What Will Be Next Move Of Gold?

Definitely gold is in an uptrend but as per last 2 months performance, we can say it will remain downside for short-term. Based on Technical & Fundamental analysis, Gold Is Down.

Hurdle: 29750 level

Targets: 29350 – 29200

Keep note for next week beginning hurdle level is very crucial. If we see gold above to this hurdle level then suddenly start buying. We may see 29850 – 30000 – 30100 – 30250+ levels.

Is this Good Time to Buy/Sell Silver?

After this weekend closing of silver, we don’t see any chances for upside movement. Technical indicators are gesturing silver will run downside. The resistance level of silver is last week high 40100 level. Strong resistance is 40810 level.

Targets: 39000 – 38800

If silver will crossover or close above 40100 level then we might see 40500 – 40700 levels.

Hint for Crude oil traders

Crude oil is slowly taking reversal for a short-term downtrend. As per some secret data, we found it can show 3770+ level before U-Turn!

A hint is enough for the smart investors.

Aluminium looking strong!

Important level: 135

Last closing price: 137.2

Aluminium is playing above very crucial level 135. If it will remain above this level then I recommend keeping buying.

Targets: 139 – 140 – 141+

…if aluminum closes below 135 then big downtrend will begin.

Next Week What Will Happen in Lead?

If you’re a base metal lover then look at the lead. Reversal is loading. If it will break last trading session high then I recommend “don’t do anything” but if its price will remain below 166 level then Sell Only!

Targets: 163 – 161 – 159

Natural gas calls & important updates for next week

In the previous week, we were saying buy natural gas again and again! Why? Today I will reveal the truth.

You can read previous week newsletter:

In last trading session, Natural gas has touched the second target!

Earning Per Lot: Rs.7,500

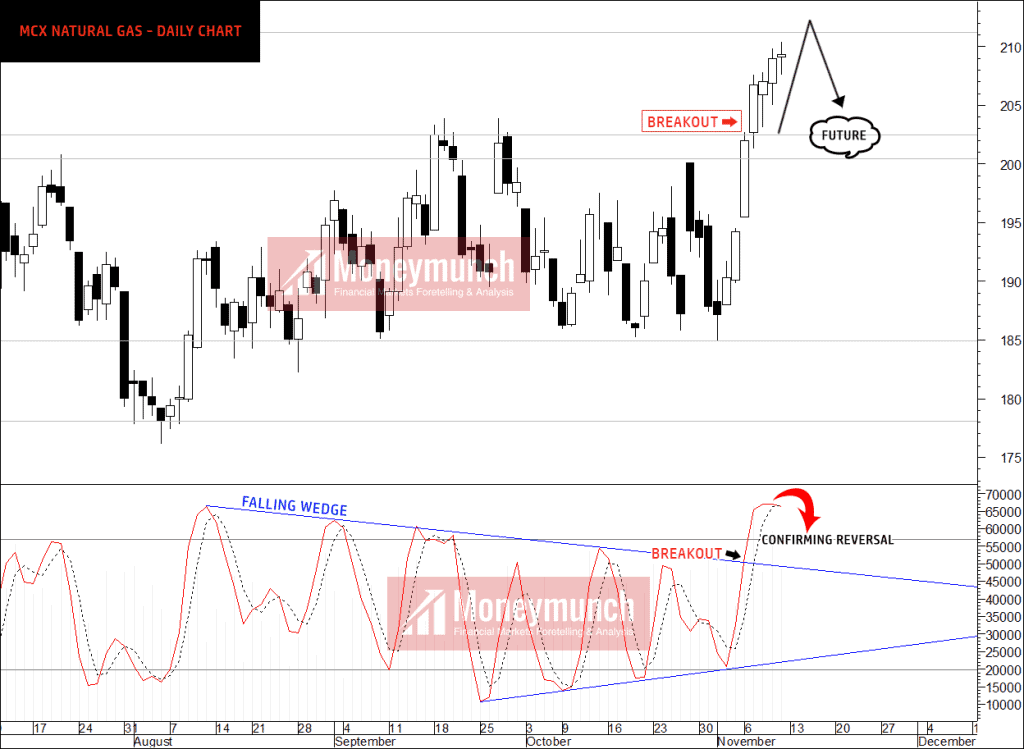

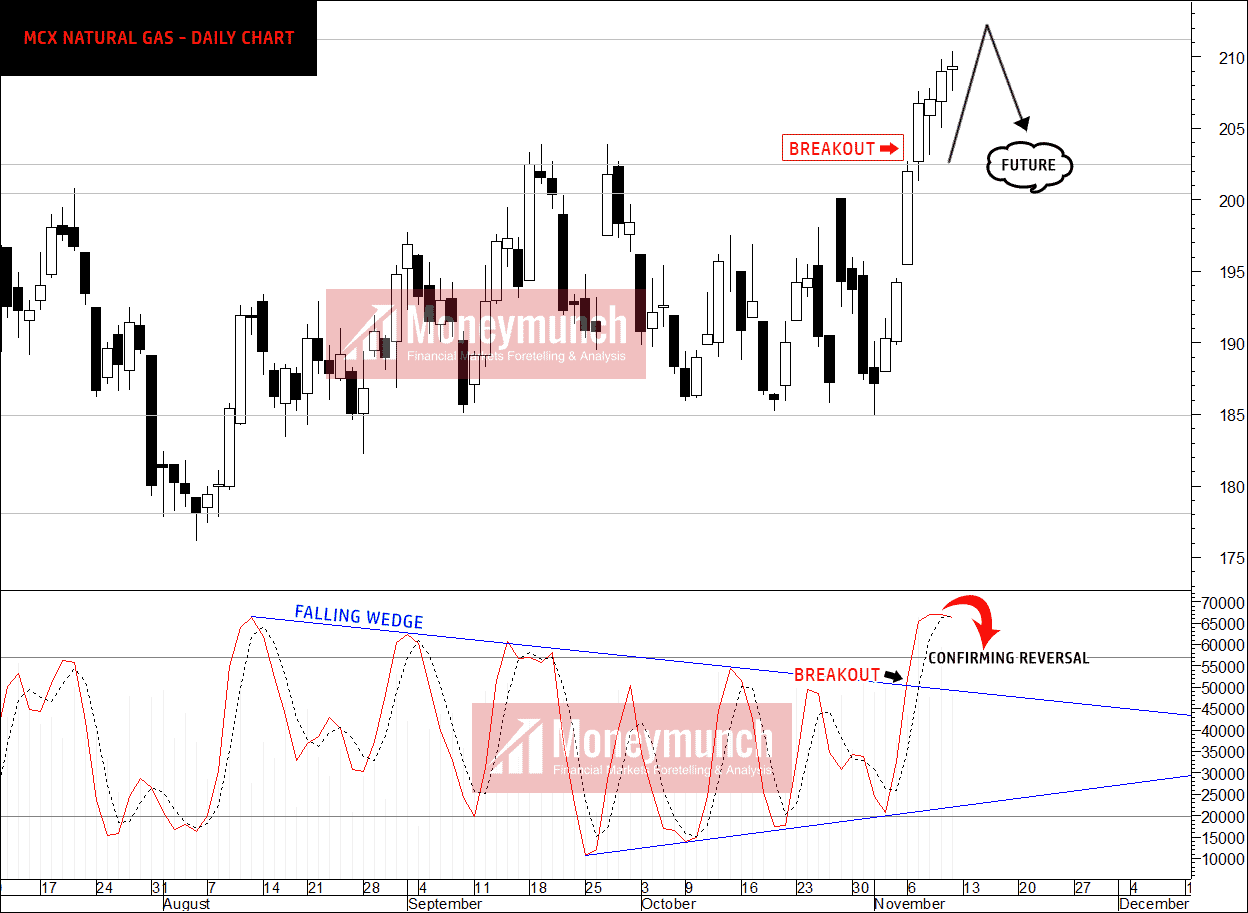

What will next? Look at the below chart:

As per above chart, Natural gas looking weak in upcoming days. When should you sell? What will be exact entry level? Natural gas stop loss level?

Natural gas will start moving down soon.

Top: 212 level

Entry Level: 211

Stop loss: 214

Targets: 203 – 200

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Dear Sir

I really surprised after seeing your calls it’s great still I have not seen any one like you given perfect levels in market.

Thanks & Regards

P. Srinath

Great call.lead hit all targets

Excellent sir!

What is your subscription Charge for commodity ?

Please visit here to check our pricing plans: https://moneymunch.com/our-service/

nifty target sir december,