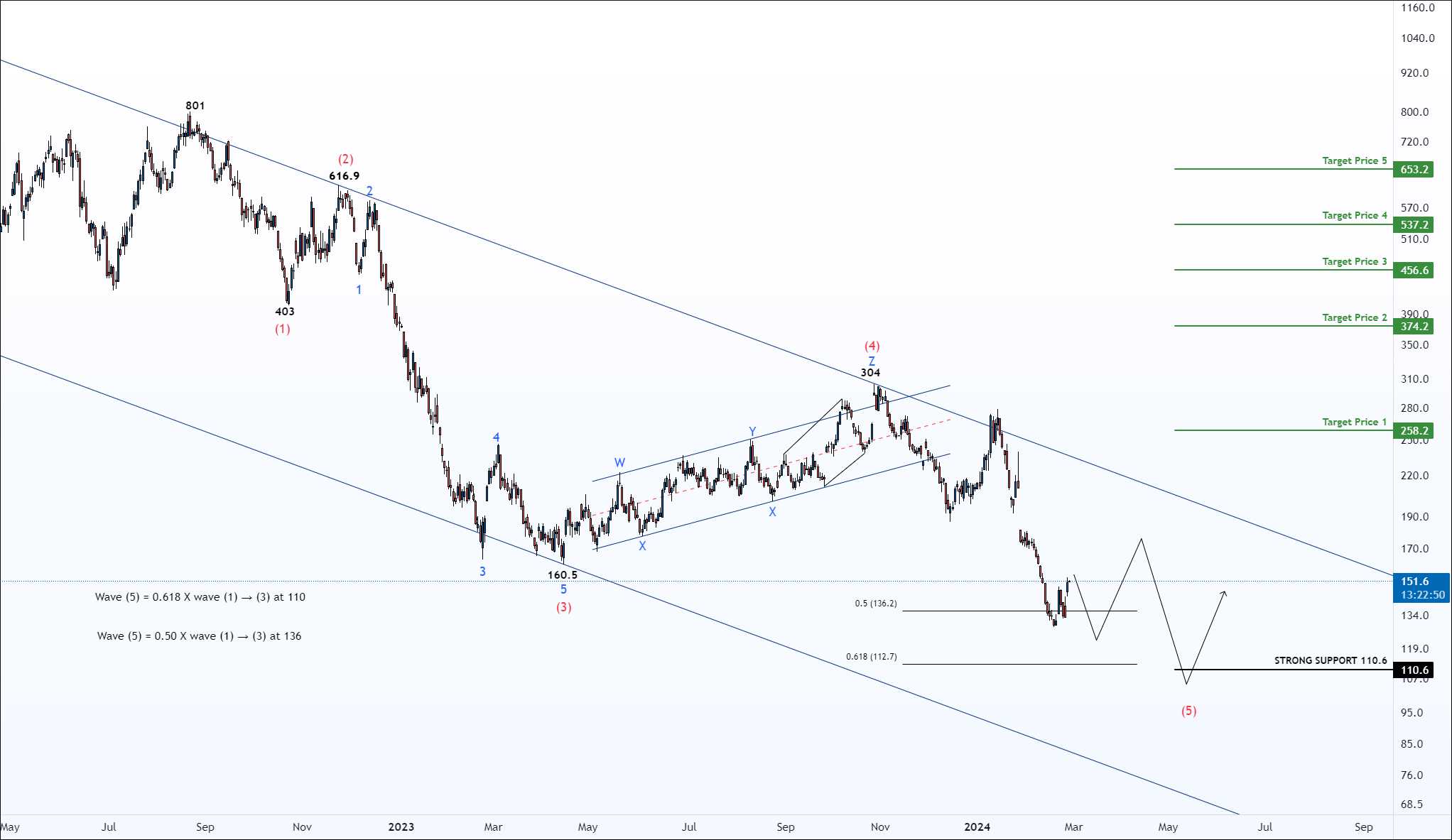

