We have mentioned many times in previous newsletters, “COMEX volatility because of political uncertainty”. Do you know, three trillion dollars gained in the U.S. markets after U.S. election? Major commodities were up last week. 0.25% interest rates risen last week and gold futures increased 2.67% & silver futures increased 2.75%!

Since March beginning crude oil future was declining but it had slightly recovered 1.16% on last week. The noticeable thing is crude oil future price doesn’t impact much on MCX energy sector black oil. And the interesting thing is MCX Natural gas moving upside like a boss!

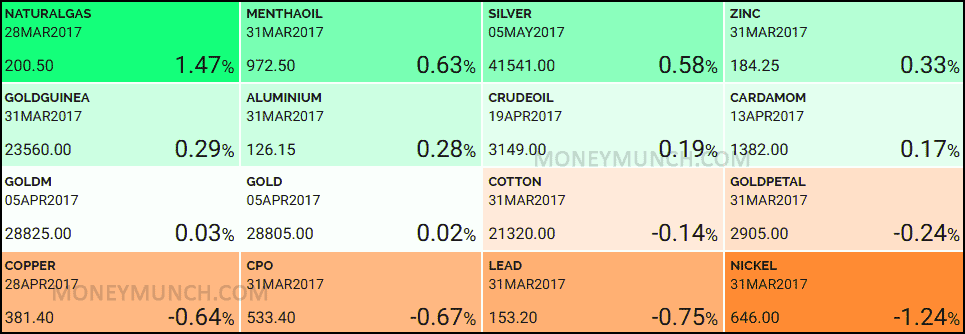

| MCX WEEKLY TOP GAINERS | MCX WEEKLY TOP LOSERS | ||||

| Natural Gas | +7 | +3.62% | Nickel | -27.6 | -4.11% |

| Lead | +3.25 | +2.17% | Copper | -10 | -2.56% |

| Silver | +612 | +1.52% | Mentha oil | -24 | -2.40% |

| Gold | +284 | +1.00% | Zinc | -4.05 | -2.15% |

| Aluminium | +1.2 | +1.00% | Cardamom | -27.39 | -1.95% |

| CPO | +0.9 | +0.17% | Crude oil | -54 | -1.69% |

| Cotton | -100 | -0.47 | |||

I don’t need to say single word or line about Gold and Silver because I already told you short-term direction on last week newsletter. If you are a new reader or forget that then click here to Gold & Silver Technical report.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

In previous week crude oil was dropped -1.69% and lost -54 rupees. If crude oil will break 3100 level and close below it then downtrend will continue. It could hit 3050 – 3000 – 2960 levels!

On next week few important events are coming and that will 110% affect the bullion sector commodities.

Last week worst performer was MCX nickel. It had lost -27.6 rupees (-4.11%). You must check out last week report to know we said to start selling the nickel on last Monday opening bell!

Nickel is the hottest commodity and thousands of traders are waiting for reversal.

Do you think it will move upside this week?

To read the full report of Nickel subscribe to our free newsletter services.

In the previous week, crude palm oil gained 0.17% only. That means, it cooking something! CPO strong resistance is 546.5 level because it failed twice to show closing above this level! If it will show us closing above to this level then you could buy for 555 – 560 levels.

This week we recommending sell CPO after 528 level breakout. It may fall up to 524 – 520 – 518 below levels.

Lookout above heatmap in Mentha oil took second place and it had lost -10 rupees in last week performance. As per last week data it had generated on neck line so that’s clear bearish continuation signal. It will shortly jump down and hit 960 and below levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock