There is tremendous importance in options trading when it comes to strike prices. Traders can reduce the pain of option decay by choosing the right strike price.

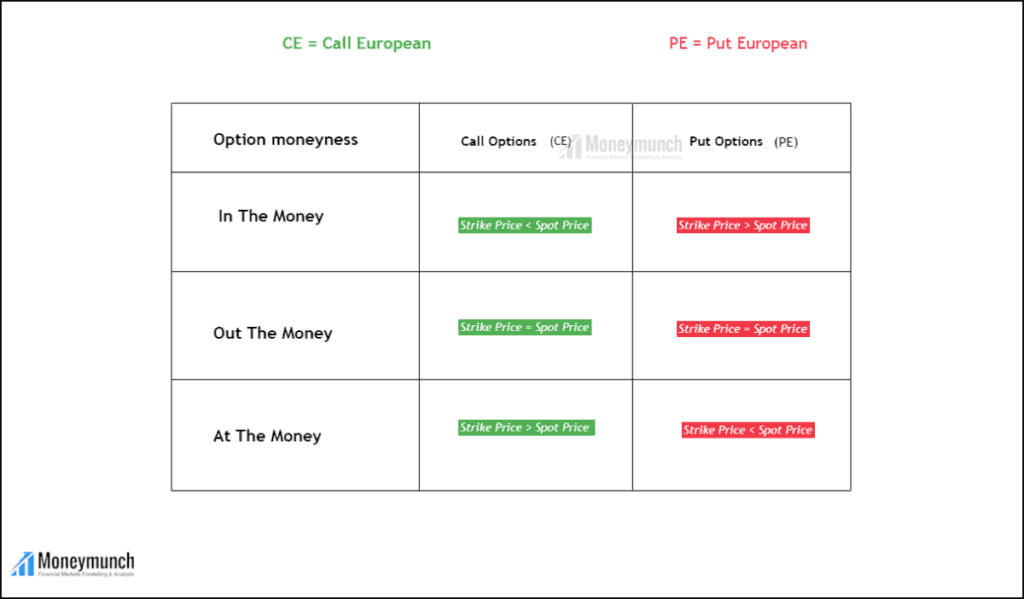

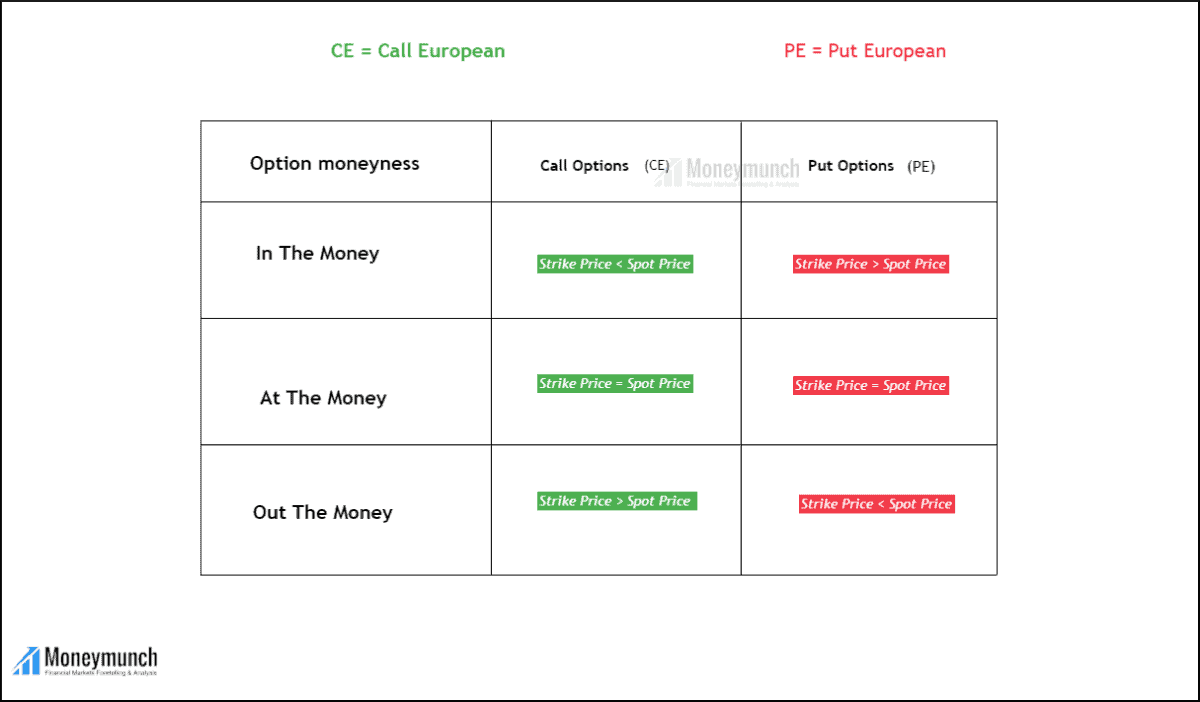

In terms of money, there are three kinds of strike prices.

1) ATM – At the Money

2) OTM – Out of the Money

3) ITM – In the Money

In The Money (ITM)

In the Money includes time value and intrinsic value. The term ‘in-the-money’ refers to a call option whose strike price is less than its underlying asset’s spot price, and a put option whose value is greater than spot prices.