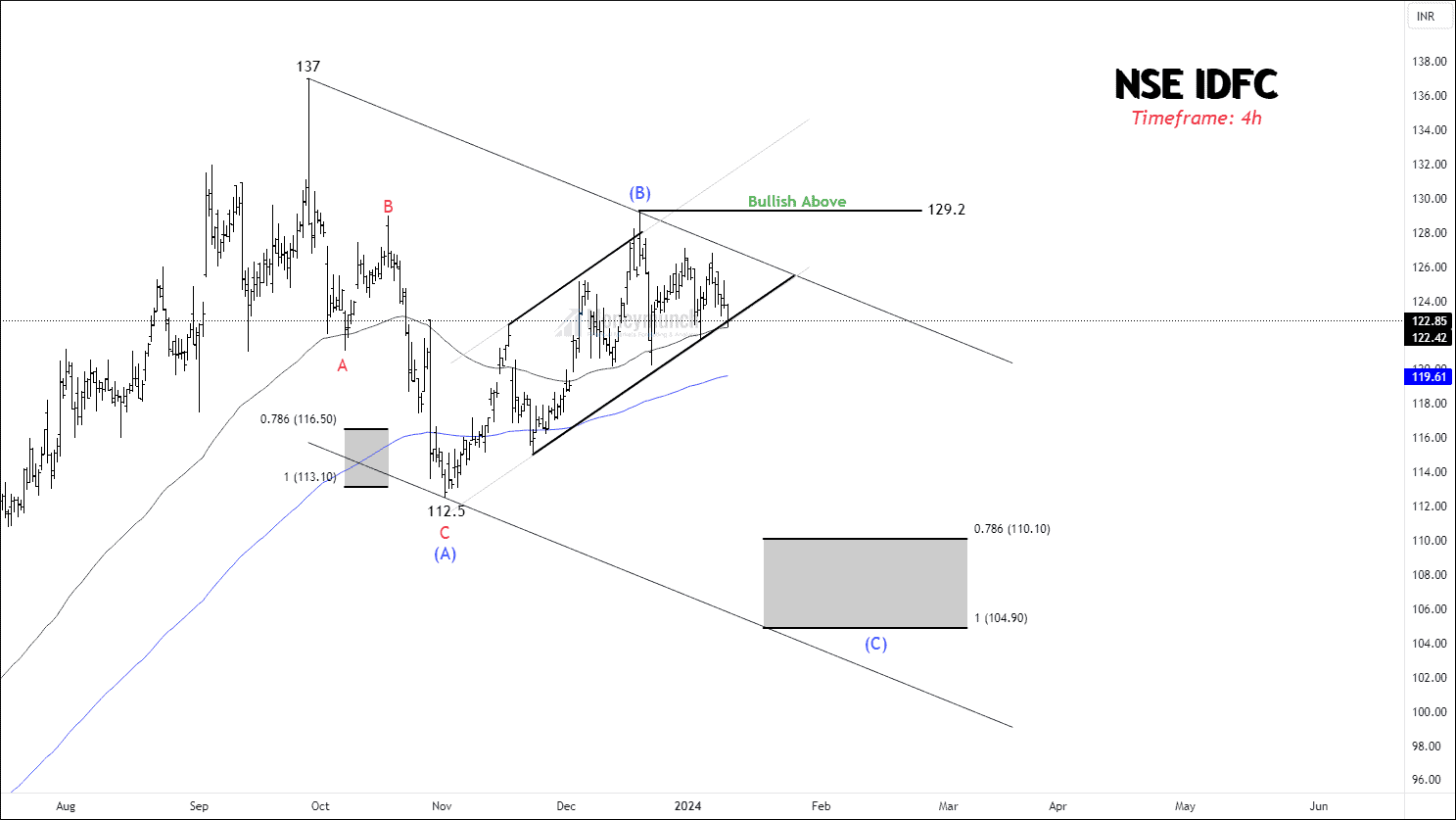

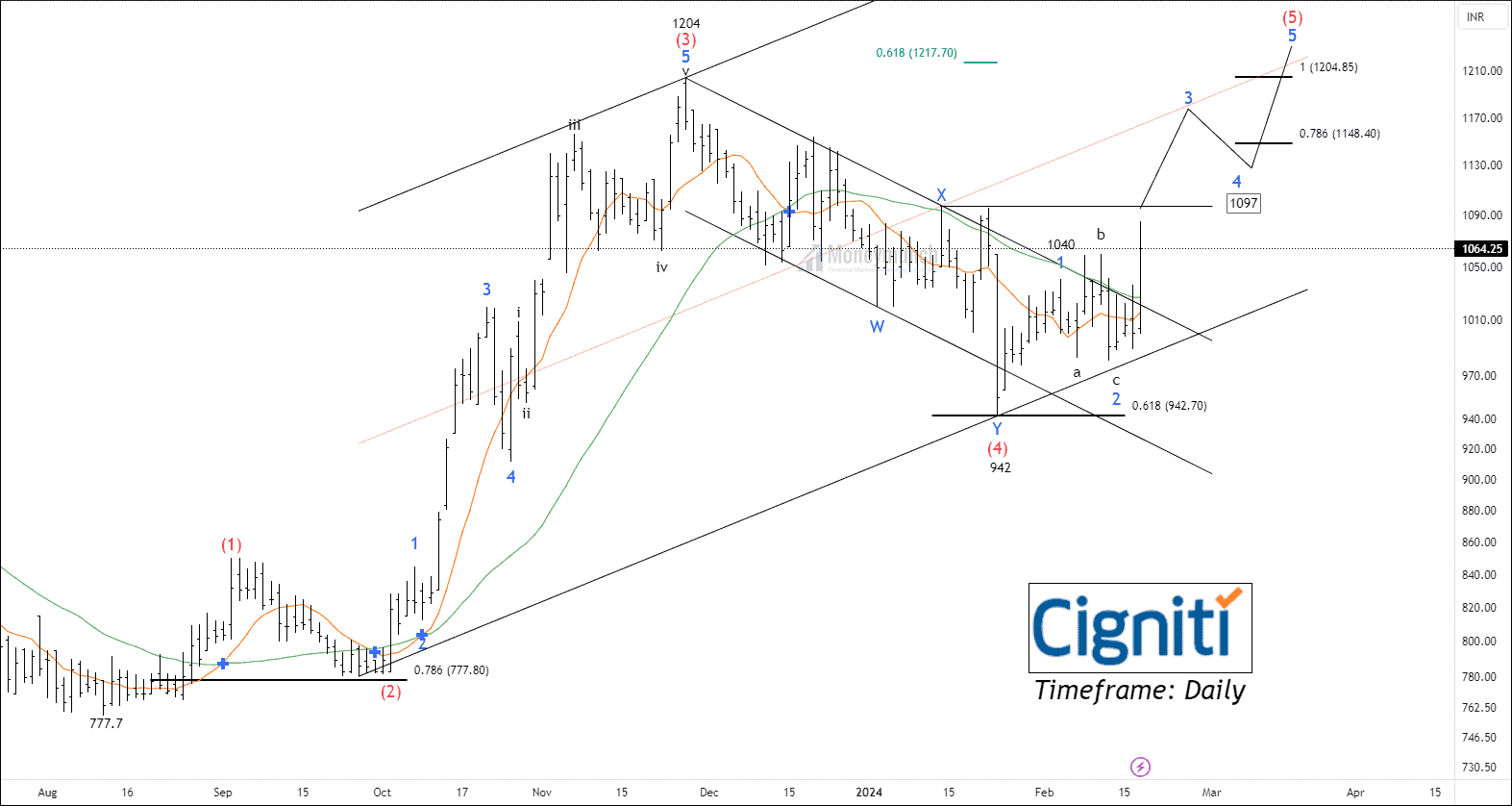

