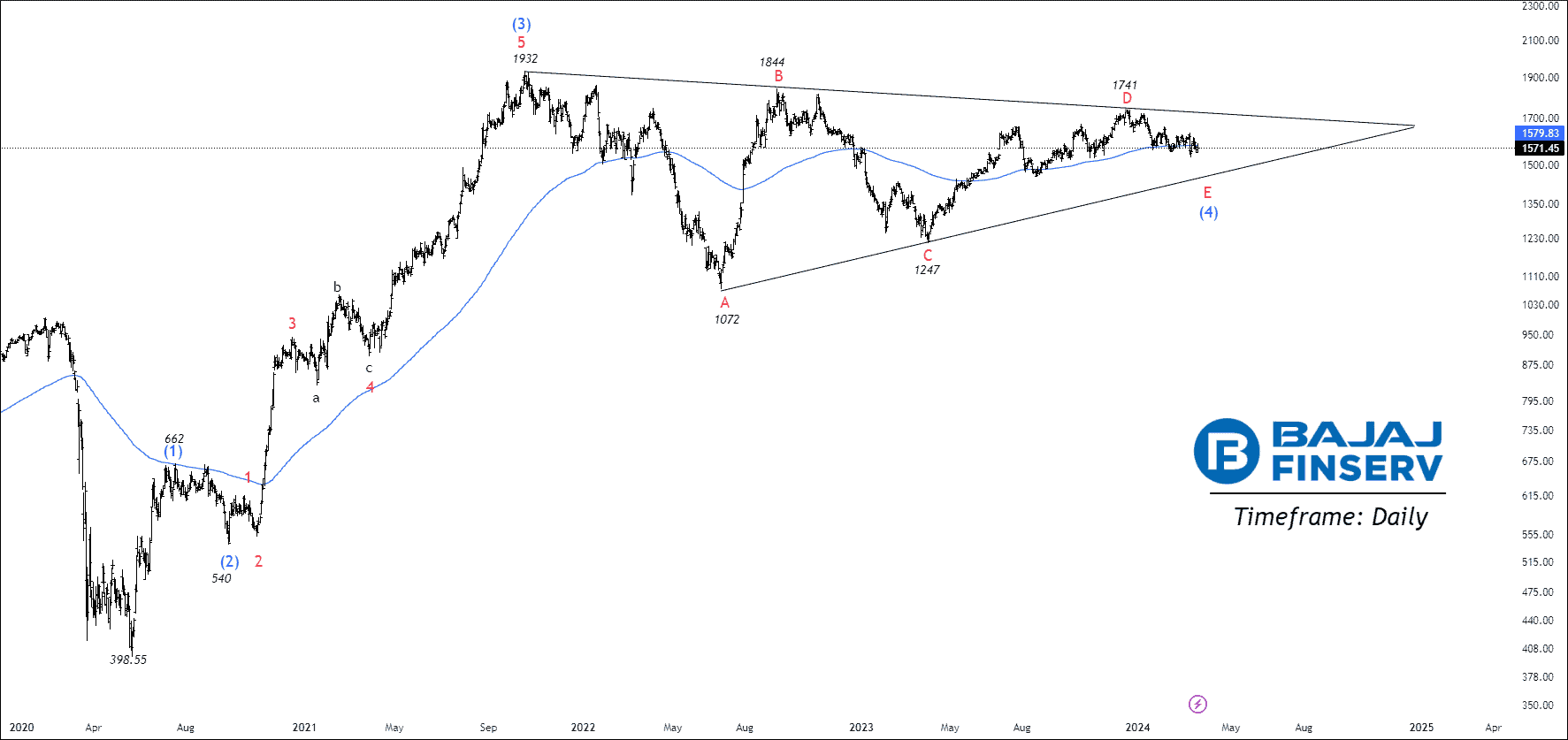

NSE BAJAJFINSV Is Preparing for Sub-Wave E of (C)