For instance,

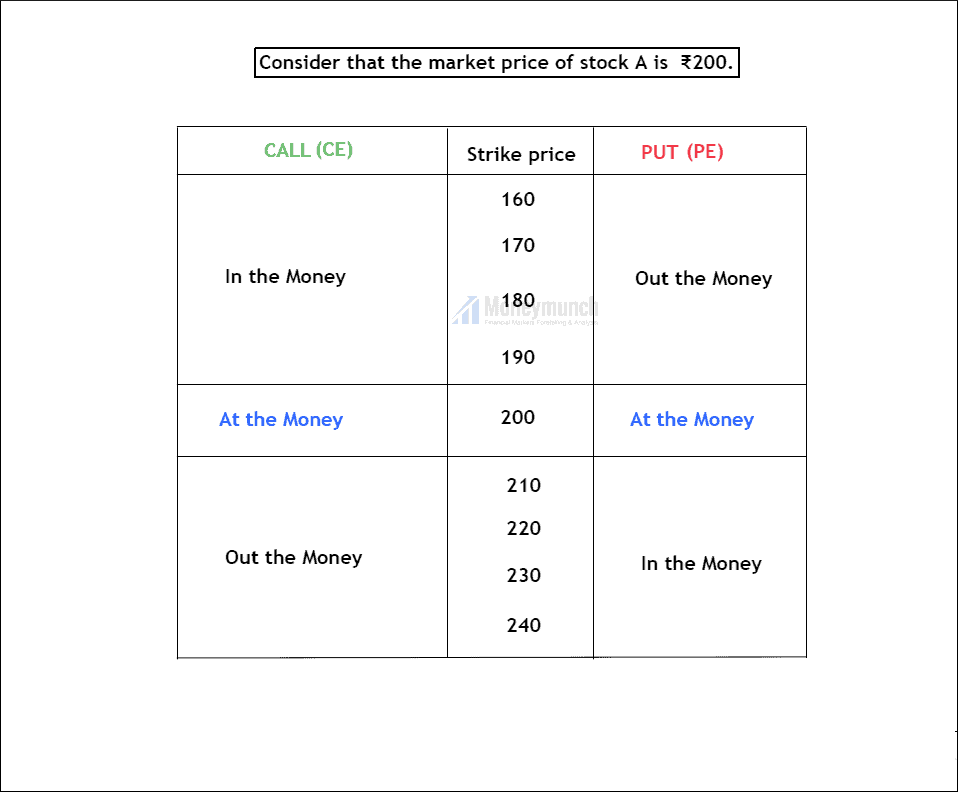

According to figure 1.2, if stock A’s spot price is ₹200,

Call options: (strike < spot):

If the Spot price is ₹200, then the strike price below ₹200 will be In the money, which provides positive cash flow to the option holder if he exercises immediately.

Real-time example:

Nifty’s spot price on 25 November 2022 is 18512.75. If the option holder chooses a strike price lower than 18512.75, we can consider it as in the money. A few examples would be 18500, 18450, 18400, etc. In this case, option holders expect the market to rise.

Put Options (strike > spot):

If the Spot price is ₹200, then the strike price above 200 will be In the money, which provides positive cash flow to the option holder if he exercises immediately.

Real-time example:

Nifty’s spot price on 25 November 2022 is 18512.75. If the option holder chooses a strike price higher than 18512.75, we can consider it as in the money. A few examples are 18550, 18600, and 18650. In this case, option holders expect the market to fall.

At The Money (ATM):

An at-the-money option has the same strike price as the underlying asset. It includes time value only. The term ‘at-the-money’ refers to a call/put option whose strike price is equal to the spot price of its underlying asset.

For instance,

According to figure 1.2, if stock A’s spot price is ₹200,

Call options:(strike = spot):

A stock’s stock price is ₹200, so the strike price is ₹200 as well. In this option, traders get zero cash flow if they exercise their right immediately.

Realtime example:

NSE ONGC’s spot price on 25 November 2022 is ₹140. If the option holder chooses a strike price of ₹140, we can consider it as an at-the-money option. In this case, option holders expect the market to rise.

Put Options(strike = spot):

A stock’s stock price is 200, so the strike price is ₹200 as well. In this option, traders get zero cash flow if they exercise their right immediately.

Realtime example:

NSE ONGC’s spot price on 25 November 2022 is ₹140. If the option holder chooses a strike price of ₹140, we can consider it as an at-the-money option. In this case, option holders expect the market to fall.

Out The Money (OTM)

Out-the-money includes time value only. The term ‘out-the-money’ refers to a call option whose strike price is higher than its underlying asset’s spot price. And a put option whose value is lower than spot prices. Out the money is risky as it provides negative cash flows.

For instance,

According to figure 1.2, if stock A’s spot price is ₹200,

Call options: (strike > spot):

If the Spot price is ₹200, then the strike price above ₹200 will be out-the-money, which provides negative cash flow to the option holder if he exercises immediately. The following strike prices are examples of OTM: 210, 220, 230, 240, etc.

Real-time example:

Nifty’s spot price on 25 November 2022 is 18512.75. If the option holder chooses a strike price higher than 18512.75, we can consider it as in the money. A few examples would be 18550, 18600, 18800,19000, etc. In this case, option holders expect the market to rise.

Put Options (strike < spot):

If the Spot price is ₹200, then the strike price below ₹200 will be out of the money, which provides negative cash flow to the option holder if he exercises immediately. The following strike prices are examples of OTM: 190, 180, 170, 160, etc.

Real-time example:

Nifty’s spot price on 25 November 2022 is 18512.75. If the option holder chooses a strike price lower than 18512.75, we can consider it as out-the-money. A few examples are 18450, 18400, 18300, and 18200. In this case, option holders expect the market to fall.

Now you all are aware of option moneyness. We will discuss selecting the right strike price in our upcoming article.

Enjoy the weekend!

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Neat and clean

Thanks for sharing.

Excellent Work My Friend Nailed it… Many Traders needs to READ this and learn… IF only!

Amazing analysis.

Really like it

Nice work.

Great Content,Thanks for sharing

great explanation, you got here!

These are so informative. Thank you!

wow) great job)

Excellent 👏🏼