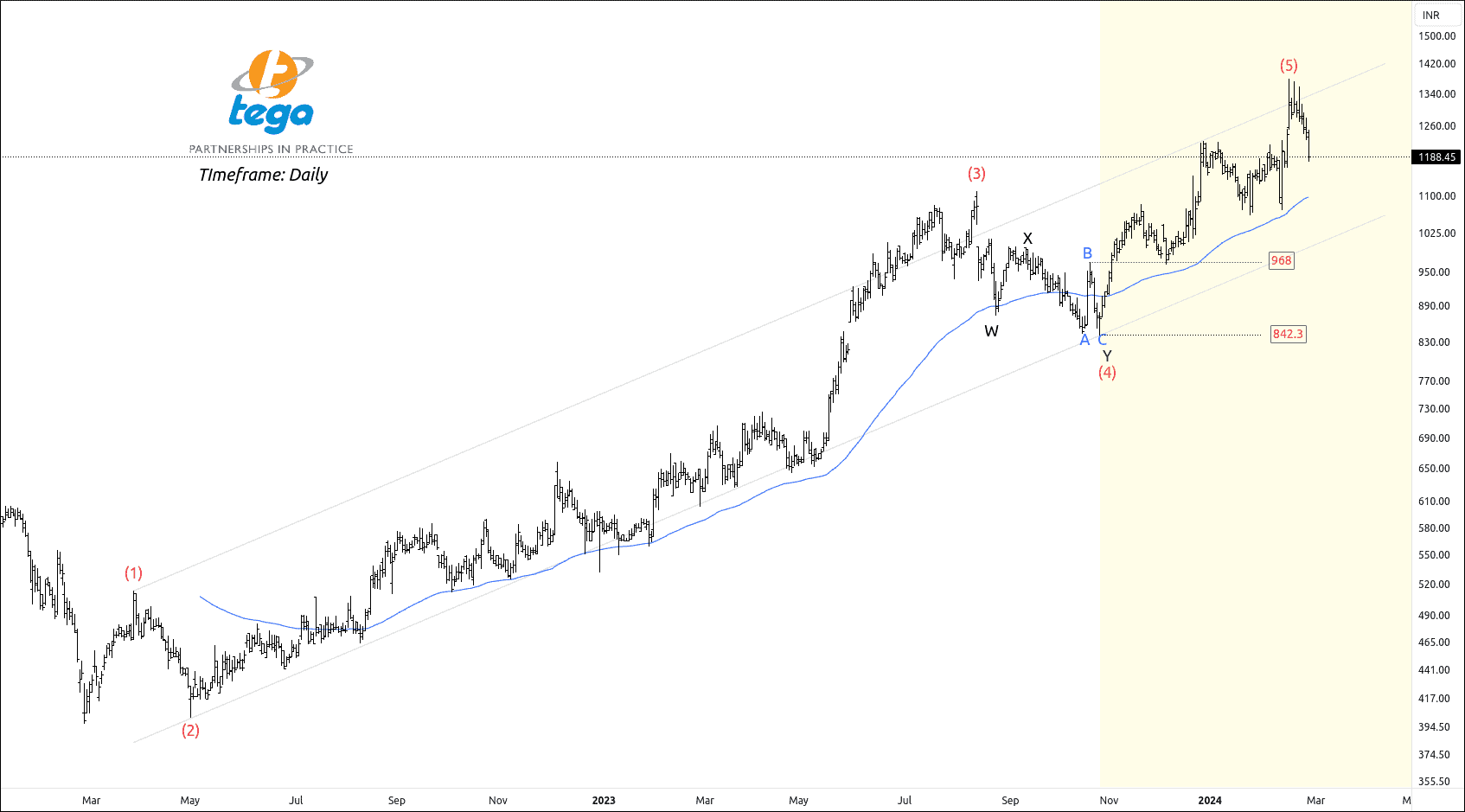

Do you remember the NSE TEGA Wave setup?

