Everybody knows, Moneymunch is official website for the Long-Term / Short-Term shareholders. From September 10th, MCX Gold is continued playing between resistance 31,100 and support 28,350 levels. This year has been not easy for bullion investors in India. The price went from a high of approximately 35K to where it is nowadays, in the mid-29K range. It has fallen 26% this year, but remember it is still at a very high level compared to historic investment demand. What is behind the jump down in the gold rate? Simple answer is Dollar index and Gold index pressure on prices.

So what will happen tomorrow and into this week?

Only subscribers can read the full article. Please log in to read the entire text.

Only subscribers can read the full article. Please log in to read the entire text.

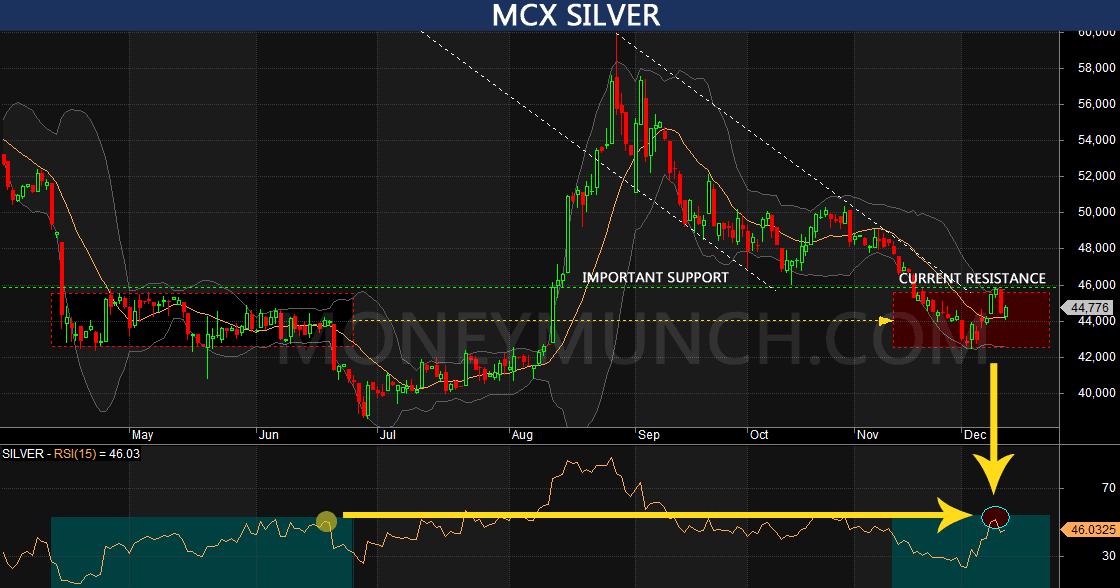

Look above chart [Note: For smart traders only]

Targets: 44000 – 43500 – 42500 below

Now rough resistance 46,000, you may say hurdle also…

Keep in mind, Monday morning 80% chance to open upper side

Above resistance, it will become important support because later targets will be 47000-48000 upper…

Are you thinking, above silver information is crazily write but what to do… I will give exact information to subscribers due to market hours!

Let’s come to the point directly. I had written about Crude oil in my last free commodity newsletter. New readers, go here for: check free crude oil tips.

Crude oil closed below hurdle 6060 and what you think now? Will we look MCX Crude oil at 6000-5942-5884-5833 levels? I think, don’t need to explain again.

Natural gas overbought in last week. Our subscribers and free users also minted money by our 10th Dec newsletter. Thus, expecting correction and it may take U-turn. More information about Natural gas will be updated for members and Big correction alert I will send you due to market hours!

Oh yes, remember, subscribers always get more benefits and access.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

Lock

Lock

Sir, in your last article you say silver will try to move down side and it’s walking downside as well as you say on Natural gas top – it will show you Big correction with U-turn…oh my god, everything is running as you said on Monday. you’re really guru of commodity market and hats off you..!

I am following mr.dev recommendation from last couple of months and everything happen whatever this person say. Anyway, yesterday I was called on your customer care number and your executive guide about subscription, “he said to me, moneymunch is lunching Christmas offer and there charge will 18,500 only for 1 year.”

Just now, I transferred all amount in your SBI bank.

Thank you for offer.

– Koilothramath Madhavan