First I will say, please read it again my 1st July weekly outlook in Gold and Silver. CLICK HERE TO READ IT. I said there, “Once it break and close below 25,172 support then it will move downside continuous and touch 24,664 – 24,201 – 23,739 – 23,378 levels. If it will ensue up arrow (in above gold chart) then definitely hit 25,798 – 26,422 – 26,829 levels.”

As I said, Gold kissed my two targets and made high 26,430. I was also written there about Silver and that is still secret for subscriber. I just want to say you, if you don’t understand market direction then don’t trade. More I will say to subscribers only! To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

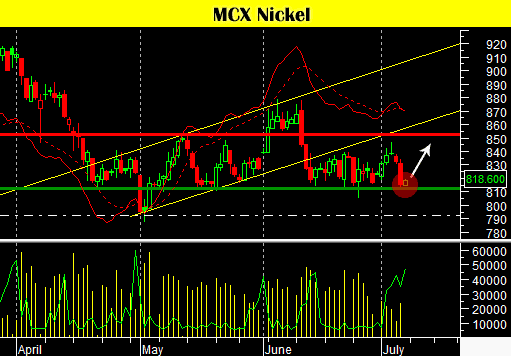

Nickel is looking upside. Hurdle is 812 level. Once break the hurdle close below it then it will touch 806 – 799 – 792 levels. But I expect, 824 – 831 – 837 above.

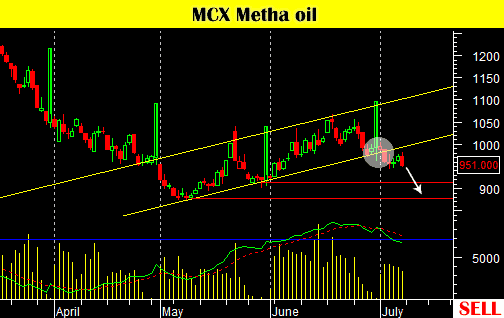

You can see in above chart, Mentha oil broke the support thus, I don’t think, it should to move upwardly. Targets: 933 – 914 – 901 – 880.

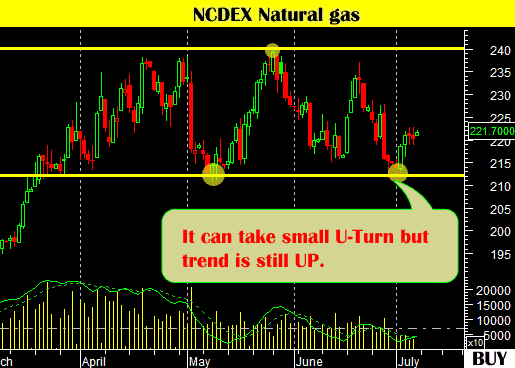

See my above chart, you can look 3 yellow circle. That is saying, once touch support 212.5 then it try to kiss resistance. So what to do with Natural gas? Simple, go and buy it but carefully because exact level is require make perfect trade. My targets: 226 – 230 – 232.5 level after close above 223.5 otherwise it will come back @ 212.5 level.

MCX CPO is looking very strong. I don’t need to explain more, just buy it now. Targets: 515 – 517 – 519

Short-term target: 523

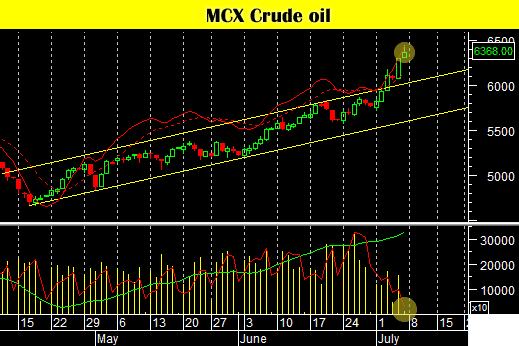

What you say about Crude oil?

It will go down or up?

I write below with chart and weekly trend of crude oil but for subscribers only!

Only subscribers can read the full article. Please log in to read the entire text.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

Lock

Lock