Click here: NSE TEGA – Elliott Wave Projection

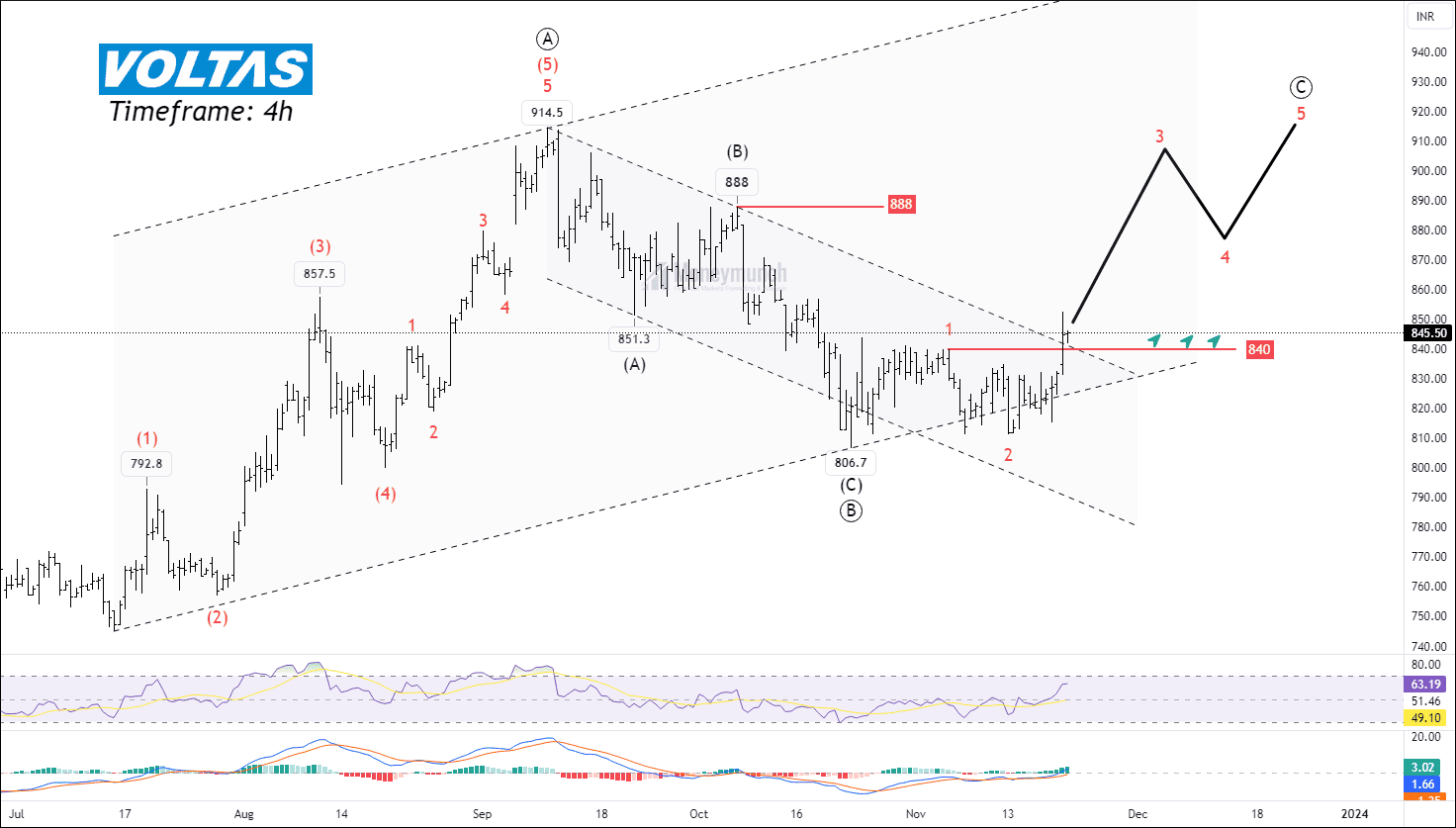

BEFORE

BEFORE

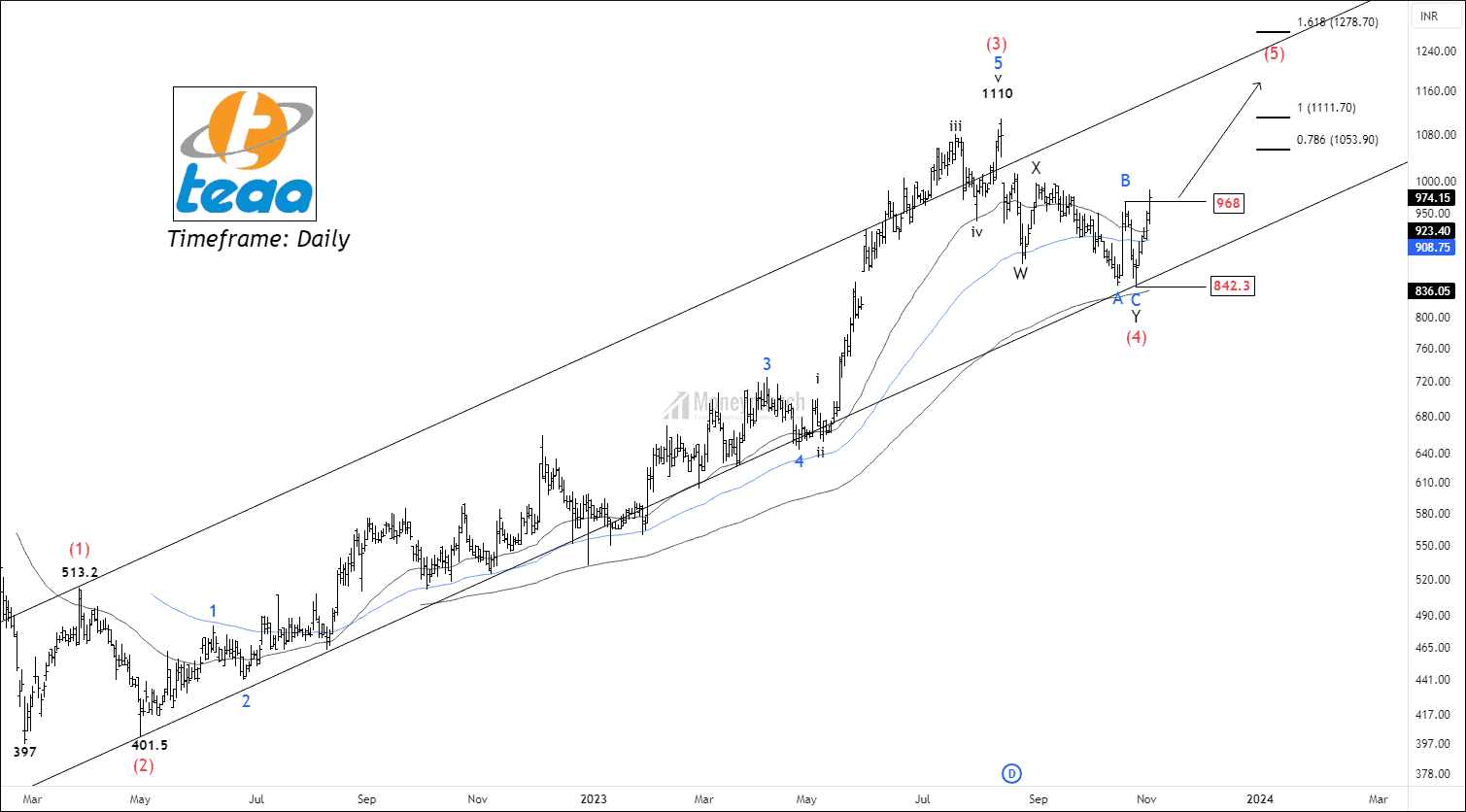

We had written clearly, “If price wave Wave B at 968, traders can buy for the following targets: 1055 – 1171 – 1270+”