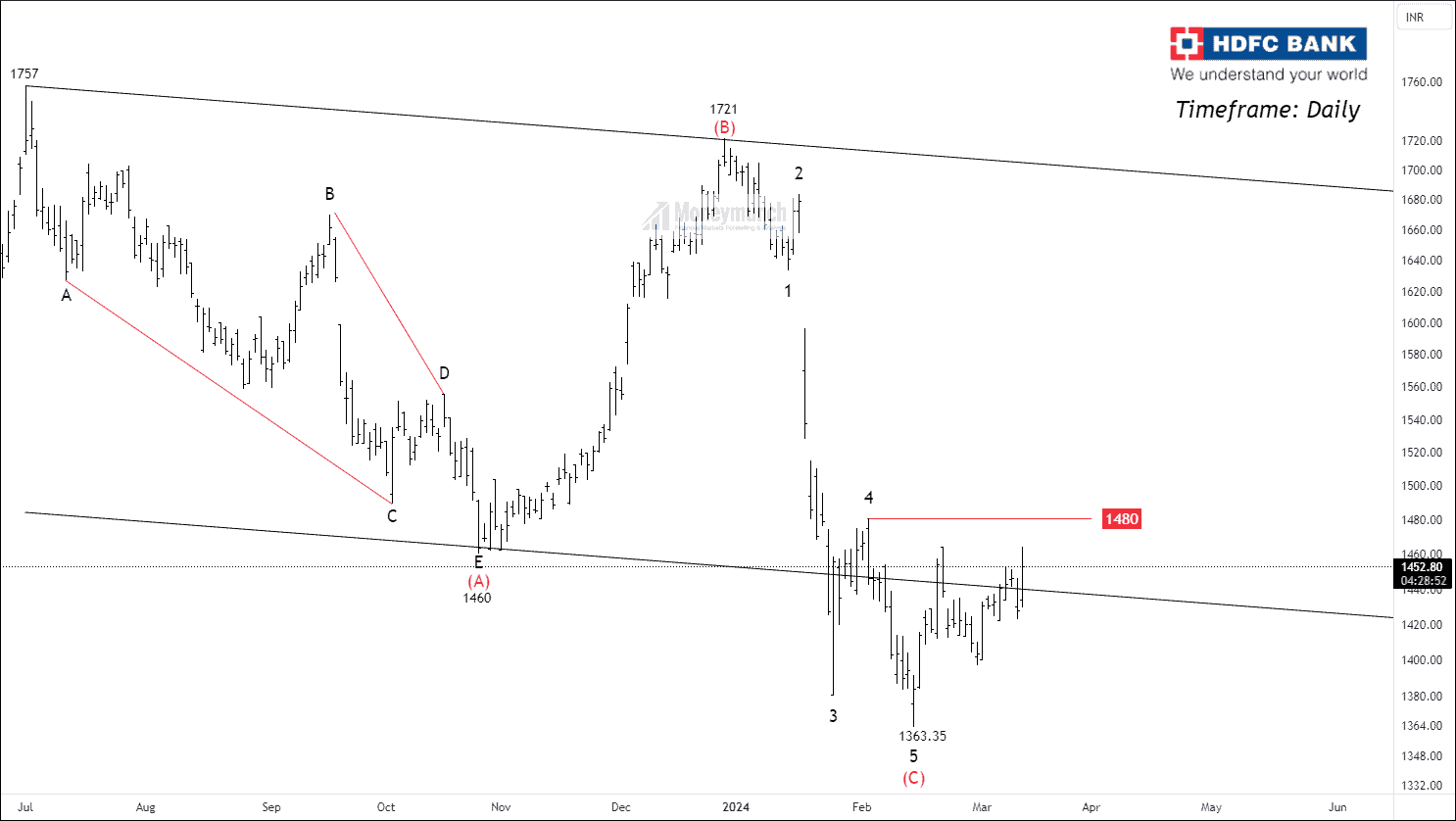

Will NSE HDFCBANK Regain Its Dominance?

As per the chart, NSE HDFCBANK has entered the corrective channel after giving a throw-under. The price is resistance from the 35/50 Exponential moving average. The primary issue lies in the decreasing ATR and ADX, as a robust uptrend necessitates a supportive ADX.

Based on the wave principle, HDFC Bank has completed corrective wave (C) at 1363.35. To validate the uptrend structure, the price needs to surpass wave four at 1480. It’s advisable to refrain from entering the market unless there’s a robust breakout of the sub-structure. Targets can be projected up to 1600.

