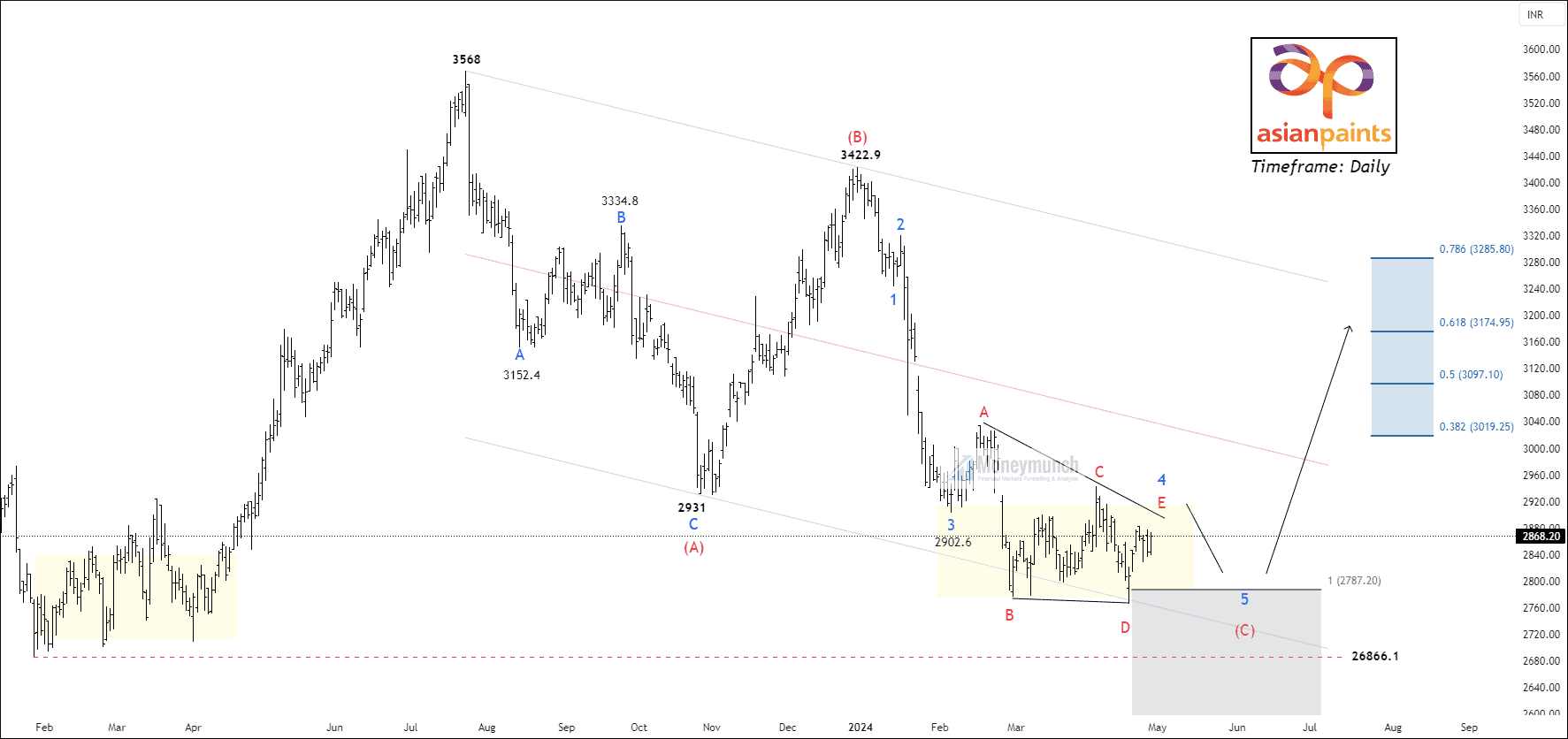

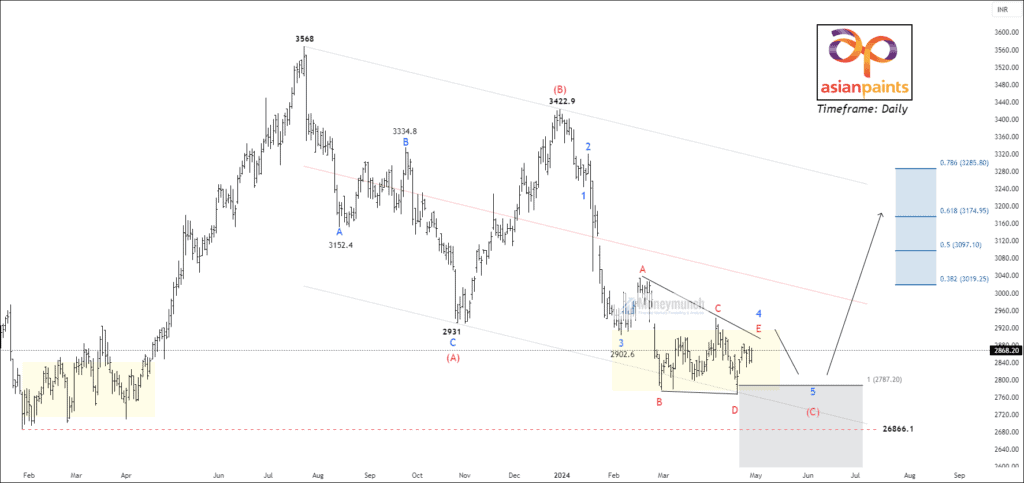

Timeframe: Daily

NSE ASIAN PAINTS has been undergoing a corrective phase for about 80 weeks, with its price confined within a range of 3329 – 2938, excluding excesses. The ADX indicator has declined to 21, while the average true range (ATR) stands at 43. Presently, the price has breached the 20-day exponential moving average (EMA) and is trading below the 50, 100, and 200 EMAs.

According to the wave principle, the price has formed a corrective formation A-B-C. Wave (B) occurred at 3422.9, and wave (C) has taken place. Wave (C) has already reached 100% of wave (A), indicating equality between wave (A) and wave (C). Sub-wave 4 of wave (C) is expected to occur, followed by wave 5 of wave (C). A buying opportunity may arise if the price breaks above the wave A – C line and maintains levels above 2931. Targets for the Long position would be 3026 – 3152 – 3285+.

We will update further information for premium subscribers soon.

NSE BPCL – Breakout Setup

NSE BPCL shows strength on the daily timeframe chart, having surpassed both the 20-day and 50-day exponential moving averages (EMA). The ADX stands at 11.8, with the ATR recorded at 19.42.

The current formation appears impulsive, indicating a potential breakout of wave 1 and the beginning of wave 3. Should the price breach 614, traders may consider targeting the following levels: 624 – 635 – 641+. Free subscribers can take the previous day’s low as an invalidation level.

Premium subscribers will have access to further information.

NSE IOC – Premium Setup

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Just wow

What do you think about finnifty??

Grateful! Thanks for sharing.

Please provide me detail of your paid service. i earned good from you free calls. i want to be your paid customer.