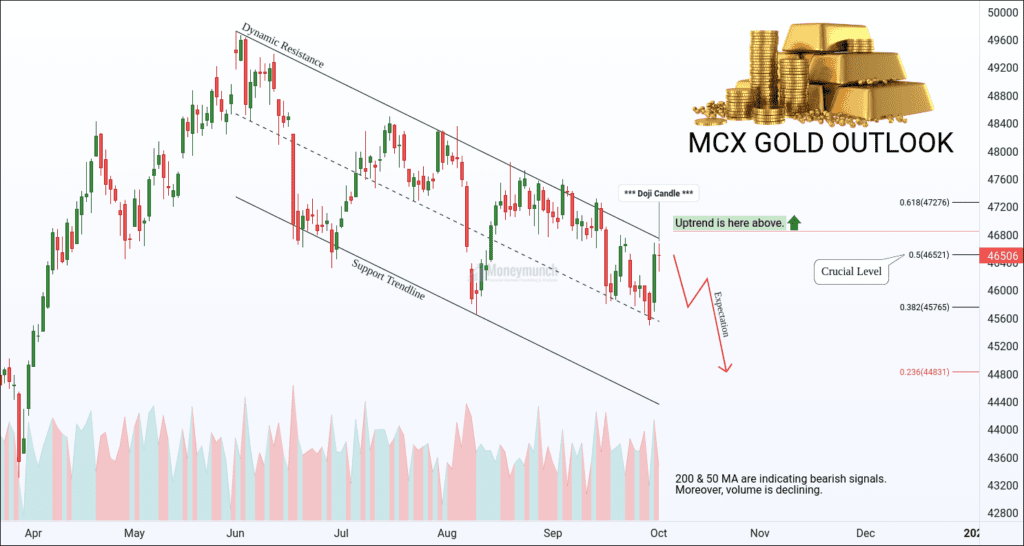

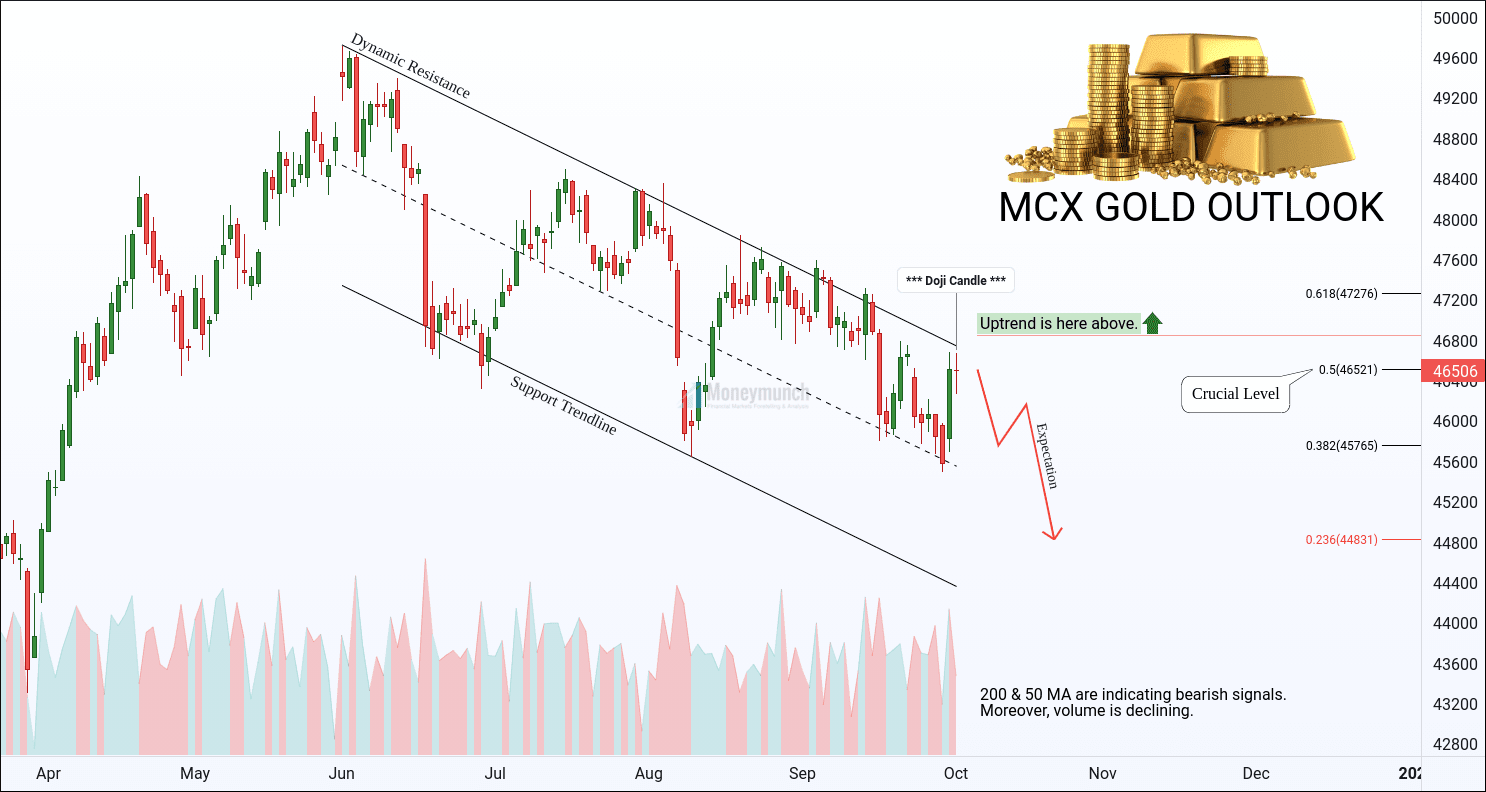

MCX gold has started falling since 1st June, and it’s moving under a parallel channel. But this time, it can break out this channel. Why? I will explain it through Elliott wave projection in the next update.

In the last trading session, it made a Doji candlestick. And that’s a sign of trend change. If gold does not break the crucial level, then it can drop up to 0.382 to 0.236.

In simple words, short-term targets: 46200 – 45960 – 45765

And for long-term traders: 45600 – 45060

But, the uptrend isn’t far away. If gold does breakout of 46860 level, then we may see 47276 – 47600 – 47960+.

Don’t get confused! You have to watch out the level 46860 for an uptrend, and the closing price below the Doji candle indicated a bearish trend signal.

This week we may see higher fluctuations due to upcoming economic events. Watch the following significant releases or events that may affect the movement of gold, silver, crude oil, & natural gas:

Monday, Oct 04, 2021

15:30 OPEC Meeting – Medium Impact

Tuesday, Oct 05, 2021

19:30 ISM Non-Manufacturing PMI (Sep) – High Impact

Wednesday, Oct 06, 2021

02:00 API Weekly Crude Oil Stock – Medium Impact

17:45 ADP Nonfarm Employment Change (Sep) – High Impact

18:30 FOMC Member Bostic Speaks – Medium Impact

20:00 Crude Oil Inventories – High Impact

21:00 FOMC Member Bostic Speaks – Medium Impact

Thursday, Oct 07, 2021

18:00 Initial Jobless Claims – High Impact

20:00 Natural Gas Storage – Low Impact

Friday, Oct 08, 2021

18:00 Nonfarm Payrolls & Unemployment Rate – High Impact

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

i’m following you more than 2 months. excellent work. would like to subscribe to your premium package. send me pricing to my email [email protected]

Check your inbox to get details of MCX Plans. And visit the following link to know more: https://moneymunch.com/our-service/

please give silver report. thanks

crude ab bech sakte hai kya sir