We will update further information soon.Continue reading

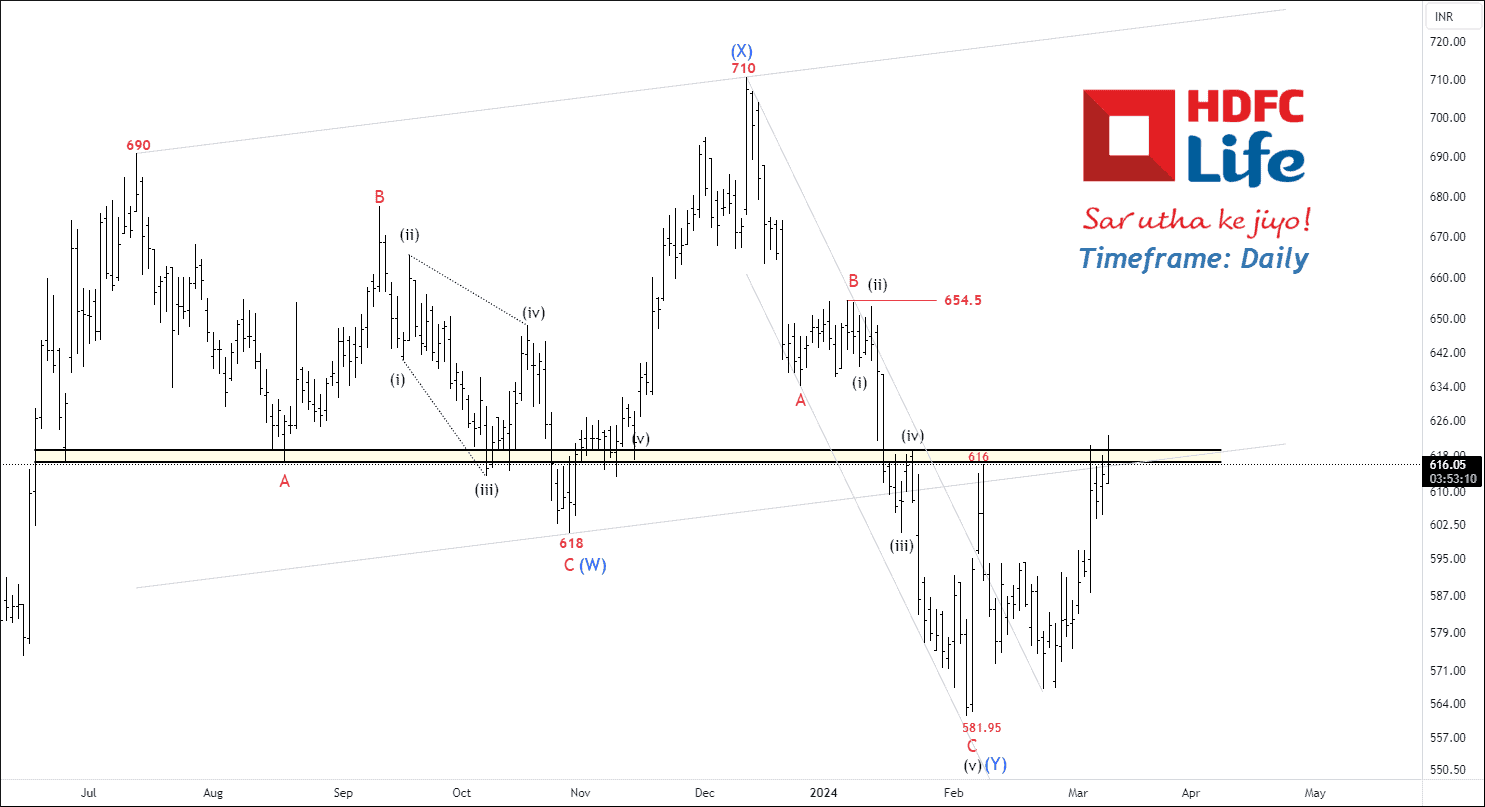

HDFCLIFE Is Preparing For Impending Advance But…

HDFC Life appears to be undergoing a corrective structure in the form of a W-X-Y pattern, indicative of a flat wave formation. Recent price action has seen the stock breaking above key moving averages, namely the 50, 100, and 200 EMAs. Notably, there’s a significant resistance zone around 620.

The ADX, a measure of trend strength, has climbed to 20, suggesting increasing momentum in the price movement. It’s observed that the impulsive wave (v) of C of (Y) may have reached saturation, hitting a 2.618% extension at 581.95.

Anticipating a potential strong upward move, traders are eyeing targets at 636 – 654 – 690. Targets following a breakout above the long-term resistance zone. However, it’s crucial to acknowledge the significance of this resistance level, as failure to breach it could lead to a retracement towards lower lows.

Stay tuned for further updates on this analysis.Continue reading

NSE COCHINSHIP – Trading Insights & Updates

Did you trade NSE COCHINSHIP trade setup?

Click here: Trade Setup – NSE 3MINDIA, FINEORG & More

We had written clearly, “If the price sustains above 865, traders can trade the following targets: 878– 891– 909+”

[04 March 2024]

- 09:15 AM – NSE COCHINSHIP Made a new low of 864.5, which was our entry point.

- 09:30 AM – Price touched the first target of 878.

- 09:45 AM – Security price reached the final target of 909, and made a new high of 913.8.

Only Premium subscribers will receive trade setups on our mobile application.Continue reading

NSE INFY – Bears Destroyed the Whereabouts of Bulls

Did you trade NSE INFY trade setup?

Click here: Trade Setup – NSE BAJAJFINANCE & INFY

We had written clearly, “Sustained trading below 1647 could indicate further downside potential. Traders may consider the following targets: 1635 – 1622 – 1605+”

[05 March 2024]

- 11:45 AM – NSE INFY hit the Final target of 1605, and made a new low of 1602.

[06 March 2024]

- 10:45 AM – Price made a new low of 1580.10.

We will keep sharing this type of setup for premium subscribers only.Continue reading