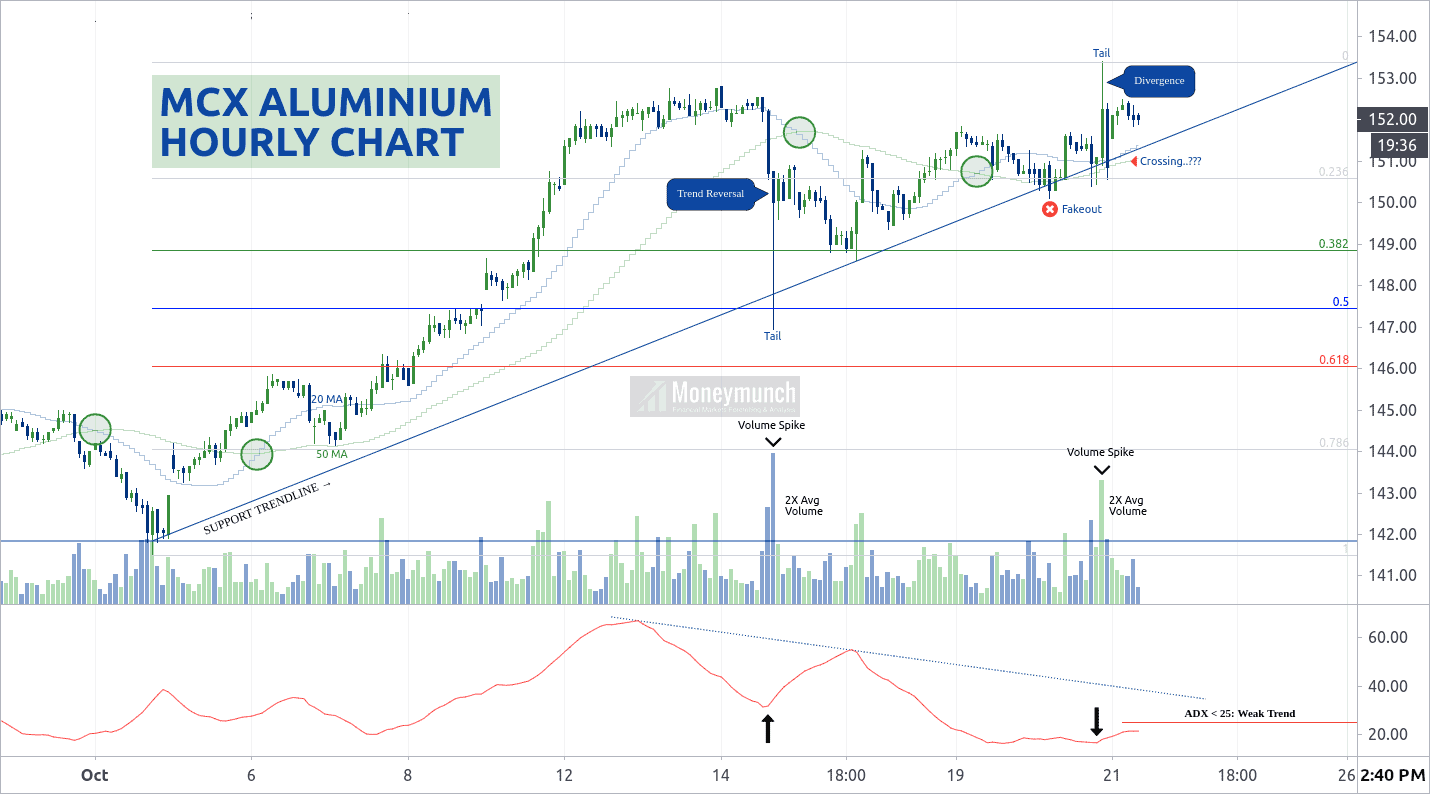

At present, MCX aluminium playing on support trendline and drilling upward. Its volume is spiking 2X compares to average volume. Each spike is turning the existing trend. And moving average has tried to cross 50 MA with 20 MA but failed. That indicates a continued uptrend ahead.

According to ADX & Fib retracement, the bullish trend will start after a crossover ADX value of 25 until intraday traders can keep selling Aluminium for the targets of 150.6 – 149.6.

What happens after ADX > 25?

Aluminium will start moving upside for 154 – 156.6 – 160+ levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.