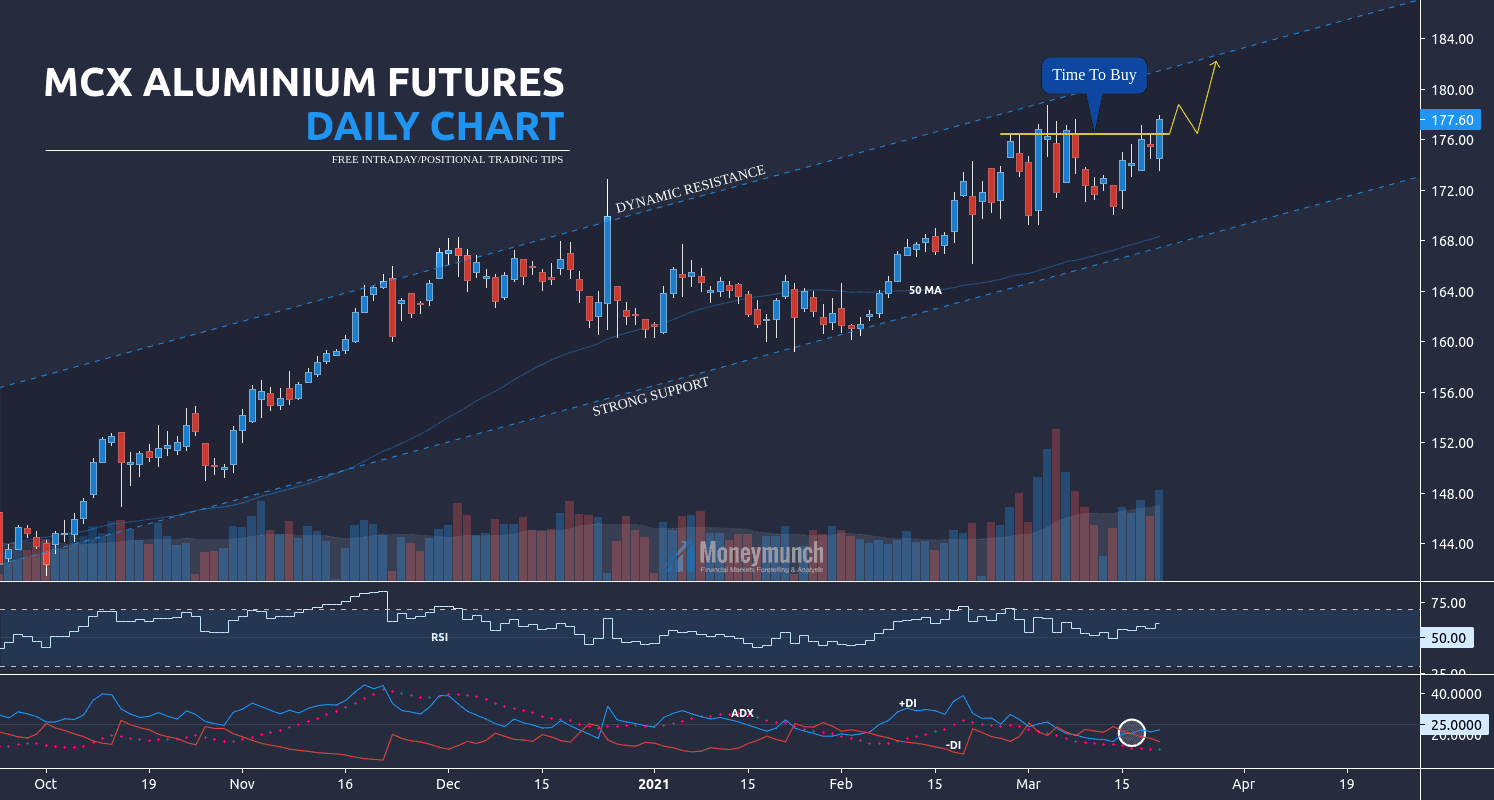

Aluminium Is Close To Something Big

According to this chart, MCX Aluminium can fly from here if it does not close below 176.4 levels.