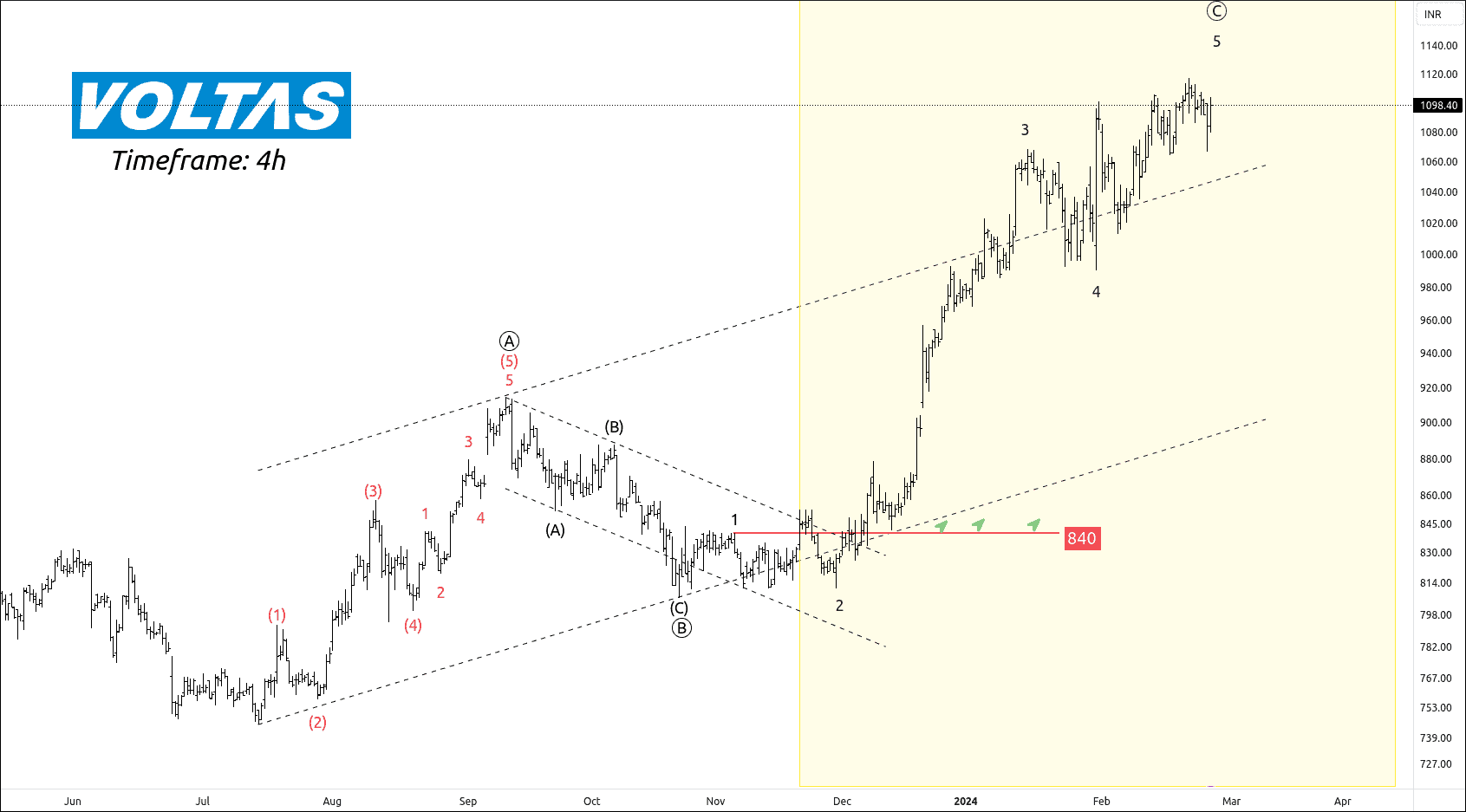

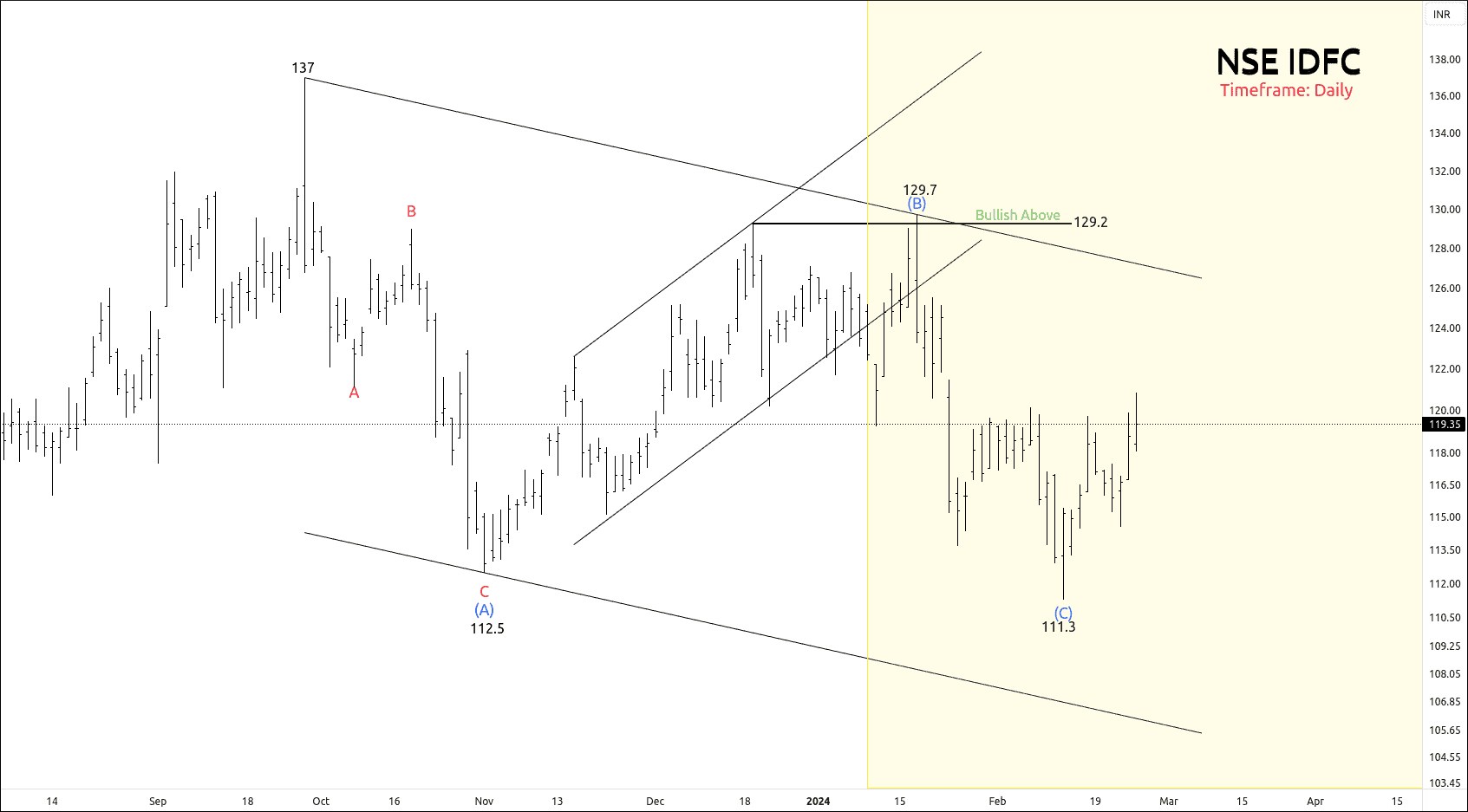

AFTER

AFTER

[15 November 2023]

- 09:15 AM – Price touched the first target of 1055.

[26 December 2023]

- 11:00 AM – NSE TEGA hit the second target of 1171.

[15 February 2024]

- 09:15 AM – Price achieved the final target of 1270, and made a new high of 1380.

This Setup could generate returns exceeding 42% in just 15 weeks.Continue reading