The TV pundits all contribute their fair share to the conditioning process by clouding thoughts of any market player. To the extent that all ambiguities presented will bait investors to thinking IRRATIONALLY! Like, waiting for a 1000 point rally to emerge once the fiscal cliff is resolved.

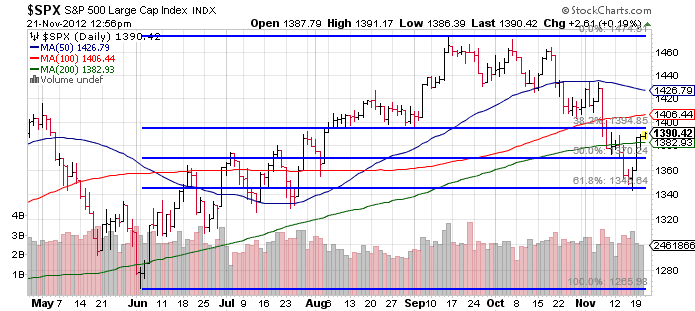

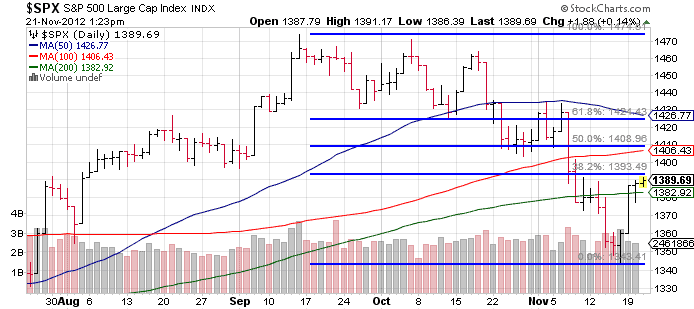

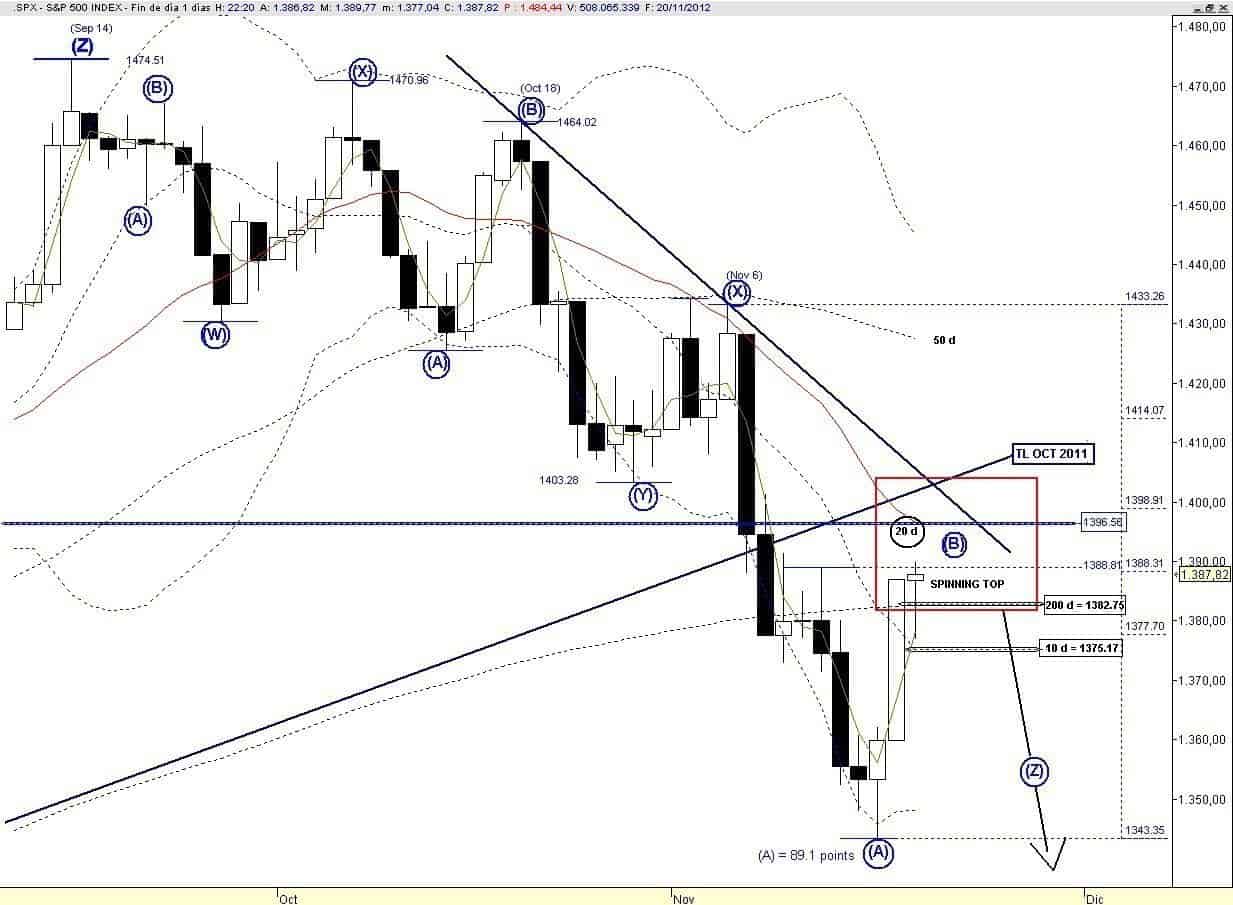

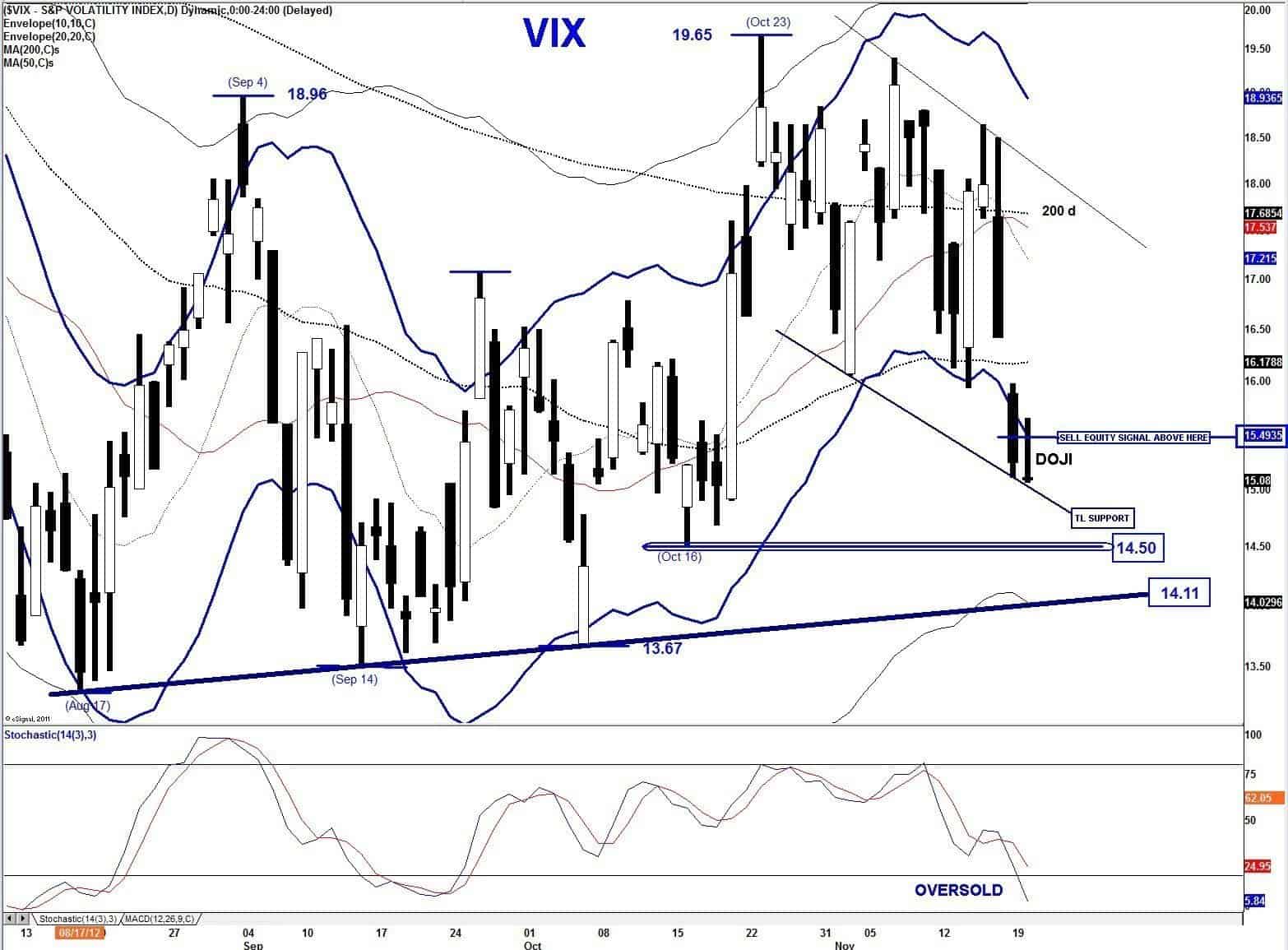

Fortunately, underneath all the headlines a visual and graphical interpretation can be mathematically extracted. It is here, in these very charts, where you will find an answer that illustrates what is really going on, so that us technicians can observe, scrutinize, and formulate a particular bias.

The information provided does not tell you why, or when, but what!

In this case, ‘the what’ is a bear market rally. These particular rallies are very sneaky and most convincing, but can be properly identified when using the right tools.

For starters, a basket of heavily weighted companies, ‘THE NIFTY FIFTYs,’ which offer the bulk in the performance in the averages -all now have chart patterns that cannot sustain the continuation of this advance. Invariably, when volume remains light during an extended window of time, the result is an inevitable sharp collapse back downward to the previous lows or worse, new lows that can no longer support a bull market.

The S&P 500 index is a case in point, which is still in rally mode, and perhaps can continue higher if there is further consolidation. But if only mother market is ever so accommodative to our own expectations.

And it is because of her complexities that make it an impossible arena for perfection. The current rally back is clearly overworking itself to recapture the previous drop in November and rather than guessing where exactly it will end, think of it in terms of direction. The future course of these violent counter trends ultimately end in a scare plunge; and all the pumping in the world cannot uphold the violent cascade of selling pressure that will implode on the masses.

Consider the technical chart below, which projects a disaster waiting to happen, and with only a small chance of one last leg higher before this rally is all said and done.

S&P 500 – Daily Chart

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.