Targets: 178.6 – 179.6

Short-term targets: 180 – 181.6+

But, if it closes below 176.4 levels, then this call will deactivate. And it will start collapsing for the levels of 174 – 172 from there.

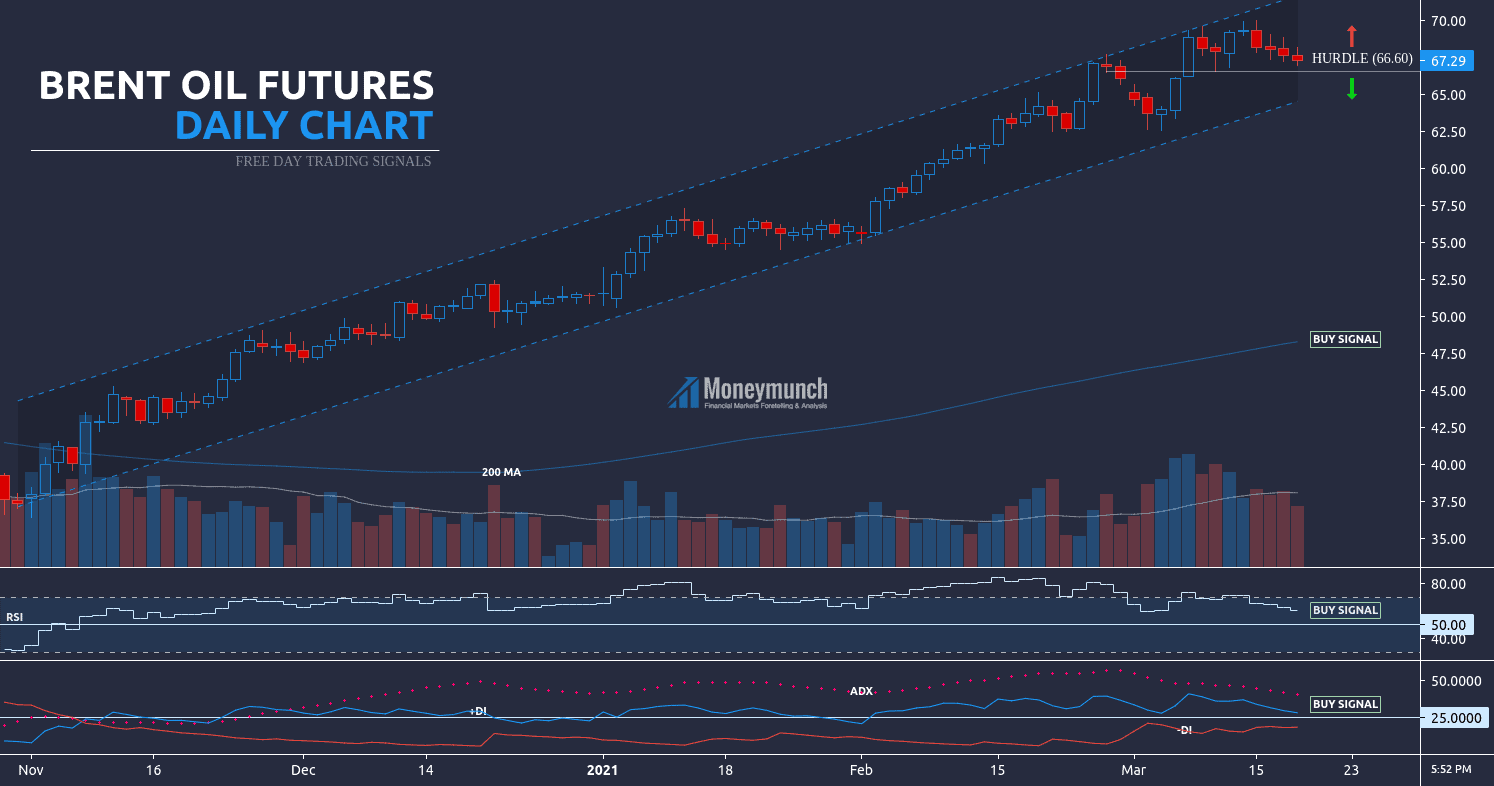

