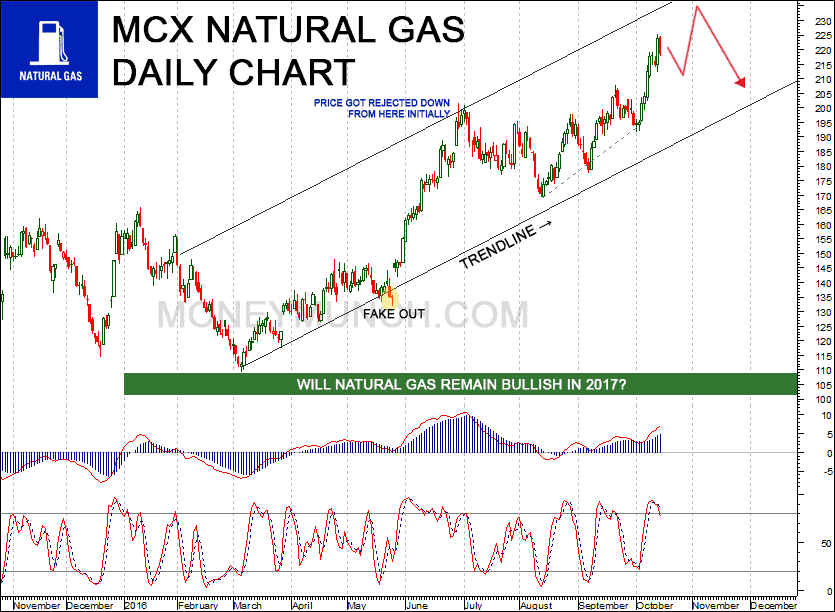

This chart is a daily chart of natural gas. We can see natural gas started moving up after complete the first month (January) of 2016. In May month it made trap for greedy sellers (by fake out) and risen up till June end! But the main point is Natural gas well played in June ending because it had made one more trap for greedy buyers by price got rejected down initially in 29-06-2016 (look at above chart). But this all things are now a history.

Now what will be next move of natural gas?

Will natural gas remain bullish in 2017 too?

Will NG hit 230-246-258-277 this levels before 2016 end?

For read long term view of Natural gas: subscribe to our free newsletter services.

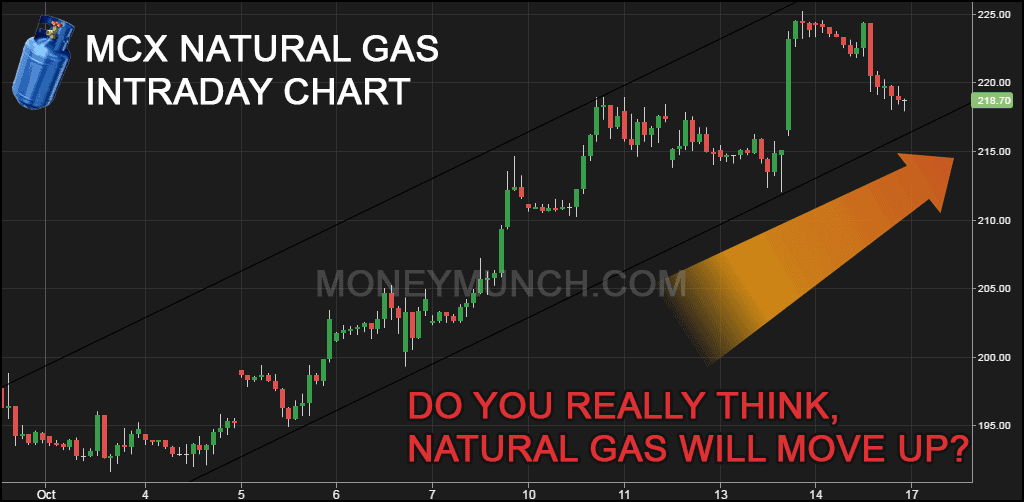

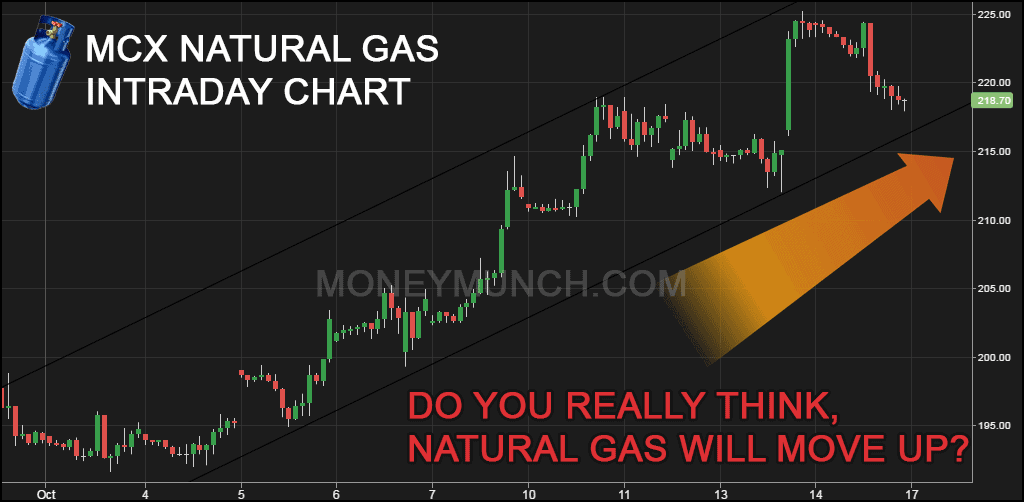

October month is fortunate for natural gas short-term buyers because it gained almost 24.1 rupees! Look at below chart:

Natural gas may come down up to 216 to make a fake out but if I would recommend to stay with trend and buy natural gas for 225-230 levels.

If MCX NG will try to break 215 levels or close below it then the natural gas could slip up to 210-203 levels. And I think, this information enough for a smart traders and short-terms investors.

But I would like to remind you again this article readers, if you want to BUY / SELL natural gas for long-term and with less risk then I suggest to subscribe our to read full Energy report.

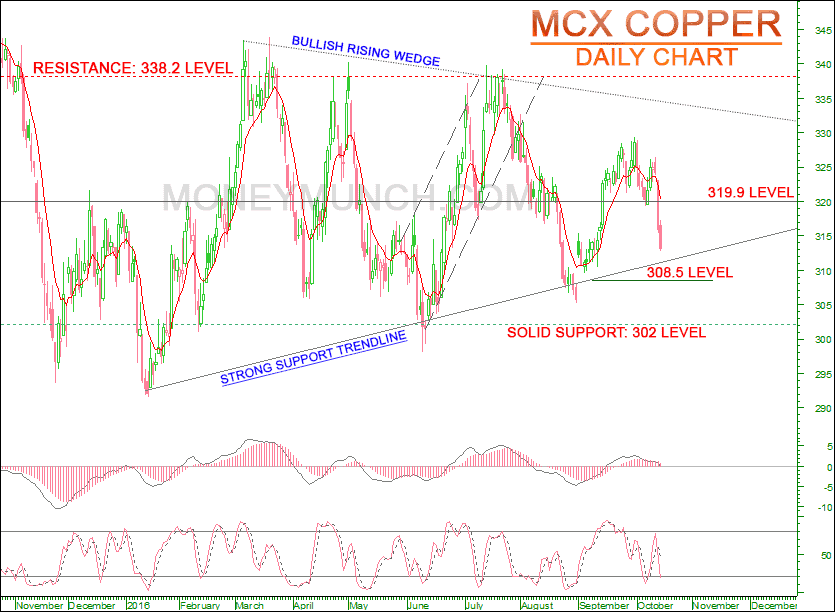

Copper will move continuously upward in 2017 too? Well, I think I should to update that later. At the present time, copper is making bullish rising wedge and strong support trendline is suggesting upcoming days. It can generate fake out up to 308.5 levels before this month end, but you may continue buying the copper for 319.9 levels!

Keep in mind, 308.5 levels below closing can drag the copper down up to solid support level.

If you want to analyze copper and aluminium technically then I must prefer to read my 1st Aug, 2016 newsletter. Click here to read old report of Copper & Aluminium

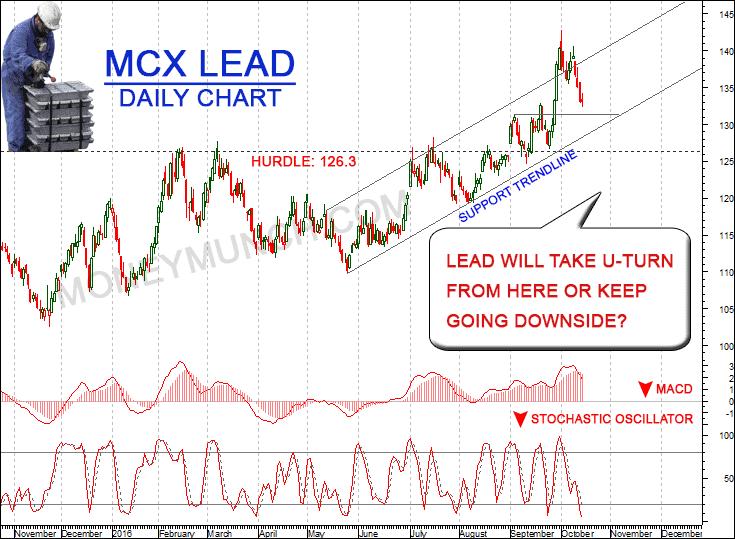

Look at above MCX Lead daily chart. You may see MACD & Stochastic Oscillator indicating the down signals but small support is coming up at 130.7 level so what your strategy for intraday trading? You can share your view on lead in below comment box and I will update full report of MCX Lead for subscribers! To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

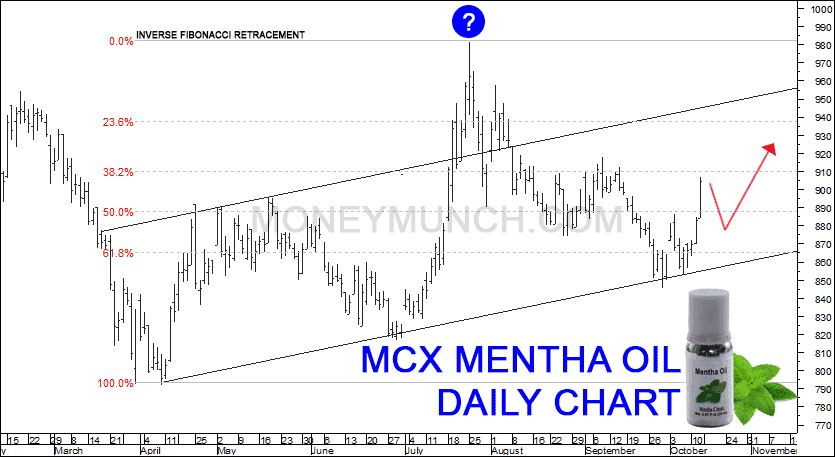

Look at above MCX Mentha oil intraday chart. We will see shortly small selling pressure on mentha oil and it could slip up to 880 below levels.

If Mentha oil will close above the 920 level then then we will see 940-950 levels before 2016 year-end!

I think, gesture is enough for smart traders so I’m not going to explain in details.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock