What I had written at 9:30 AM about copper?

Click Here to see it

Copper Two target blast, ENJOY!

It made high 418.1

Now what you expect about copper?

The Global Market category provides insights, analysis, and updates on the economic and financial trends that impact international markets. From the latest news on emerging markets to trends in international trade and investments, this category covers it all. Stay up-to-date with the latest developments and get the information you need to make informed decisions in the global market.

What I had written at 9:30 AM about copper?

Click Here to see it

Copper Two target blast, ENJOY!

It made high 418.1

Now what you expect about copper?

Just watch, this script of this week…!

(IMPROVE your Trading Skill by Watch levels)

BOMBAY DYEING & MFG. CO L (BOMDYEING): This Stock is good for long(buy side) 372 above…

Selling pressure: 366-368

Intraday Targets 355-352

(After break 350…then PANIC up to 333-340)

As I expected silver going to fired. Silver is hottest commodity. What about today? It’ll go up to touch silmy targets or today it’ll ride downside?

Remember:

My Intraday targets: 46269 – 46376

Short Term skyrocket targets: 46492 – 46680

MCX Mentha Oil View – FREE

Close your eyes & Buy – Forget

Short Term Targets: 1243 – 1282

Intraday Targets: 1226 – 1238

Intact Target: 1300

How are you playing the markets right now? I have Sellers for Bad News and Buyers for Good News, what are you thinking? Which news right now? I’m watching no back door for seller. Exactly, I said my subscribers – ‘If Dow Jones cross Rs.11222 then you’ll see new direction on commodity market as well as on stock market.’ If Dow Jones opens around last close price then safe traders for one new treasury key for earn money. Yes, just buy stock and forget for 1 week. I give 100% positive news clear in your mind; you’ll get 300% return on any stock.

Big events: Silver gained 8.9% on the week – hitting a 30-year high, while gold only gained a paltry 2.6%. Silver closed at $26.75 an ounce on Friday. Gold closed at $1,394 an ounce, as is 26 percent higher on the year.

The large movie here is that silver is an inflation take part in and it looks similar to the U.S. is on a rock-hard track for a continued declining currency and upper inflation in the months and years to come. Speculation is on the increase and silver is probably a more speculative to take part in than gold. I would expect silver to continue outpacing gold if this “risk trade” from the out of control stimulus by the Fed and Congress continues.

Readers, please be serious with Crude Oil. I’m watching new high in Crude Oil 3900 something like 1 week.

Buying level: opening bell

Hurdle – 3862

Target – 3900

Yes, my subscribers already in position on Crude Oil with level 3705.

Click here for read past report of crude oil.

Buy nickel around the Monday low.

Make position, don’t fear, and close your eyes.

First good target for intraday traders – 1092.

Short term traders for level 1101

Natural Gas

High Alert: If natural gas crossover 174.9 then will take to 177 – 180.

Always, scare with 174.9 level.

If natural gas not crosses it then it can go down around 164.

What you expect now?

Do you want to know about commodity market? Subscribe our free newsletter service.

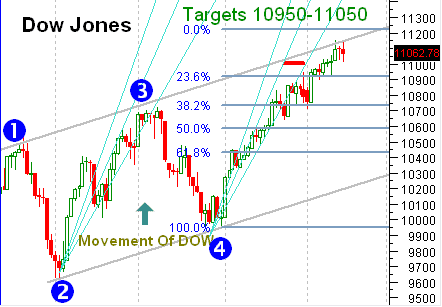

LOOKS chats of Dow Jones

(Rally of Non-Stop 1200 Points)

In Next 8 Trading Days (192hrs), you have to open History of Bloodbath…

Think to Start blood from 11200—11300

Non-Stop fall 10880/10696/10550

Major Support 11000 if close below it… ready to see non-stop fall…

Past 15-Days ago, I mentioned targets of Dow 11500 and also mentioned here same last post

I will update Nifty tomorrow morning…

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.