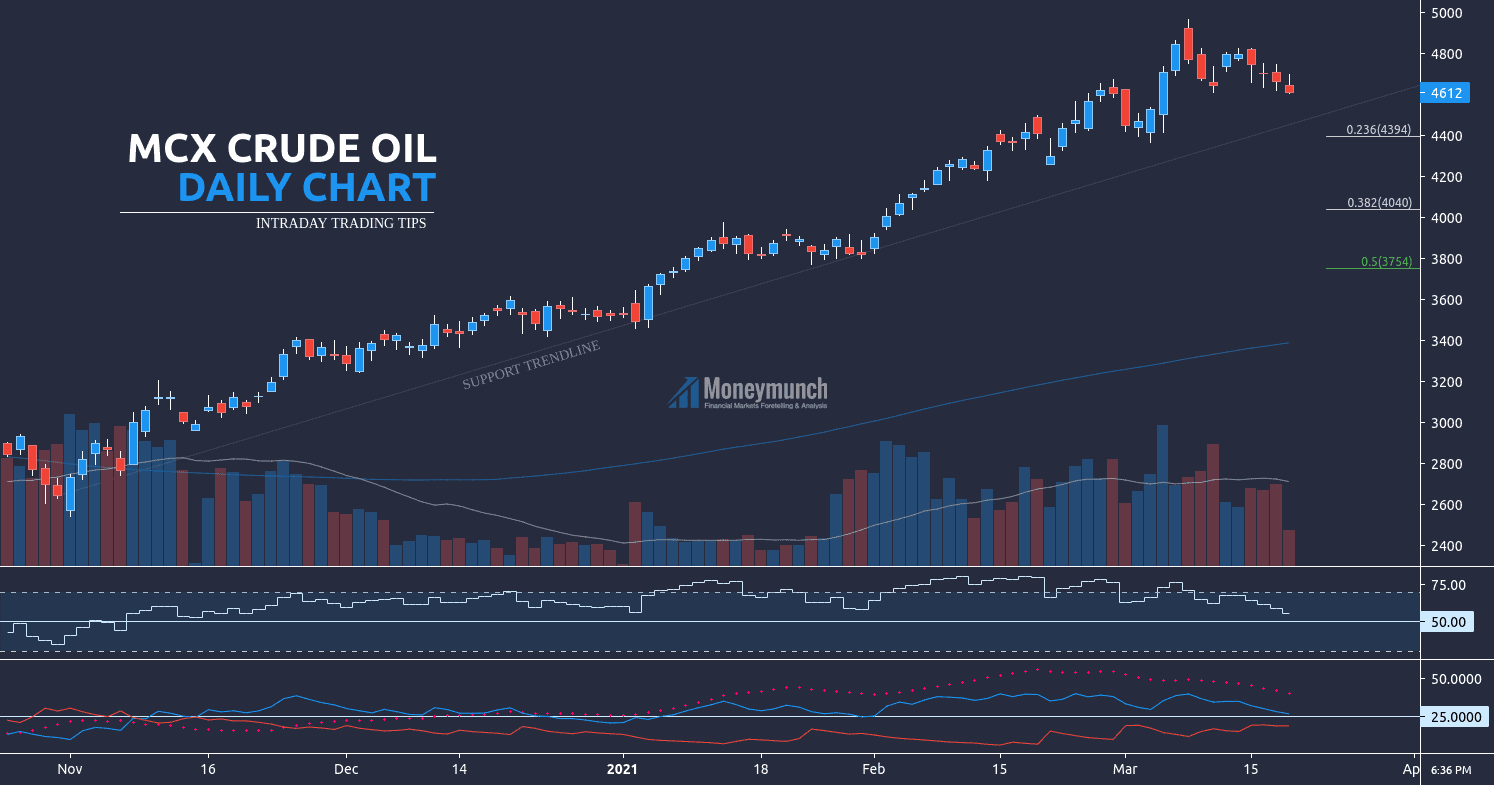

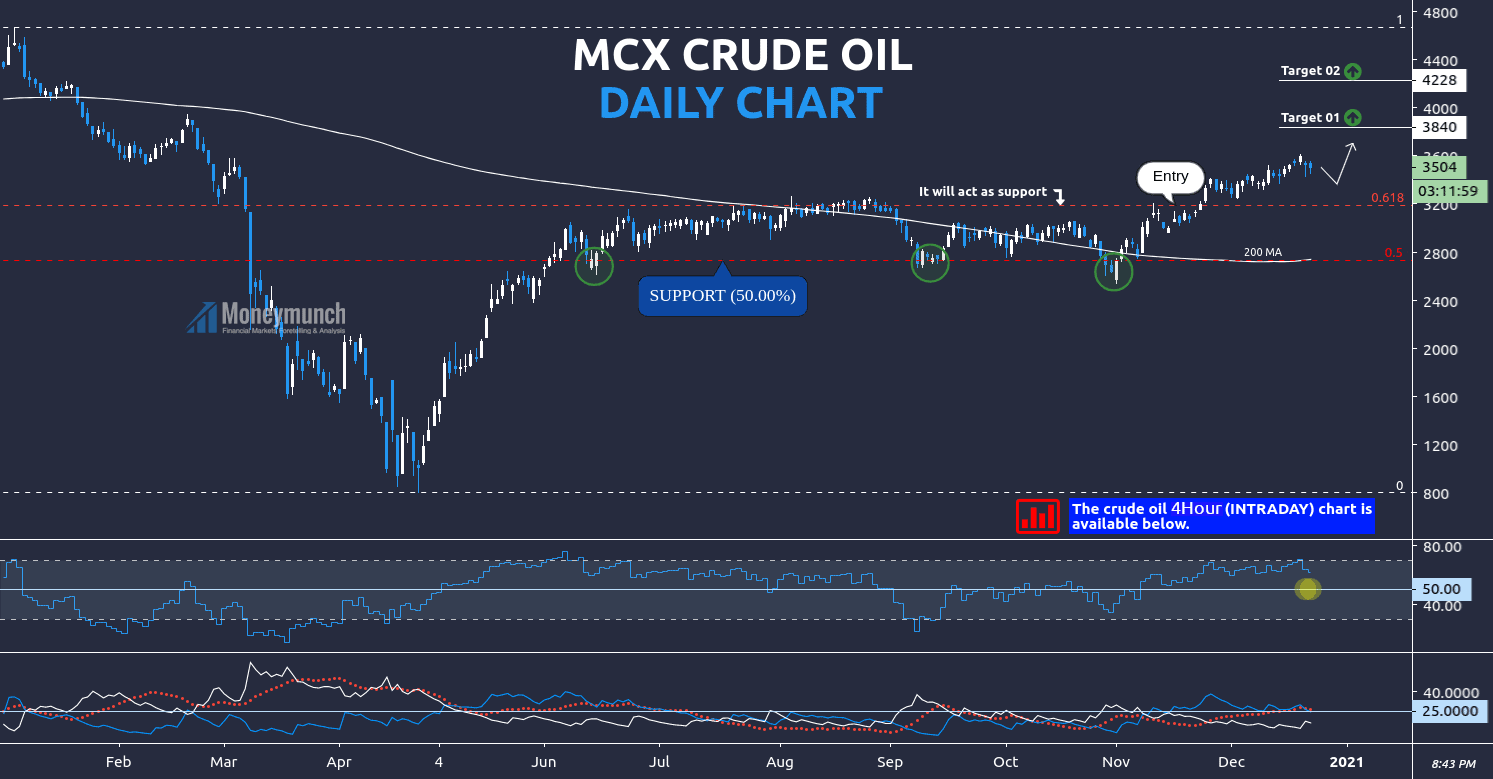

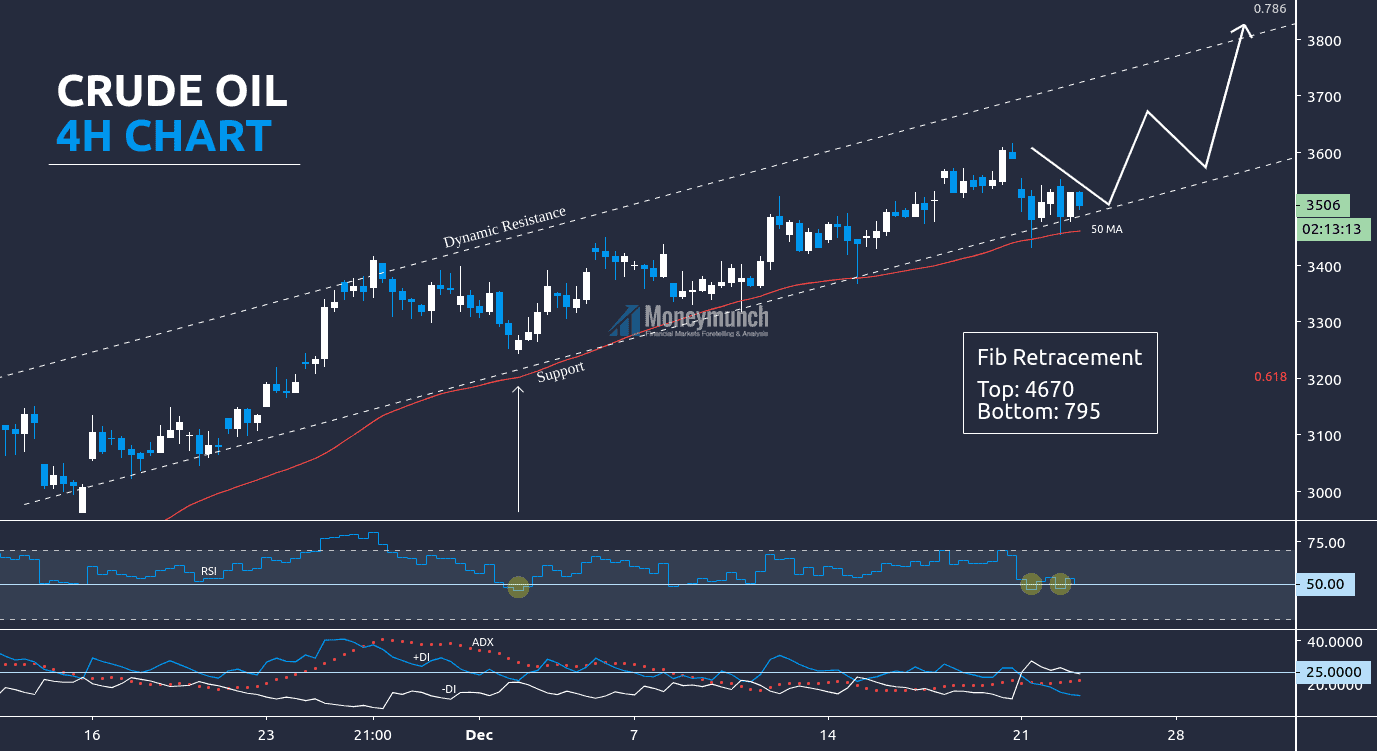

Crude Oil Is Going to Blast – A New Update & Tips

How many of you sold crude oil on the previous Thursday?

Article: MCX Crude Oil & NYMEX Brent Oil In-depth Analysis & Tips

In the previous article on crude oil & brent oil, I said in bold words, “…so, intraday traders can set the following targets to make some money: 4560 – 4500 – 4460 – 4400 | …and, if brent oil breaks the hurdle ($66.60) and shows a closing price below it, we will see a heavy downfall. Targets: $64.6 – $62.8 and below”.

The crude oil has reached all targets! Enjoy!

What next? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock