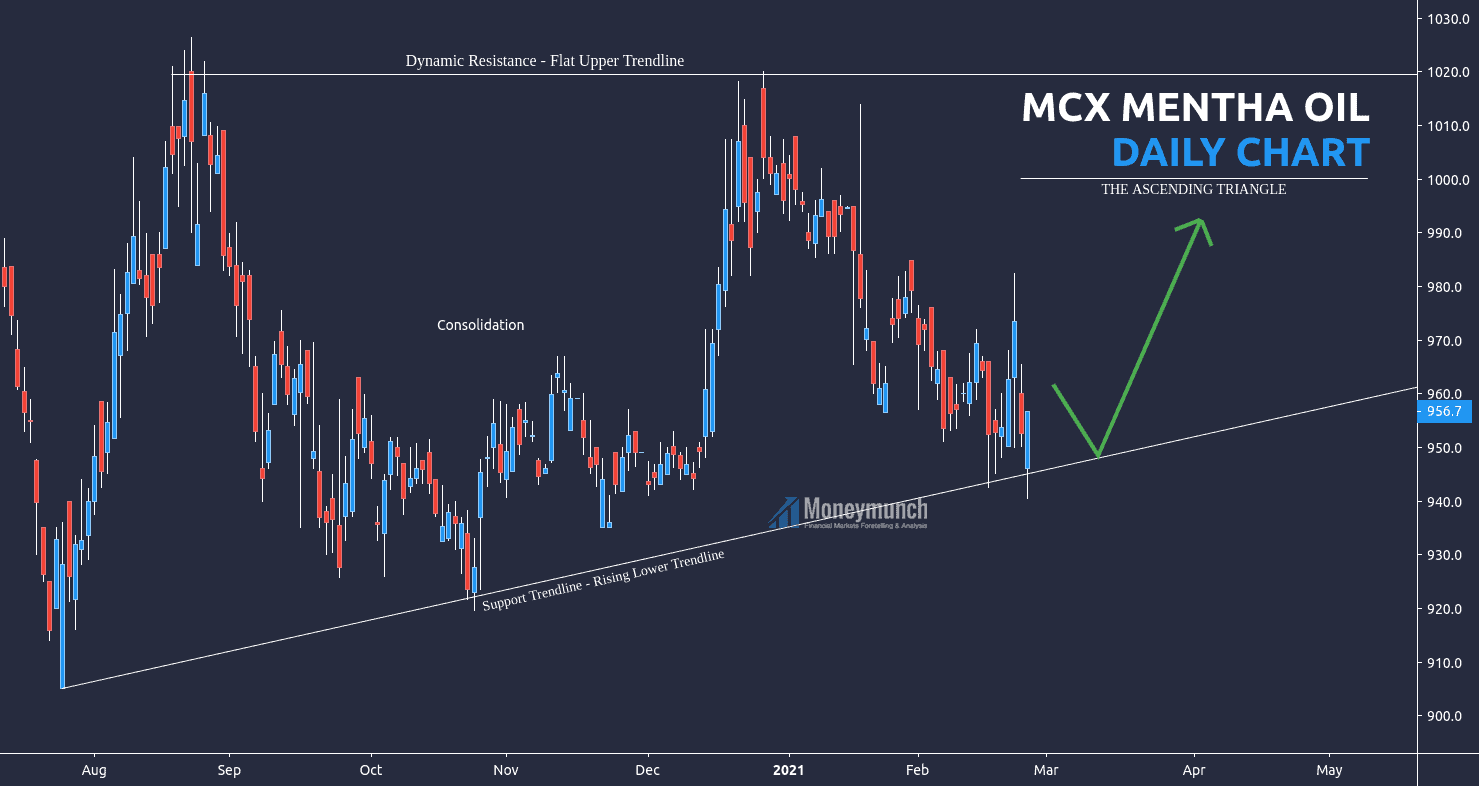

First, wait for a clear ascending triangle form. Right now, MCX Mentha oil at the support trendline (rising lower trendline). It will try to hit 964 – 986 – 1000 – 1020 levels from here. Intraday traders can go with the current trend.

But don’t buy below the support trendline. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.